HCA Holdings 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 HCA Holdings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hospital Utilization

We believe the most important factors relating to the overall utilization of a hospital are the quality and

market position of the hospital and the number and quality of physicians and other health care professionals

providing patient care within the facility. Generally, we believe the ability of a hospital to be a market leader is

determined by its breadth of services, level of technology, quality and condition of the facilities, emphasis on

quality of care and convenience for patients and physicians. Other factors that impact utilization include the

growth in local population, local economic conditions and market penetration of managed care programs.

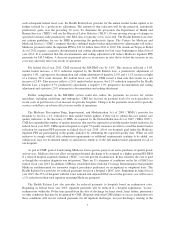

The following table sets forth certain operating statistics for our health care facilities. Health care facility

operations are subject to certain seasonal fluctuations, including decreases in patient utilization during holiday

periods and increases in the cold weather months. The data set forth in this table includes only those facilities that

are consolidated for financial reporting purposes.

Years Ended December 31,

2012 2011 2010 2009 2008

Number of hospitals at end of period(a) ......... 162 163 156 155 158

Number of freestanding outpatient surgery centers

at end of period(b) ........................ 112 108 97 97 97

Number of licensed beds at end of period(c) ..... 41,804 41,594 38,827 38,839 38,504

Weighted average licensed beds(d) ............. 41,795 39,735 38,655 38,825 38,422

Admissions(e) ............................. 1,740,700 1,620,400 1,554,400 1,556,500 1,541,800

Equivalent admissions(f) ..................... 2,832,100 2,595,900 2,468,400 2,439,000 2,363,600

Average length of stay (days)(g) ............... 4.7 4.8 4.8 4.8 4.9

Average daily census(h) ..................... 22,521 21,123 20,523 20,650 20,795

Occupancy rate(i) .......................... 54% 53% 53% 53% 54%

Emergency room visits(j) .................... 6,912,000 6,143,500 5,706,200 5,593,500 5,246,400

Outpatient surgeries(k) ...................... 873,600 799,200 783,600 794,600 797,400

Inpatient surgeries(l) ........................ 506,500 484,500 487,100 494,500 493,100

(a) Excludes eight facilities in 2010, 2009 and 2008 that were not consolidated (accounted for using the equity

method) for financial reporting purposes.

(b) Excludes one facility in 2012 and 2011, nine facilities in 2010 and eight facilities in 2009 and 2008 that

were not consolidated (accounted for using the equity method) for financial reporting purposes.

(c) Licensed beds are those beds for which a facility has been granted approval to operate from the applicable

state licensing agency.

(d) Represents the average number of licensed beds, weighted based on periods owned.

(e) Represents the total number of patients admitted to our hospitals and is used by management and certain

investors as a general measure of inpatient volume.

(f) Equivalent admissions are used by management and certain investors as a general measure of combined

inpatient and outpatient volume. Equivalent admissions are computed by multiplying admissions (inpatient

volume) by the sum of gross inpatient revenue and gross outpatient revenue and then dividing the resulting

amount by gross inpatient revenue. The equivalent admissions computation “equates” outpatient revenue to

the volume measure (admissions) used to measure inpatient volume, resulting in a general measure of

combined inpatient and outpatient volume.

(g) Represents the average number of days admitted patients stay in our hospitals.

(h) Represents the average number of patients in our hospital beds each day.

(i) Represents the percentage of hospital licensed beds occupied by patients. Both average daily census and

occupancy rate provide measures of the utilization of inpatient rooms.

(j) Represents the number of patients treated in our emergency rooms.

(k) Represents the number of surgeries performed on patients who were not admitted to our hospitals. Pain

management and endoscopy procedures are not included in outpatient surgeries.

(l) Represents the number of surgeries performed on patients who have been admitted to our hospitals. Pain

management and endoscopy procedures are not included in inpatient surgeries.

17