HCA Holdings 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 HCA Holdings annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2012 Annual Report to Stockholders

Table of contents

-

Page 1

2012 Annual Report to Stockholders -

Page 2

... Registered Public Accounting Firm Ernst & Young LLP Nashville, Tennessee Corporate Headquarters One Park Plaza Nashville, Tennessee 37203 615-344-9551 Form 10-K The Company has ï¬led an annual report on Form 10-K for the year ended December 31, 2012, with the United States Securities and... -

Page 3

... Corporate Affairs Jon M. Foster President American Group Charles J. Hall President National Group A. Bruce Moore, Jr. President Service Line and Operations Integration Michael P. O'Boyle President and CEO Parallon Business Solutions P. Martin Paslick Senior Vice President and Chief Information... -

Page 4

...The terms "HCA" or the "Company" as used in this report refer to HCA Holdings, Inc. and its affiliates, unless otherwise stated or indicated by context. The term "facilities" refers to entities owned or operated by subsidiaries or affiliates of HCA Holdings, Inc. References herein to "HCA employees... -

Page 5

... For the fiscal year ended December 31, 2012 Or ' TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from to Commission File Number 1-11239 HCA Holdings, Inc. (Exact Name of Registrant as Specified in its Charter) Delaware (State or... -

Page 6

... Securities ...Selected Financial Data ...Management's Discussion and Analysis of Financial Condition and Results of Operations ...Quantitative and Qualitative Disclosures about Market Risk ...Financial Statements and Supplementary Data ...Changes in and Disagreements with Accountants on Accounting... -

Page 7

... health care services companies in the United States. At December 31, 2012, we operated 162 hospitals, comprised of 156 general, acute care hospitals; five psychiatric hospitals; and one rehabilitation hospital. In addition, we operated 112 freestanding surgery centers. Our facilities are located... -

Page 8

... scale and market positions to enhance profitability; and selectively pursue a disciplined development strategy. Health Care Facilities We currently own, manage or operate hospitals; freestanding surgery centers; diagnostic and imaging centers; radiation and oncology therapy centers; comprehensive... -

Page 9

... services from the federal government under the Medicare program, state governments under their respective Medicaid or similar programs, managed care plans, private insurers and directly from patients. Our revenues from third-party payers and the uninsured for the years ended December 31, 2012, 2011... -

Page 10

...services provided. Our hospitals generally offer discounts from established charges to certain group purchasers of health care services, including private insurance companies, employers, health maintenance organizations ("HMOs"), preferred provider organizations ("PPOs") and other managed care plans... -

Page 11

... federal fiscal year 2013. In addition, CMS has established three National Coverage Determinations that prohibit Medicare reimbursement for erroneous surgical procedures performed on an inpatient or outpatient basis. The Health Reform Law provides for reduced payments based on a hospital's HAC rates... -

Page 12

...it will distribute $850 million in federal fiscal year 2013 to hospitals under the value-based purchasing program. Historically, the Medicare program has set aside 5.10% of Medicare inpatient payments to pay for outlier cases. For federal fiscal year 2012, CMS established an outlier threshold of $22... -

Page 13

... the IPF PPS from a rate year to a federal fiscal year update cycle, effective October 1, 2012. The rehabilitation, psychiatric and long-term care ("RPL") market basket update is used to update the IPF PPS. The Health Reform Law also provides for reductions to the market basket update, including the... -

Page 14

...Medicare procedures that historically have been performed in ASCs may be moved to physicians' offices. Commercial third-party payers may adopt similar policies. For federal fiscal year 2011 and each subsequent federal fiscal year, the Health Reform Law provides for the annual market basket update to... -

Page 15

... initial contracts to all 15 MAC jurisdictions. While chain providers had the option of having all hospitals use one home office MAC, HCA chose to use the MACs assigned to the geographic areas in which our hospitals are located. CMS periodically resolicits bids, and the MAC servicing a geographic... -

Page 16

... for services with dates beginning July 1, 2012. The final rule requires each state Medicaid program to deny payments to providers for the treatment of health care-acquired conditions designated by CMS as well as other provider-preventable conditions that may be designated by the state. 12 -

Page 17

...-year voluntary, national pilot program on payment bundling for Medicare services beginning no later than January 1, 2013. Under the program, providers agree to receive one payment for services provided to Medicare patients for certain medical conditions or episodes of care. The Health Reform Law... -

Page 18

... where applicable, state regulations require the submission of annual cost reports covering the revenues, costs and expenses associated with the services provided by each hospital to Medicare beneficiaries and Medicaid recipients. Annual cost reports required under the Medicare and Medicaid programs... -

Page 19

... of health care services, including managed care plans and private insurance companies. Admissions reimbursed by commercial managed care and other insurers were 30%, 31%, and 32% of our total admissions for the years ended December 31, 2012, 2011 and 2010, respectively. Managed care contracts are... -

Page 20

... use of certified EHR technology in an applicable prior reporting period will face Medicare payment reductions. The Medicaid EHR incentive program is voluntary for states to implement. For participating states, the Medicaid EHR incentive program provides incentive payments for acute care hospitals... -

Page 21

... of the hospital and the number and quality of physicians and other health care professionals providing patient care within the facility. Generally, we believe the ability of a hospital to be a market leader is determined by its breadth of services, level of technology, quality and condition of the... -

Page 22

...care professionals, location, breadth of services, technology offered, quality and condition of the facilities and prices charged. The Health Reform Law requires hospitals to publish annually a list of their standard charges for items and services. We have increased our focus on operating outpatient... -

Page 23

... array of outpatient services, offer market competitive pricing to private payer groups, upgrade facilities and equipment and offer new or expanded programs and services. Regulation and Other Factors Licensure, Certification and Accreditation Health care facility construction and operation are... -

Page 24

... Such laws generally require the reviewing state agency to determine the public need for additional or expanded health care facilities and services. Failure to provide required notifications or obtain necessary state approvals can result in the inability to expand facilities, complete an acquisition... -

Page 25

...hospitals and other health care facilities, including employment contracts, leases, medical director agreements and professional service agreements. We also have similar relationships with physicians and facilities to which patients are referred from our facilities. In addition, we provide financial... -

Page 26

... per claim submitted and exclusion from the federal health care programs. Entities that receive payment as a result of services provided to a Medicare patient who is referred by a physician with whom the entity has a Stark Law non-compliant financial relationship must refund such amounts within the... -

Page 27

unnecessary goods and services and cost report fraud. Federal enforcement officials have the ability to exclude from Medicare and Medicaid any investors, officers and managing employees associated with business entities that have committed health care fraud, even if the officer or managing employee ... -

Page 28

...FCA and relevant state laws. HIPAA Administrative Simplification and Privacy and Security Requirements The Administrative Simplification Provisions of HIPAA require the use of uniform electronic data transmission standards for certain health care claims and payment transactions submitted or received... -

Page 29

... Some of the states in which we operate have laws prohibiting corporations and other entities from employing physicians, practicing medicine for a profit and making certain direct and indirect payments or feesplitting arrangements between health care providers designed to induce or encourage... -

Page 30

... by, federal and state agencies. Any additional investigations of the Company, our executives or managers could result in significant liabilities or penalties to us, as well as adverse publicity. Health Care Reform The Health Reform Law will change how health care services are covered, delivered... -

Page 31

... of health coverage through the private sector as a result of the Health Reform Law will occur through new requirements applicable to health insurers, employers and individuals. Health insurers must keep their annual nonmedical costs lower than 15% of premium revenue for the group market and... -

Page 32

... through which consumers may access health plan ratings that are assigned by the state based on quality and price, view governmental health program eligibility requirements and calculate the actual cost of health coverage. Health insurers participating in an Exchange must offer a set of minimum... -

Page 33

... Services. The Health Reform Law establishes or expands three provisions to promote value-based purchasing and to link payments to quality and efficiency. First, in federal fiscal year 2013, HHS is directed to implement a value-based purchasing program for inpatient hospital services. This program... -

Page 34

... the worst national risk-adjusted HAC rates in the previous year will receive a 1% reduction in their total inpatient operating Medicare payments. In addition, the Health Reform Law prohibits the use of federal funds under the Medicaid program to reimburse providers for medical services provided to... -

Page 35

... what medical conditions will be included in the program and the amount of the payment for each condition. The Health Reform Law also provides for a five-year bundled payment pilot program for Medicaid services. HHS may select up to eight states to participate based on the potential to lower costs... -

Page 36

... of health insurance coverage under the Health Reform Law may result in a material increase in the number of patients using our facilities who have either private or public program coverage. In addition, the Health Reform Law provides for the establishment of a value-based purchasing program, ACOs... -

Page 37

... plans, since health insurers offering those kinds of products have traditionally sought to pay lower rates to hospitals; and whether the net effect of the Health Reform Law, including the prohibition on excluding individuals based on pre-existing conditions, the requirement to keep medical costs... -

Page 38

...ethics and compliance program, we provide annual ethics and compliance training to our employees and encourage all employees to report any violations to their supervisor, an ethics and compliance officer or a toll-free telephone ethics line. The Health Reform Law requires providers to implement core... -

Page 39

...labor costs. In some markets, nurse and medical support personnel availability has become a significant operating issue to health care providers. To address this challenge, we have implemented several initiatives to improve retention, recruiting, compensation programs and productivity. Our hospitals... -

Page 40

...Vice President - Corporate Affairs President - American Group President - National Group President - Operations President - Service Line and Operations Integration President and CEO - Parallon Business Solutionssm Senior Vice President and Chief Information Officer President - Clinical and Physician... -

Page 41

... HCA-Hospital Corporation of America's Vice President for Investor, Corporate and Government Relations. Mr. Campbell joined HCA-Hospital Corporation of America in 1972. Mr. Campbell serves on the board of the Nashville Health Care Council, as a member of the American Hospital Association's President... -

Page 42

..., he served in various Vice President roles in the Company's Information Technology & Services department. Mr. Paslick joined the Company in 1985. Dr. Jonathan B. Perlin was appointed President - Clinical and Physician Services Group and Chief Medical Officer in February 2011. Dr. Perlin had served... -

Page 43

...our ability to obtain additional financing for working capital, capital expenditures, product or service line development, debt service requirements, acquisitions and general corporate or other purposes; and limiting our ability to adjust to changing market conditions and placing us at a competitive... -

Page 44

...at a higher interest rate. Our ability to refinance our indebtedness on favorable terms, or at all, is directly affected by the current global economic and financial conditions. In addition, our ability to incur secured indebtedness (which would generally enable us to achieve better pricing than the... -

Page 45

... federal fiscal year 2013. The amount of the provision for doubtful accounts is based upon management's assessment of historical write-offs and expected net collections, business and economic conditions, trends in federal and state governmental and private employer health care coverage, the rate of... -

Page 46

... of operations. In recent years, legislative and regulatory changes have resulted in limitations on and, in some cases, reductions in levels of payments to health care providers for certain services under the Medicare program. The Budget Control Act of 2011 (the "BCA") provides for new spending... -

Page 47

... federal Medicaid funding. Thus, states may opt not to implement the expansion. In some cases, commercial third-party payers rely on all or portions of Medicare payment systems to determine payment rates. Changes to government health care programs that reduce payments under these programs may... -

Page 48

... plans, since health insurers offering those kinds of products have traditionally sought to pay lower rates to hospitals; and whether the net effect of the Health Reform Law, including the prohibition on excluding individuals based on pre-existing conditions, the requirement to keep medical costs... -

Page 49

... in federal fiscal year 2014; the allocation to our hospitals of the Medicaid DSH reductions, commencing in federal fiscal year 2014; what the losses in revenues will be, if any, from the Health Reform Law's quality initiatives; how successful ACOs will be at coordinating care and reducing costs or... -

Page 50

... increase labor costs and reduce profitability. Our operations are dependent on the efforts, abilities and experience of our management and medical support personnel, such as nurses, pharmacists and lab technicians, as well as our physicians. We compete with other health care providers in recruiting... -

Page 51

... individuals who have emergency medical conditions; licensure and certification; hospital rate or budget review; preparing and filing of cost reports; operating policies and procedures; activities regarding competitors; and addition of facilities and services. Among these laws are the federal Anti... -

Page 52

... program in 11 states. The Health Reform Law expands the RAC program's scope to include managed Medicare plans and to include Medicaid claims. In addition, CMS employs MICs to perform post-payment audits of Medicaid claims and identify overpayments. The Health Reform Law increases federal funding... -

Page 53

... adverse events. The Health Reform Law also prohibits the use of federal funds under the Medicaid program to reimburse providers for medical assistance provided to treat HACs. Beginning in federal fiscal year 2015, the 25% of hospitals with the worst national risk-adjusted HAC rates in the previous... -

Page 54

... hospitals and health care professionals that adopt and meaningfully use certified EHR technology. HHS uses the Provider Enrollment, Chain and Ownership System ("PECOS") to verify Medicare enrollment prior to making EHR incentive program payments. During 2012, we received Medicare and Medicaid... -

Page 55

... pay purchase prices that are higher than we believe are reasonable. Some states require CONs in order to acquire a hospital or other facility or to expand facilities or services. In addition, the acquisition of health care facilities often involves licensure approvals or reviews and complex change... -

Page 56

...Any material change in the current payment programs or regulatory, economic, environmental or competitive conditions in those states could have a disproportionate effect on our overall business results. In addition, our hospitals in Florida, Texas and other areas across the Gulf Coast are located in... -

Page 57

... future. On February 15, 2013, upon completion of a secondary offering of our shares held by certain of the Investors, we ceased to qualify as a "controlled company" under applicable New York Stock Exchange listing standards and are required to appoint a board of directors comprised of a majority of... -

Page 58

... operated by us as of December 31, 2012: State Hospitals Beds Alaska ...California ...Colorado ...Florida ...Georgia ...Idaho ...Indiana ...Kansas ...Kentucky ...Louisiana ...Mississippi ...Missouri ...Nevada ...New Hampshire ...Oklahoma ...South Carolina ...Tennessee ...Texas ...Utah ...Virginia... -

Page 59

...operations or financial position). The Court awarded the Foundation, under the terms of the Asset Purchase Agreement, a "fraction" of its attorney fees. The Foundation appealed the remedy phase ruling, and the Company cross-appealed the liability determination. On October 31, 2011, the New Hampshire... -

Page 60

... acquired the Company's stock pursuant or traceable to the Company's Registration Statement issued in connection with the March 9, 2011 initial public offering. The lawsuit asserted a claim under Section 11 of the Securities Act of 1933 against the Company, certain members of the board of directors... -

Page 61

.... The Court also indicated it would award plaintiff attorneys fees. HCA recorded $175 million of legal claim costs in the fourth quarter of 2012 related to this ruling; however, the Company plans to appeal the ruling. General Liability and Other Claims We are subject to claims for additional income... -

Page 62

.... Our common stock is traded on the New York Stock Exchange (the "NYSE") (symbol "HCA"). Our first day of trading was March 10, 2011. On September 21, 2011, we repurchased 80,771,143 shares of our common stock beneficially owned by affiliates of Bank of America Corporation at a purchase price of $18... -

Page 63

...to the cumulative returns of the S&P 500 Index and the S&P Health Care Index. The graph assumes $100 invested on March 10, 2011 in our common stock and in each index with the subsequent reinvestment of dividends. The stock performance shown on the graph represents historical stock performance and is... -

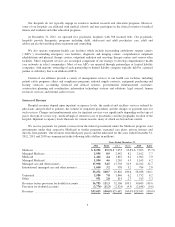

Page 64

... per share ...Financial Position: Assets ...Working capital ...Long-term debt, including amounts due within one year ...Equity securities with contingent redemption rights ...Noncontrolling interests ...Stockholders' deficit ...Cash Flow Data: Cash provided by operating activities ...Cash used in... -

Page 65

... granted approval to operate from the applicable state licensing agency. (d) Represents the average number of licensed beds, weighted based on periods owned. (e) Represents the total number of patients admitted to our hospitals and is used by management and certain investors as a general measure of... -

Page 66

... and medical and technical support personnel, (12) the availability and terms of capital to fund the expansion of our business and improvements to our existing facilities, (13) changes in accounting practices, (14) changes in general economic conditions nationally and regionally in our markets, (15... -

Page 67

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Forward-Looking Statements (continued) Medicaid incentive payments, and (21) other risk factors described in this annual report on Form 10-K. As a consequence, current plans, ... -

Page 68

... advanced technology, by expanding our specialty services and by building our outpatient operations. We believe our continued investment in the employment, recruitment and retention of physicians will improve the quality of care at our facilities. Continue to Leverage Our Scale and Market Positions... -

Page 69

... our in-market growth agenda, we intend to focus on selectively developing and acquiring new hospitals, outpatient facilities and other health care service providers. We believe the challenges faced by the hospital industry may spur consolidation and we believe our size, scale, national presence and... -

Page 70

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Critical Accounting Policies and Estimates (continued) Revenues (continued) patients who are financially unable to pay for the health care services they receive. The Patient ... -

Page 71

... to a deduction from patient service revenues. The amount of the provision for doubtful accounts is based upon management's assessment of historical writeoffs and expected net collections, business and economic conditions, trends in federal, state, and private employer health care coverage and other... -

Page 72

... related to the collection of the patient due accounts. Adverse changes in the percentage of our patients having adequate health care coverage, general economic conditions, patient accounting service center operations, payer mix, or trends in federal, state, and private employer health care coverage... -

Page 73

... 20-year period is used in our reserve estimation process. This company-specific data includes information regarding our business, including historical paid losses and loss adjustment expenses, historical and current case loss reserves, actual and projected hospital statistical data, professional... -

Page 74

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Critical Accounting Policies and Estimates (continued) Professional Liability Claims (continued) approximately five years, although the facts and circumstances of each individual ... -

Page 75

..., including government programs and managed care health plans, under which the facilities are paid based upon the cost of providing services, predetermined rates per diagnosis, fixed per diem rates or discounts from gross charges. We do not pursue collection of amounts related to patients who meet... -

Page 76

...our inpatient revenues, before provision for doubtful accounts, related to Medicare, managed Medicare, Medicaid, managed Medicaid, managed care plans and other insurers and the uninsured for the years ended December 31, 2012, 2011 and 2010 are set forth below. Years Ended December 31, 2012 2011 2010... -

Page 77

...the financial impact the program structure modifications, if any, may have on our results of operations. Electronic Health Record Incentive Payments The American Recovery and Reinvestment Act of 2009 provides for Medicare and Medicaid incentive payments, beginning in 2011, for eligible hospitals and... -

Page 78

... of Operations (continued) Electronic Health Record Incentive Payments (continued) EHR technology for the applicable period. However, unlike Medicaid, this initial payment amount will be adjusted based upon an updated calculation using the annual cost report information for the cost report period... -

Page 79

... used to measure inpatient volume, resulting in a general measure of combined inpatient and outpatient volume. (c) Same facility information excludes the operations of hospitals and their related facilities that were either acquired, divested or removed from service during the current and prior year... -

Page 80

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Results of Operations (continued) Years Ended December 31, 2012 and 2011 Net income attributable to HCA Holdings, Inc. totaled $1.605 billion, or $3.49 per diluted share, for the year... -

Page 81

...utilities, insurance (including professional liability insurance) and nonincome taxes. Other operating expenses include $234 million and $317 million of indigent care costs in certain Texas markets during 2012 and 2011, respectively. Provisions for losses related to professional liability risks were... -

Page 82

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Results of Operations (continued) Years Ended December 31, 2012 and 2011 (continued) During October 2011, we completed our acquisition of the Colorado Health Foundation's ("Foundation... -

Page 83

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Results of Operations (continued) Years Ended December 31, 2011 and 2010 (continued) were 495.943 million shares and 437.347 million shares for the years ended December 31, 2011 and ... -

Page 84

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Results of Operations (continued) Years Ended December 31, 2011 and 2010 (continued) operating expenses include $317 million and $354 million of indigent care costs in certain Texas ... -

Page 85

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Results of Operations (continued) Years Ended December 31, 2011 and 2010 (continued) Our Investors provided management and advisory services to the Company, pursuant to a management ... -

Page 86

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Liquidity and Capital Resources (continued) During 2012, we received cash of $30 million from sales of real estate investments and other health care entities. We also received net ... -

Page 87

... America Corporation at a purchase price of $18.61 per share, the closing price of the Company's common stock on the New York Stock Exchange on September 14, 2011. The repurchase was financed using a combination of cash on hand and borrowings under available credit facilities. The shares repurchased... -

Page 88

...related fees and expenses, we used the net proceeds to pay a distribution to our stockholders and holders of certain vested stock awards. Management believes that cash flows from operations, amounts available under our senior secured credit facilities and our anticipated access to public and private... -

Page 89

... which were awarded to plaintiffs by the courts. These cases are currently under appeal and the bonds will not be released by the courts until the cases are closed. (e) Amounts relate primarily to various insurance programs and employee benefit plan obligations for which we have letters of credit... -

Page 90

HCA HOLDINGS, INC. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (continued) Market Risk We are exposed to market risk related to changes in market values of securities. The investments in debt and equity securities of our wholly-owned insurance subsidiaries ... -

Page 91

... and Changing Prices Various federal, state and local laws have been enacted that, in certain cases, limit our ability to increase prices. Revenues for general, acute care hospital services rendered to Medicare patients are established under the federal government's prospective payment system. Total... -

Page 92

... Disclosures about Market Risk Information with respect to this Item is provided under the caption "Market Risk" under Item 7, "Management's Discussion and Analysis of Financial Condition and Results of Operations." Item 8. Financial Statements and Supplementary Data Information with respect... -

Page 93

... of the Public Company Accounting Oversight Board (United States), the consolidated balance sheets of HCA Holdings, Inc. as of December 31, 2012 and 2011, and the related consolidated statements of income, stockholders' deficit, and cash flows for each of the three years in the period ended December... -

Page 94

...the extent applicable to our chief executive officer, principal financial officer or principal accounting officer) at this location on our website or report the same on a Current Report on Form 8-K. Our Code of Conduct is available free of charge upon request to our Corporate Secretary, HCA Holdings... -

Page 95

... account. * For additional information concerning our equity compensation plans, see the discussion in Note 2 - Share-Based Compensation in the notes to the consolidated financial statements. Item 13. Certain Relationships and Related Transactions, and Director Independence The information required... -

Page 96

...the consolidated financial statements. 3. List of Exhibits 2.1 - Agreement and Plan of Merger, dated July 24, 2006, by and among HCA Inc., Hercules Holding II, LLC and Hercules Acquisition Corporation (filed as Exhibit 2.1 to the Company's Current Report on Form 8-K filed July 25, 2006 (File No. 001... -

Page 97

... and bookrunners, Deutsche Bank Securities and Wachovia Capital Markets LLC, as joint bookrunners and Merrill Lynch Capital Corporation, as documentation agent (filed as Exhibit 4.7(b) to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2006 (File No. 001-11239), and... -

Page 98

..., Deutsche Bank Trust Company Americas, as paying agent, registrar and transfer agent, and Law Debenture Trust Company of New York, as trustee (filed as Exhibit 4.1 to the Company's Current Report on Form 8-K filed April 28, 2009, and incorporated herein by reference). Security Agreement, dated as... -

Page 99

... as Exhibit 4.5 to the Company's Current Report on Form 8-K filed October 3, 2011, and incorporated herein by reference). General Intercreditor Agreement, dated as of November 17, 2006, between Bank of America, N.A., as First Lien Collateral Agent, and The Bank of New York, as Junior Lien Collateral... -

Page 100

...4.1 to the Company's Current Report on Form 8-K filed October 3, 2011, and incorporated herein by reference). Additional General Intercreditor Agreement, dated as of February 16, 2012, by and among Bank of America, N.A., in its capacity as First Lien Collateral Agent, The Bank of New York Mellon, in... -

Page 101

... Rate Global Medium-Term Note (filed as Exhibit 4.20 to the Company's Registration Statement on Form S-4 (File No. 333-145054), and incorporated herein by reference). Form of 7.69% Note due 2025 (filed as Exhibit 4.10 to the Company's Annual Report on Form 10-K for the fiscal year ended December... -

Page 102

...of August 1, 2011, among HCA Inc., HCA Holdings, Inc., Law Debenture Trust Company of New York, as trustee, and Deutsche Bank Trust Company Americas, as paying agent, registrar and transfer agent (filed as Exhibit 4.2 to the Company's Current Report on Form 8-K filed August 1, 2011, and incorporated... -

Page 103

... paying agent and transfer agent (filed as Exhibit 4.2 to the Company's Current Report on Form 8-K filed December 6, 2012, and incorporated herein by reference). Form of 6.25% Senior Notes due 2021 (included in Exhibit 4.52) HCA-Hospital Corporation of America Nonqualified Initial Option Plan (filed... -

Page 104

...Amended and Restated (filed as Exhibit 10.2 to the Company's Current Report on Form 8-K filed February 14, 2012, and incorporated herein by reference).* Form of Director Restricted Share Unit Agreement (Annual Award) Under the 2006 Stock Incentive Plan for Key Employees of HCA Holdings, Inc. and its... -

Page 105

... Office of Inspector General of the United States Department of Health and Human Services (filed as Exhibit 99.4 to the Company's Current Report on Form 8-K dated December 20, 2000 (File No. 001-11239), and incorporated herein by reference). Management Agreement, dated November 17, 2006, among HCA... -

Page 106

... Omnibus Amendment to Stock Option Agreements Issued Under the 2006 Stock Incentive Plan for Key Employees of HCA Holdings, Inc. and its Affiliates, as amended, effective February 16, 2011 (filed as Exhibit 10.38 to the Company's Annual Report on Form 10-K for the fiscal year ended December 31, 2010... -

Page 107

... Act of 2002. The following financial information from our annual report on Form 10-K for the year ended December 31, 2012, filed with the SEC on February 26, 2013, formatted in Extensible Business Reporting Language (XBRL): (i) the consolidated balance sheets at December 31, 2012 and 2011, (ii) the... -

Page 108

...undersigned, thereunto duly authorized. HCA HOLDINGS, INC. By: /S/ RICHARD M. BRACKEN Richard M. Bracken Chairman of the Board and Chief Executive Officer Dated: February 26, 2013 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following... -

Page 109

HCA HOLDINGS, INC. INDEX TO CONSOLIDATED FINANCIAL STATEMENTS Page Report of Independent Registered Public Accounting Firm ...Consolidated Financial Statements: Consolidated Income Statements for the years ended December 31, 2012, 2011 and 2010 ...Consolidated Comprehensive Income Statements for ... -

Page 110

...three years in the period ended December 31, 2012, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), HCA Holdings, Inc.'s internal control over financial reporting... -

Page 111

...YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010 (Dollars in millions, except per share amounts) 2012 2011 2010 Revenues before the provision for doubtful accounts ...Provision for doubtful accounts ...Revenues ...Salaries and benefits ...Supplies ...Other operating expenses ...Electronic health record... -

Page 112

HCA HOLDINGS, INC. CONSOLIDATED COMPREHENSIVE INCOME STATEMENTS FOR THE YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010 (Dollars in millions) 2012 2011 2010 Net income ...Other comprehensive income (loss) before taxes: Foreign currency translation ...Unrealized gains on available-for-sale securities ... -

Page 113

...407 6,172 Long-term debt ...Professional liability risks ...Income taxes and other liabilities ...Stockholders' deficit: Common stock $0.01 par; authorized 1,800,000,000 shares; outstanding 443,200,200 shares - 2012 and 437,477,900 shares - 2011 ...Capital in excess of par value ...Accumulated other... -

Page 114

... FOR THE YEARS ENDED DECEMBER 31, 2012, 2011 AND 2010 (Dollars in millions) Equity (Deficit) Attributable to HCA Holdings, Inc. in Accumulated Equity Common Stock Capital Excess of Other Attributable to Shares Par Par Comprehensive Retained Noncontrolling (000) Value Value Loss Deficit Interests... -

Page 115

... ...Acquisition of hospitals and health care entities ...Disposal of hospitals and health care entities ...Change in investments ...Other ...Net cash used in investing activities ...Cash flows from financing activities: Issuances of long-term debt ...Net change in revolving bank credit facilities... -

Page 116

... a price of $30.00 per share (before deducting underwriter discounts, commissions and other related offering expenses). Our common stock is traded on the New York Stock Exchange (symbol "HCA"). HCA Holdings, Inc. is a holding company whose affiliates own and operate hospitals and related health care... -

Page 117

...include federal and state agencies (under the Medicare and Medicaid programs), managed care health plans, commercial insurance companies and employers. Estimates of contractual allowances under managed care health plans are based upon the payment terms specified in the related contractual agreements... -

Page 118

HCA HOLDINGS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 1 - ACCOUNTING POLICIES (continued) Revenues (continued) to cost reports filed during previous years includes two adjustments to Medicare revenues that affected multiple annual cost report periods for the majority of our ... -

Page 119

... checks are funded through available cash balances or our credit facility. Accounts Receivable We receive payments for services rendered from federal and state agencies (under the Medicare and Medicaid programs), managed care health plans, commercial insurance companies, employers and patients. We... -

Page 120

... FINANCIAL STATEMENTS (Continued) NOTE 1 - ACCOUNTING POLICIES (continued) Accounts Receivable (continued) and 2010, respectively. Adverse changes in general economic conditions, patient accounting service center operations, payer mix or trends in federal or state governmental health care coverage... -

Page 121

... effective as we are not able to justify recording a contract-based asset based upon our analysis of the related control, regulatory and legal considerations. The physician recruiting liability amount of $15 million at both December 31, 2012 and 2011 represents the amount of expense recognized in... -

Page 122

... and $14 million at December 31, 2012 and 2011, respectively, recorded in "other current assets". Financial Instruments Derivative financial instruments are employed to manage risks, including interest rate and foreign currency exposures, and are not used for trading or speculative purposes. We... -

Page 123

...year that will determine the final calculation of the incentive payment is known at that time. Medicare EHR incentive calculations and related initial payment amounts are based upon the most current filed cost report information available at the time our eligible hospitals demonstrate meaningful use... -

Page 124

... 2012 presentation. NOTE 2 - SHARE-BASED COMPENSATION Stock Incentive Plan The 2006 Stock Incentive Plan for Key Employees of HCA Holdings Inc. and its Affiliates, as Amended and Restated (the "Stock Incentive Plan") is designed to promote the long term financial interests and growth of the Company... -

Page 125

... value. The expected volatility is derived using historical stock price information of certain peer group companies for a period of time equal to the expected term. The risk-free interest rate is the approximate yield on United States Treasury Strips having a life equal to the expected share-based... -

Page 126

HCA HOLDINGS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 2 - SHARE-BASED COMPENSATION (continued) Stock Option, SAR and RSU Activity (continued) the year ended December 31, 2012 was $226 million. As of December 31, 2012, the unrecognized compensation cost related to nonvested ... -

Page 127

...'s operations in our consolidated income statements beginning November 2011. The total cost of the HealthONE acquisition has been allocated to the assets acquired and liabilities assumed based upon their respective fair values in accordance with ASC No. 805, Business Combinations. The purchase price... -

Page 128

... in our National Group, $17 million related to a hospital facility in our Southwest Group and $44 million related to Corporate and other, which includes $35 million for the writeoff of capitalized engineering and design costs related to certain building safety requirements (California earthquake... -

Page 129

... the years ended December 31, 2012, 2011 and 2010, respectively. A reconciliation of the federal statutory rate to the effective income tax rate follows: 2012 2011 2010 Federal statutory rate ...35.0% 35.0% 35.0% State income taxes, net of federal tax benefit ...2.2 2.0 2.7 Change in liability for... -

Page 130

... diluted earnings per share using the weighted average number of common shares outstanding plus the dilutive effect of outstanding stock options, SARs and RSUs, computed using the treasury stock method. During March 2011, we completed the initial public offering of 87,719,300 shares of our common... -

Page 131

...55) $515 Amortized Cost 2011 Unrealized Amounts Gains Losses Fair Value Debt securities: States and municipalities ...Auction rate securities ...Asset-backed securities ...Money market funds ...Equity securities ...Amounts classified as current assets ...Investment carrying value ... $398 139 20... -

Page 132

HCA HOLDINGS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 7 - INVESTMENTS OF INSURANCE SUBSIDIARIES (continued) Scheduled maturities of investments in debt securities at December 31, 2012 were as follows (dollars in millions): Amortized Cost Fair Value Due in one year or less ... -

Page 133

... Date Fair Value Euro - United States Dollar Currency Swap ...Derivatives - Results of Operations 241 Euro November 2013 $(13) The following tables present the effect of our interest rate and cross currency swaps on our results of operations for the year ended December 31, 2012 (dollars in... -

Page 134

...would use in pricing the asset or liability. As a basis for considering market participant assumptions in fair value measurements, ASC 820 utilizes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting... -

Page 135

...Fair Value Assets: Investments of insurance subsidiaries: Debt securities: States and municipalities . . Auction rate securities ...Asset-backed securities ...Money market funds ...Equity securities ...Investments of insurance subsidiaries ...Less amounts classified as current assets ...Liabilities... -

Page 136

...Fair Value Assets: Investments of insurance subsidiaries: Debt securities: States and municipalities ...Auction rate securities ...Asset-backed securities ...Money market funds ...Equity securities ...Investments of insurance subsidiaries ...Less amounts classified as current assets ...Liabilities... -

Page 137

HCA HOLDINGS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 10 - LONG-TERM DEBT A summary of long-term debt at December 31, including related interest rates at December 31, 2012, follows (dollars in millions): 2012 2011 Senior secured asset-based revolving credit facility (... -

Page 138

...our option, either (a) a base rate determined by reference to the higher of (1) the federal funds rate plus 0.50% or (2) the prime rate of Bank of America or (b) a LIBOR rate for the currency of such borrowing for the relevant interest period, plus, in each case, an applicable margin. The applicable... -

Page 139

... of $1.000 billion senior notes due 2021 issued by HCA Holdings, Inc.; and (vi) $4 million of unamortized debt discounts that reduce the indebtedness. General Debt Information The senior secured credit facilities and senior secured notes are fully and unconditionally guaranteed by substantially all... -

Page 140

...2012, the Civil Division of the U.S. Attorney's Office in Miami requested information on reviews assessing the medical necessity of interventional cardiology services provided at any Company facility (other than peer reviews). The Company is cooperating with the government's request and is currently... -

Page 141

...award plaintiff attorneys fees. HCA recorded $175 million of legal claim costs in the fourth quarter of 2012 related to this ruling; however, the Company plans to appeal the ruling. NOTE 12 - LEASES We lease medical office buildings and certain equipment under operating lease agreements. Commitments... -

Page 142

... (after costs of the offering) of $2.506 billion. On September 21, 2011, we repurchased 80,771,143 shares of our common stock beneficially owned by affiliates of Bank of America Corporation at a purchase price of $18.61 per share, the closing price of the Company's common stock on the New York Stock... -

Page 143

... Kansas City market. As of January 1, 2013, the National Group includes 77 hospitals located in Alaska, California, southern Georgia, Florida, Idaho, Indiana, northern Kentucky, Nevada, New Hampshire, South Carolina, Utah and Virginia, and the American Group includes 79 hospitals located in Colorado... -

Page 144

... intangible assets are summarized in the following table (dollars in millions): Structure as of December 31, 2012 For the Years Ended December 31, 2012 2011 2010 Revenues: National Group ...Southwest Group ...Central Group ...Corporate and other ...Equity in earnings of affiliates: National Group... -

Page 145

HCA HOLDINGS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 15 - SEGMENT AND GEOGRAPHIC INFORMATION (continued) Structure as of December 31, 2012 As of December 31, 2012 2011 Assets: National Group ...Southwest Group ...Central Group ...Corporate and other ... $ 7,770 10,197 5,... -

Page 146

... FINANCIAL STATEMENTS (Continued) NOTE 15 - SEGMENT AND GEOGRAPHIC INFORMATION (continued) Structure as of January 1, 2013 As of December 31, 2012 2011 Assets: National Group ...American Group ...Corporate and other ... $ 9,451 13,744 4,880 $28,075 $ 9,551 13,406 3,941 $26,898 National Group... -

Page 147

HCA HOLDINGS, INC. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) NOTE 16 - OTHER COMPREHENSIVE LOSS The components of accumulated other comprehensive loss are as follows (dollars in millions): Unrealized Gains on Availablefor-Sale Securities Foreign Currency Translation Adjustments Change ... -

Page 148

......Year ended December 31, 2012 ... $4,860 3,939 4,106 $2,648 2,824 3,770 $(3,569) (2,657) (3,030) $3,939 4,106 4,846 NOTE 18 - SUPPLEMENTAL CONDENSED CONSOLIDATING FINANCIAL INFORMATION AND OTHER COLLATERAL-RELATED INFORMATION On November 22, 2010, HCA Inc. reorganized by creating a new holding... -

Page 149

...-RELATED INFORMATION (continued) Our condensed consolidating balance sheets at December 31, 2012 and 2011 and condensed consolidating statements of comprehensive income and cash flows for each of the three years in the period ended December 31, 2012, segregating HCA Holdings, Inc. issuer, HCA... -

Page 150

... CONDENSED CONSOLIDATING FINANCIAL INFORMATION AND OTHER COLLATERAL-RELATED INFORMATION (continued) HCA HOLDINGS, INC. CONDENSED CONSOLIDATING COMPREHENSIVE INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2011 (Dollars in millions) HCA Subsidiary Holdings, Inc. HCA Inc. Subsidiary NonCondensed... -

Page 151

... - SUPPLEMENTAL CONDENSED CONSOLIDATING FINANCIAL INFORMATION AND OTHER COLLATERAL-RELATED INFORMATION (continued) HCA HOLDINGS, INC. CONDENSED CONSOLIDATING COMPREHENSIVE INCOME STATEMENT FOR THE YEAR ENDED DECEMBER 31, 2010 (Dollars in millions) HCA Holdings, Inc. Issuer HCA Inc. Issuer Subsidiary... -

Page 152

...Goodwill and other intangible assets ...Deferred loan costs ...Other ...LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY Current liabilities: Accounts payable ...Accrued salaries ...Other accrued expenses ...Long-term debt due within one year ...Long-term debt ...Intercompany balances ...Professional... -

Page 153

...Goodwill and other intangible assets ...Deferred loan costs ...Other ...LIABILITIES AND STOCKHOLDERS' (DEFICIT) EQUITY Current liabilities: Accounts payable ...Accrued salaries ...Other accrued expenses ...Long-term debt due within one year ...Long-term debt ...Intercompany balances ...Professional... -

Page 154

... costs ...Share-based compensation ...Equity in earnings of affiliates ...Other ...Net cash provided by (used in) operating activities ...Cash flows from investing activities: Purchase of property and equipment ...Acquisition of hospitals and health care entities ...Disposal of hospitals and health... -

Page 155

...deferred loan costs ...Share-based compensation ...Pay-in-kind interest ...Equity in earnings of affiliates ...Other ...Net cash provided by (used in) operating activities ...Cash flows from investing activities: Purchase of property and equipment ...Acquisition of hospitals and health care entities... -

Page 156

... long-lived assets ...Amortization of deferred loan costs ...Share-based compensation ...Equity in earnings of affiliates ...Other ...Net cash provided by (used in) operating activities ...Cash flows from investing activities: Purchase of property and equipment ...Acquisition of hospitals and health... -

Page 157

...The Hospital Company Consolidated Statements of Stockholder's Deficit presentation for the years ended December 31, 2012, 2011 and 2010 are as follows (dollars in millions): 2012 2011 2010 Presentation in HCA Holdings, Inc. Consolidated Statements of Stockholders' Deficit: Share-based benefit plans... -

Page 158

HCA HOLDINGS, INC. QUARTERLY CONSOLIDATED FINANCIAL INFORMATION (UNAUDITED) (Dollars in millions) 2012 First Second Third Fourth Revenues ...Net income ...Net income attributable to HCA Holdings, Inc...Basic earnings per share ...Diluted earnings per share ... $8,405 $ 639(a) $ 540(a) $ 1.23 $ 1.18... -

Page 159

...in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant's ability to record, process, summarize and report financial information; and (b) Any fraud, whether or not material, that involves management or other employees who... -

Page 160

... information; and (b) Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. By: /s/ R. MILTON JOHNSON R. Milton Johnson President and Chief Financial Officer Date: February 26, 2013 -

Page 161

... of 1934; and (2) The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company. By: /s/ RICHARD M. BRACKEN Richard M. Bracken Chairman of the Board and Chief Executive Officer February 26, 2013 By: /s/ R. MILTON...