HCA Holdings 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 HCA Holdings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our hospitals do not typically engage in extensive medical research and education programs. However,

some of our hospitals are affiliated with medical schools and may participate in the clinical rotation of medical

interns and residents and other education programs.

At December 31, 2012, we operated five psychiatric hospitals with 506 licensed beds. Our psychiatric

hospitals provide therapeutic programs including child, adolescent and adult psychiatric care, adult and

adolescent alcohol and drug abuse treatment and counseling.

We also operate outpatient health care facilities which include freestanding ambulatory surgery centers

(“ASCs”), freestanding emergency care facilities, diagnostic and imaging centers, comprehensive outpatient

rehabilitation and physical therapy centers, outpatient radiation and oncology therapy centers and various other

facilities. These outpatient services are an integral component of our strategy to develop comprehensive health

care networks in select communities. Most of our ASCs are operated through partnerships or limited liability

companies, with majority ownership of each partnership or limited liability company typically held by a general

partner or subsidiary that is an affiliate of HCA.

Certain of our affiliates provide a variety of management services to our health care facilities, including

patient safety programs; ethics and compliance programs; national supply contracts; equipment purchasing and

leasing contracts; accounting, financial and clinical systems; governmental reimbursement assistance;

construction planning and coordination; information technology systems and solutions; legal counsel; human

resources services; and internal audit services.

Sources of Revenue

Hospital revenues depend upon inpatient occupancy levels, the medical and ancillary services ordered by

physicians and provided to patients, the volume of outpatient procedures and the charges or payment rates for

such services. Charges and reimbursement rates for inpatient services vary significantly depending on the type of

payer, the type of service (e.g., medical/surgical, intensive care or psychiatric) and the geographic location of the

hospital. Inpatient occupancy levels fluctuate for various reasons, many of which are beyond our control.

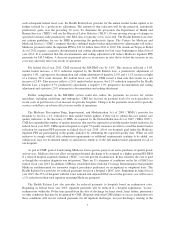

We receive payments for patient services from the federal government under the Medicare program, state

governments under their respective Medicaid or similar programs, managed care plans, private insurers and

directly from patients. Our revenues from third-party payers and the uninsured for the years ended December 31,

2012, 2011 and 2010 are summarized in the following table (dollars in millions):

Years Ended December 31,

2012 Ratio 2011 Ratio 2010 Ratio

Medicare ...................................... $ 8,292 25.1%$ 7,653 25.8% $ 7,203 25.7%

Managed Medicare .............................. 2,954 8.9 2,442 8.2 2,162 7.7

Medicaid ...................................... 1,464 4.4 1,845 6.2 1,962 7.0

Managed Medicaid .............................. 1,504 4.6 1,265 4.3 1,165 4.2

Managed care and other insurers .................... 17,998 54.5 15,703 52.9 14,762 52.7

International (managed care and other insurers) ........ 1,060 3.2 938 3.2 784 2.8

33,272 100.7 29,846 100.6 28,038 100.1

Uninsured ..................................... 2,580 7.8 1,846 6.2 1,732 6.2

Other ......................................... 931 2.8 814 2.7 913 3.3

Revenues before provision for doubtful accounts ....... 36,783 111.3 32,506 109.5 30,683 109.6

Provision for doubtful accounts .................... (3,770) (11.3) (2,824) (9.5) (2,648) (9.6)

Revenues ...................................... $33,013 100.0%$29,682 100.0% $28,035 100.0%

5