Fujitsu 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 Fujitsu annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2

To Our Shareholders

Fiscal 2002 Summary

Fujitsu faced another challenging market environment in fiscal 2002, as market conditions in the

U.S. continued to deteriorate amidst the aftermath of the telecom bubble and global deflationary

trends. To ensure our future competitiveness in global markets, we continued the comprehensive

restructuring initiatives we began the previous year. We streamlined our operations. We looked

for ways to cut costs throughout our organization. And we dedicated ourselves to developing new

business. As a result of these efforts, we succeeded in generating a major turnaround, posting

consolidated operating income of ¥100.4 billion, despite a decline in sales.

Our consolidated net sales were ¥4,617.5 billion, down 7.8% from the previous year. While sales

of PCs and mobile phones increased, overall sales of platform products declined sharply as telecom

carriers worldwide cut back on new investments and large-scale system orders in Japan,

particularly from financial institutions, dropped off. Our services business also recorded lower

sales to the telecommunications and financial sectors. Sales of semiconductors increased, however,

as a result of much stronger demand for logic chips and flash memory products.

We managed a significant turnaround in operating income, moving from a loss of ¥74.4 billion

the previous year to a profit of ¥100.4 billion in fiscal 2002. Our software and services business

achieved better productivity in software development and improved profitability in our U.S. and

U.K. services subsidiaries. Our platforms business returned to profitability as a result of

restructuring initiatives. And our electronic devices business managed to trim operating losses.

With the extraordinary losses stemming from restructuring charges and a charge to cover corrective

measures for certain small form-factor hard disk drives, however, we recorded a consolidated net

loss of ¥122.0 billion.

By clamping down on capital expenditures, allocating funds to only the most promising growth

areas, and selling a portion of our investment securities, we generated free cash flow of ¥53.3

billion.

Restructuring Initiatives in Fiscal 2002

Following the major restructuring we undertook the previous year, in order to further improve our

cost structure to cope with increasingly stringent market conditions, we implemented another

round of restructuring in fiscal 2002, mainly in our platforms and electronic devices businesses.

Spending constraints among telecom carriers—in Japan as well as North America—continued to

be severe. To cope with these business realities, we reorganized our telecommunications

equipment production facilities in Japan, as well as our development and production operations for

telecom components.

We also reorganized our printed circuit board production facilities in Japan. We spun off our

From left:

Naoyuki Akikusa, Chairman and Representative Director

Hiroaki Kurokawa, President and Representative Director

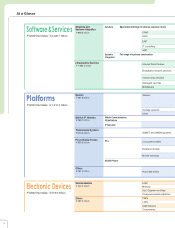

Summary of Results