HCA Holdings 2012 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2012 HCA Holdings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Managed Care and Other Discounted Plans

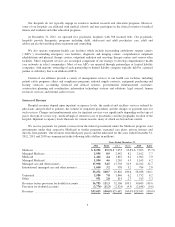

Most of our hospitals offer discounts from established charges to certain large group purchasers of health

care services, including managed care plans and private insurance companies. Admissions reimbursed by

commercial managed care and other insurers were 30%, 31%, and 32% of our total admissions for the years

ended December 31, 2012, 2011 and 2010, respectively. Managed care contracts are typically negotiated for

terms between one and three years. While we generally received contracted annual average increases that were

expected to yield 5% to 6% from managed care payers during 2012, there can be no assurance that we will

continue to receive increases in the future. It is not clear what impact, if any, the increased obligations on

managed care payers and other health plans imposed by the Health Reform Law will have on our ability to

negotiate reimbursement increases.

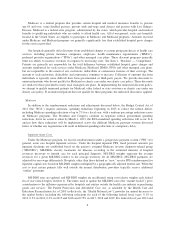

Uninsured and Self-Pay Patients

A high percentage of our uninsured patients are initially admitted through our emergency rooms. For the

year ended December 31, 2012, approximately 82% of our admissions of uninsured patients occurred through our

emergency rooms. The Emergency Medical Treatment and Labor Act (“EMTALA”) requires any hospital that

participates in the Medicare program to conduct an appropriate medical screening examination of every person

who presents to the hospital’s emergency room for treatment and, if the individual is suffering from an

emergency medical condition, to either stabilize that condition or make an appropriate transfer of the individual

to a facility that can handle the condition. The obligation to screen and stabilize emergency medical conditions

exists regardless of an individual’s ability to pay for treatment. The Health Reform Law requires health plans to

reimburse hospitals for emergency services provided to enrollees without prior authorization and without regard

to whether a participating provider contract is in place. Further, the Health Reform Law contains provisions that

seek to decrease the number of uninsured individuals, including requirements and incentives, which do not

become effective until 2014, for individuals to obtain, and large employers to provide, insurance coverage. These

mandates may reduce the financial impact of screening for and stabilizing emergency medical conditions.

However, many factors are unknown regarding the impact of the Health Reform Law, including how many

previously uninsured individuals will obtain coverage as a result of the law or the change, if any, in the volume

of inpatient and outpatient hospital services that are sought by and provided to previously uninsured individuals

and the payer mix. In addition, it is difficult to predict the full impact of the Health Reform Law due to the law’s

complexity, lack of implementing regulations or interpretive guidance, gradual and potentially delayed

implementation, remaining or new court challenges and possible amendment or repeal.

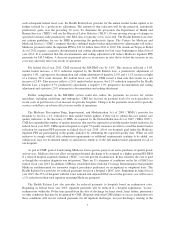

Electronic Health Record Incentives

ARRA provides for Medicare and Medicaid incentive payments for eligible hospitals and for eligible

professionals that adopt and meaningfully use certified electronic health record (“EHR”) technology. Through

December 2012, over $10 billion in incentive payments have been made through the Medicare and Medicaid

EHR incentive programs to eligible hospitals and eligible professionals.

Under the Medicare incentive program, eligible hospitals that demonstrate meaningful use will receive

incentive payments for up to four fiscal years. The Medicare incentive payment amount is the product of three

factors: (1) an initial amount comprised of a base amount of $2,000,000, plus $200 for each acute care inpatient

discharge, beginning with a hospital’s 1,150th discharge of the applicable year and ending with a hospital’s

23,000th discharge of the applicable year; (2) the “Medicare share,” which is the sum of Medicare Part A and

Part C acute care inpatient-bed-days divided by the product of the total acute care inpatient-bed-days and a

charity care factor; and (3) a transition factor applicable to the payment year. In order to maximize their incentive

payments, acute care hospitals must participate in the incentive program by federal fiscal year 2013. Beginning in

federal fiscal year 2015, acute care hospitals that have failed to demonstrate meaningful use of certified EHR

technology in an applicable prior reporting period will receive reduced market basket updates under inpatient

PPS.

15