Freeport-McMoRan 2004 Annual Report Download - page 2

Download and view the complete annual report

Please find page 2 of the 2004 Freeport-McMoRan annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LettertoShareholders 2

OperationsOverview 4

Economic,SocialandEnvironmentalOverview 12

BoardofDirectorsandManagement 16

FinancialandOperatingInformation 17

StockholderInformation 81

YearsEndedDecember31, 2004 2003 2002 2001 2000

(InThousands,ExceptPerShareAmounts)

Revenues $2,371,866 $2,212,165 $1,910,462 $1,838,866 $1,868,610

Operatingincome 703,576 823,308 640,137 542,926 492,293

Netincomeapplicabletocommonstock 156,776 154,219 127,050 76,496 39,500

Dilutednetincomepercommonshare 0.85 0.97 0.87 0.53 0.26

Dividendspaidpercommonshare 1.10 0.27 — — —

AtDecember31:

Totalassets 5,086,995 4,718,366 4,192,193 4,211,929 3,950,741

Long-termdebt,includingcurrentportion,

short-termborrowingsandredeemable

preferredstock 1,951,906 2,228,330 2,488,393 2,801,104 2,665,030

Cashandrestrictedcashandinvestments 551,950 498,616 115,782 149,475 7,968

Stockholders’equity 1,163,649 775,984 266,826 104,444 37,931

Freeport-McMoRanCopper&GoldInc.(FCX)conductsitsoperationsthroughitssubsidiaries,PTFreeport

Indonesia,PTPuncakjayaPower,PTIrjaEasternMineralsandAtlanticCopper,S.A.PTFreeportIndonesia’s

operationsintheIndonesianprovinceofPapuaincludeexplorationanddevelopment,miningandmillingofore

containingcopper,goldandsilver,andtheworldwidemarketingofconcentratescontainingthosemetals.

PTPuncakjayaPowersuppliespowertoPTFreeportIndonesia’soperations.PTIrjaEasternMineralsconducts

mineralexplorationactivitiesinPapua.AtlanticCopper,FCX’swhollyownedsubsidiaryinHuelva,Spain,and

PTSmelting,PTFreeportIndonesia’s25-percent-ownedsmelterfacilityintheIndonesianprovinceofEastJava,

areengagedinthesmeltingandrefiningofcopperconcentrates.

OurcommonstocktradesontheNewYorkStockExchangeunderthesymbol“FCX.”

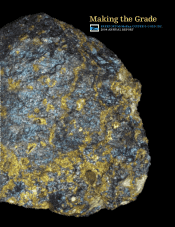

On the cover:

Massivecoppersulphideorefrom

theGrasbergmine’shigh-gradecentralstockworkzone,

Section6South.Themineralspresentinthespecimen

are:chalcopyrite(brassyyellow/orange),bornite

(darkblue/purple),covellite(violet/lightblue),quartz

(clear/roundpatches),withfragmentsoftheoriginal

Grasbergmonzodioriterock(whitepatches).Thegoldin

thespecimenoccursasparticlestoosmalltoseewithin

thecoppersulphideminerals.Thissamplewaspresented

toRichardC.Adkerson,PresidentandChiefExecutive

OfficerofFreeport-McMoRanCopper&GoldInc.by

ArmandoMahler,ExecutiveVicePresidentandGeneral

ManagerofPTFreeportIndonesia,ononeofMr.Adkerson’s

recentvisitstotheminingoperations.

Background photo:

ThesouthwalloftheGrasberg

open-pitminefollowingresumptionofmininginhigher-grade

orein2004.

INVESTORINQUIRIES

TheInvestorRelationsDepartmentwillbepleasedtoreceiveanyinqui-

riesabouttheCompany'ssecurities,includingitscommonstockand

depositaryshares,oraboutanyphaseofthecompany'sactivities.A

linktoourAnnualReportonForm10-KfiledwiththeSecuritiesand

ExchangeCommission,whichincludescertificationsofourChiefExecutive

OfficerandChiefFinancialOfficerandthecompany’sEthicsandBusiness

ConductPolicy,isavailableonourwebsite.Additionally,copieswillbe

furnished,withoutcharge,toanystockholderofthecompanyentitledto

voteatitsannualmeeting,uponwrittenrequest.TheInvestorRelations

Departmentcanbecontactedasfollows:

Freeport-McMoRanCopper&GoldInc.

InvestorRelationsDepartment

1615PoydrasStreet

NewOrleans,Louisiana70112

Telephone(504)582-4000

www.fcx.com

TRANSFERAGENT

Questionsaboutlostcertificates,lostormissingdividendchecks,or

notificationsofchangeofaddressshouldbedirectedtotheFCXtransfer

agent,registraranddividenddisbursementagent:

MellonInvestorServicesLLC

OverpeckCentre,85ChallengerRoad

RidgefieldPark,NewJersey07660

Telephone(800)953-2493

www.melloninvestor.com

NOTICEOFANNUALMEETING

TheannualmeetingofstockholderswillbeheldonMay5,2005.Notice

ofthemeeting,togetherwithaproxyandaproxystatement,isbeing

senttostockholders.Apost-meetingreportsummarizingtheproceedings

ofthemeetingwillbeavailableonourwebsite(www.fcx.com)within

10daysfollowingthemeeting.Acopyofthereportwillbemailedatno

chargetoanystockholderrequestingit.

FCXCLASSBCOMMONSHARES

OurClassBcommonsharestradeontheNewYorkStockExchange(NYSE)

underthesymbol“FCX.”TheFCXsharepriceisreporteddailyinthe

financialpressunder“FMCG”inmostlistingsofNYSEsecurities.Atyear-

end2004,thenumberofholdersofrecordofourClassBcommon

shareswas8,999.

NYSEcompositetapeClassBcommonsharepricerangesduring2004and

2003were:

COMMONSHAREDIVIDENDS

Belowisasummaryofthecommonstockcashdividendsdeclaredand

paidforthequarterlyperiodsof2004and2003,andtheDecember2004

supplementaldividend:

InFebruary2005,theBoardofDirectorsauthorizedasupplemental

commonstockdividendof$0.50persharetobepaidonMarch31,2005,

toshareholdersofrecordasofMarch15,2005.Thesupplementaldivi-

dendtobepaidinMarchrepresentsanadditiontoFCX’sregularquarterly

commonstockdividendof$0.25pershareandthesupplementaldividend

of$0.25persharepaidinDecember2004.

TAXWITHHOLDING–NONRESIDENTALIENSTOCKHOLDERS

NonresidentalienswhoownstockinaU.S.corporationaregenerallysub-

jecttoafederalwithholdingtaxon100percentofthedividendspaidon

thatstock.However,when80percentormoreofacorporation’sincome

isgeneratedoutsidetheU.S.,thewithholdingpercentageisnotcalcu-

latedon100percentofthedividendbutratheronthatportionofthe

dividendattributabletoincomegeneratedintheU.S.FCXhasdetermined

that,forquarterlydividendsandsupplementaldividendspaidin2004

tononresidentalienstockholders,noneofthetotaldividendamountis

subjecttofederalwithholdingtaxbecausenoneofourincomeisfrom

U.S.sources.

Forquarterlydividendspaidin2005,FCXestimatesthatnoneofthetotal

dividendamountissubjecttofederalwithholdingtax.

Foradditionalinformation,pleasecontacttheInvestorRelations

Department.

FCXBENEFICIALOWNERS

Asreflectedinour2005proxystatement,thebeneficialownersof

morethanfivepercentofouroutstandingClassBcommonstockasof

December31,2004,areCapitalResearchandManagementCompany

(12.1percent),FMRCorp.(10.8percent)andPioneerGlobalAsset

ManagementS.p.A.(6.2percent).

Amount

perShare RecordDate PaymentDate

FirstQuarter $0.20 Jan.15,2004 Feb.1,2004

SecondQuarter 0.20 Apr.15,2004 May1,2004

ThirdQuarter 0.20 July15,2004 Aug.1,2004

FourthQuarter 0.25 Oct.15,2004 Nov.1,2004

Supplemental 0.25 Dec.20,2004 Dec.29,2004

|81

NYSEANNUALCEOCERTIFICATION

OurChiefExecutiveOfficer(CEO),RichardC.Adkerson,submittedthe

AnnualCEOCertificationtotheNYSEasrequiredundertheNYSEListed

Companyrules.

Amount

perShare RecordDate PaymentDate

FirstQuarter N/A N/A N/A

SecondQuarter $0.09 Apr.15,2003 May1,2003

ThirdQuarter 0.09 July15,2003 Aug.1,2003

FourthQuarter 0.09 Oct.15,2003 Nov.3,2003

2004 2003

High Low High Low

FirstQuarter $44.90 $35.09 $19.30 $16.01

SecondQuarter 39.85 27.76 25.70 16.72

ThirdQuarter 42.13 31.54 34.57 23.45

FourthQuarter 42.55 33.98 46.74 32.73

2003

2004