HCA Holdings 2012 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2012 HCA Holdings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

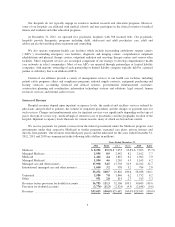

Consistent Growth Despite Economic Environment –

Quarterly Same Facility Equivalent Admissions Growth

Same Facility Equivalent Admissions

Revenues Totaled $33.013 Billion .......................11.2%

Same Facility Revenues ................................4.5%

Same Facility Equivalent Admissions ......................4.1%

Same Facility ER Visits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8.6%

Same Facility Operating Expenses per Equivalent Admission ...0.7%

Cash Flows from Operating Activities ..............$4.175 Billion

2012 Financial Highlights

Free Cash Flow Provides Financial Flexibility

1Q08

2Q08

3Q08

4Q08

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

1Q09

2Q09

3Q09

4Q09

1Q10

2Q10

3Q10

4Q10

1Q11

2Q11

3Q11

4Q11

1Q12

2Q12

3Q12

4Q12

$1.6 $1.3 $1.3

$1.7 $1.9

$0.2

$0.3 $0.3

$0.4

$0.4

$0.2

$1.1

$1.5

$1.8

$1.9

$2.0

$2.7

$3.1

$3.9

$4.2

$0.0

$0.5

$1.0

$1.5

$2.0

$2.5

$3.0

$3.5

$4.0

$4.5

2008 2009 2010 2011 2012

Capital Expenditures

Distributions to

Noncontrolling Interests

Free Cash Flow

Cash Flows Provided by

Operating Activities

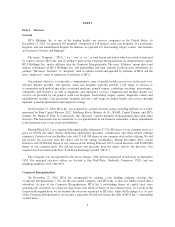

Positioned for Success

HCA’s Core Competencies and Strategic Agenda Position the Company for Future Success

• Portfolio of assets in growing, highly attractive markets

• Integrated networks with significant market share

• Flexibility to approach market incrementally across the portfolio

• Efficient cost structure

• Investment in key technologies to drive clinical and operational outcomes

• Strong free cash flow

The terms “HCA” or the “Company” as used in this report refer to HCA Holdings, Inc. and its afliates, unless otherwise stated or indicated by context. The term “facilities” refers to entities owned

or operated by subsidiaries or afliates of HCA Holdings, Inc. References herein to “HCA employees” refer to employees or afliates of HCA Management Services, LP or HCA Holdings, Inc.