HR Block 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 HR Block annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

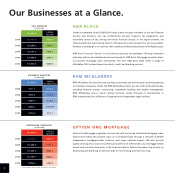

Our tax professionals are closer to their communities every day as a result of the expansion

of H&R Block’s U.S. retail locations. The convenience of our locations is a competitive plus.

In tax season 2006, the company and its franchisees grew to 12,165 locations from 11,161

in 2005. About 25 percent of the additions are shared locations primarily in Wal-Mart and

Sears stores, bringing us to where clients shop or work. The expected payback in profits

builds as new locations gain incremental clients over several years. But clients reap the benefits

immediately via shorter travel time, prompter service and easier scheduling of appointments.

Convenience also means that clients can select the tax preparation service channel they

prefer. H&R Block is the only company offering both services from its own tax professionals

and the choice of a digital do-it-yourself software product or Web-based online program,

both under the TaxCut®product name. Our research shows that as their tax situations

become more complex, our digital clients tend to migrate to an H&R Block office

professional for assistance, based on brand awareness and trust.

We can even blend our tax professional service with our digital channel – an increasingly

important differentiator for clients. Our Signature service allows TaxCut®clients to work on

their taxes at home and then have a tax professional review, sign and electronically file the

return. With our Ask a Tax Advisor service, digital clients can choose phone or e-mail for live

help from a tax professional. In tax season 2006, we set ourselves further apart with Worry-

free Audit Support™

. It’s free, and it provides TaxCut®clients advance support and even

representation before the Internal Revenue Service if a paid return e-filed through us is

selected for audit.

To enhance user experience, we’ve been remaking the look and feel, navigation and

language of our digital offerings for ease of use. More client interactivity makes questions

and advice more relevant, and it helps streamline the process. We also led an industry shift

to bundle state programs with federal for one low price with no mail-in rebate.

Clients served with TaxCut®software or online programs surged 23 percent in fiscal 2006.

The increase reflected an integrated marketing and brand-building campaign as well as

product improvements. The gain in our digital business was the key to H&R Block’s increase

in total tax clients served in fiscal 2006 as the tax services market continues to evolve.

REFERRALS AND RECRUITING BENEFIT FINANCIAL ADVISORS

Referrals from one H&R Block branded business to another are helping us to grow. We’re

doing especially well in building individual relationships between tax professionals and the

financial advisors of H&R Block Financial Advisors. The PreferredPartner Program has

increased tax professionals’ effectiveness in identifying and referring clients to the right

TOM ALLANSON

Senior Vice President and General Manager

Digital Tax Solutions

Though most people aren’t tax experts, tax

season 2006 showed a 16 percent rise

nationwide in returns self-prepared with

software products or online programs, and

then filed electronically (according to

H&R Block estimates based on IRS data).

Digital, in fact, is the fastest growing

segment of the tax market, and H&R Block

is well-positioned in this segment.

You don’t need to be an expert to use a

TaxCut®digital application. Our clients

served grew 23 percent in fiscal 2006. As we

improve the digital experience for TaxCut®

users, we go to market with a distinct

competitive edge – an office safety net of

thousands of tax professionals ready to

help digital users with blended channel

service. And when a digital client’s tax

situation calls for fully assisted service, we

look for the client to stay with H&R Block,

the brand they’ve come to know and trust.

12