Graco 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Graco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Newell Rubbermaid 5 2014 Annual Report

We also acquired Baby Jogger, a leading designer

and marketer of premium baby strollers. The Baby

Jogger® brand and City Mini®, City Select® and other

sub-brands are the perfect premium complement to

our industry-leading Graco® brand, providing a great

opportunity for Newell Rubbermaid to participate

more fully in this fast-growing segment of the market.

With sales in more than 70 countries, Baby Jogger

will also help scale the Baby segment’s geographic

footprint outside North America.

We exited approximately $25 million of non-strategic

sales in our EMEA region, simplifying our operations

for increased profitability and focusing our resources

for growth on the most attractive country-category

combinations. As a result, our 2014 normalized

operating margins in EMEA increased 580 basis

points versus last year to 14.7 percent, equal to our

normalized margins in North America.

In our Home Solutions segment, we have made

tough choices to reposition the Rubbermaid

Consumer business for profitable growth by pulling

back on certain low-margin product lines. And we

announced our intentions to exit our Calphalon®

Kitchen Electrics and outlet stores and the Endicia®

online postage business.

MORE OPPORTUNITY

AHEAD THAN BEHIND

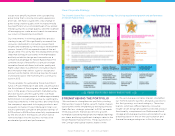

The progress we have made so far as we successfully

drive the Growth Game Plan into action has created

significant value for our shareholders. Our consistently

strong cash flow has enabled us to reward shareholders

with a return of capital through share repurchases

and steady dividend increases.

In 2014, we allocated $546 million to share repurchases

and dividend payments. We also announced the

Board of Directors’ decision to increase and extend

our ongoing open market share repurchase

authorization by an additional $500 million through

2017. Most recently, in February 2015, we increased

our quarterly dividend 12 percent to $0.19 per share,

the fifth dividend increase in the last four years.

While we are proud of our achievements, we are

even more excited by what lies ahead. We are still

only in the second phase of the Growth Game Plan,

and there is much more opportunity in front of us

than we have realized to date.

Looking ahead to 2015 and beyond, we will continue

to tackle unnecessary complexity in our business,

reduce our overhead structure and drive productivity

across the portfolio. Our clear line of sight to these

additional cost savings bolsters our commitment to

step up brand support significantly again in 2015,

with further increases to come in subsequent years.

We have considerable runway to expand our

business internationally, leveraging the success

of our Win Bigger businesses in Latin America

to build repeatable models that we can replicate

across the globe. And we will continue to make

even sharper choices as we strengthen, focus and

scale our portfolio. This will help us reach our goal

of consistently delivering greater than 4 percent

core sales growth and more than 10 percent

normalized earnings per share growth when we

enter the Acceleration phase in 2016.

In a few short years, Newell Rubbermaid has become

a faster-growing and leaner business, investing in our

brands at record levels and winning in the marketplace

in the U.S. and overseas. This transformation has

only been possible thanks to the continued support

of our shareholders.

On behalf of my colleagues at Newell Rubbermaid,

thank you.

Michael B. Polk

President and Chief Executive Ocer

* Please refer to page 18 for information regarding forward-looking

statements and page 20 for information regarding the use of

non-GAAP financial measures.