Freddie Mac 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.manner that serves our public mission and other non-financial objectives. However, these changes to our business

objectives and strategies may not contribute to our profitability. Some of these changes increase our expenses, while

others require us to forego revenue opportunities in the near-term. In addition, the objectives set forth for us under our

charter and by our Conservator, as well as the restrictions on our business under the Purchase Agreement, have adversely

impacted and may continue to adversely impact our financial results, including our segment results. For example, our

current business objectives reflect, in part, direction given to us by the Conservator. These efforts are expected to help

homeowners and the mortgage market and may help to mitigate future credit losses. However, some of our activities are

expected to have an adverse impact on our near- and long-term financial results. The Conservator and Treasury also did

not authorize us to engage in certain business activities and transactions, including the purchase or sale of certain assets,

which we believe might have had a beneficial impact on our results of operations or financial condition, if executed. Our

inability to execute such transactions may adversely affect our profitability, and thus contribute to our need to draw

additional funds under the Purchase Agreement.

We had a net worth deficit of $146 million as of December 31, 2011, and, as a result, FHFA, as Conservator, will

submit a draw request, on our behalf, to Treasury under the Purchase Agreement in the amount of $146 million. Upon

funding of the draw request: (a) our aggregate liquidation preference on the senior preferred stock owned by Treasury will

increase to $72.3 billion; and (b) the corresponding annual cash dividend owed to Treasury will increase to $7.23 billion.

Under the Purchase Agreement, our ability to repay the liquidation preference of the senior preferred stock is limited and

we will not be able to do so for the foreseeable future, if at all. The aggregate liquidation preference of the senior

preferred stock and our related dividend obligations will increase further if we receive additional draws under the

Purchase Agreement or if any dividends or quarterly commitment fees payable under the Purchase Agreement are not paid

in cash. The amounts we are obligated to pay in dividends on the senior preferred stock are substantial and will have an

adverse impact on our financial position and net worth. We expect to make additional draws under the Purchase

Agreement in future periods.

Our annual dividend obligation on the senior preferred stock exceeds our annual historical earnings in all but one

period. Although we may experience period-to-period variability in earnings and comprehensive income, it is unlikely that

we will regularly generate net income or comprehensive income in excess of our annual dividends payable to Treasury. As

a result, there is significant uncertainty as to our long-term financial sustainability. Continued cash payment of senior

preferred dividends, combined with potentially substantial quarterly commitment fees payable to Treasury under the

Purchase Agreement, will have an adverse impact on our future financial condition and net worth. The payment of

dividends on our senior preferred stock in cash reduces our net worth. For periods in which our earnings and other

changes in equity do not result in positive net worth, draws under the Purchase Agreement effectively fund the cash

payment of senior preferred dividends to Treasury.

For more information on our current business objectives, see “Executive Summary — Our Primary Business

Objectives.” For more information on the conservatorship and government support for our business, see “Executive

Summary — Government Support for Our Business” and “Conservatorship and Related Matters.”

Executive Summary

You should read this Executive Summary in conjunction with our MD&A and consolidated financial statements and

related notes for the year ended December 31, 2011.

Overview

Freddie Mac is a GSE chartered by Congress in 1970 with a public mission to provide liquidity, stability, and

affordability to the U.S. housing market. We have maintained a consistent market presence since our inception, providing

mortgage liquidity in a wide range of economic environments. During the worst housing and financial crisis since the

Great Depression, we are working to support the recovery of the housing market and the nation’s economy by providing

essential liquidity to the mortgage market and helping to stem the rate of foreclosures. We believe our actions are helping

communities across the country by providing America’s families with access to mortgage funding at low rates while

helping distressed borrowers keep their homes and avoid foreclosure, where feasible.

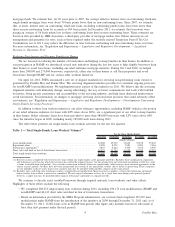

Summary of Financial Results

Our financial performance in 2011 was impacted by the ongoing weakness in the economy, including in the

mortgage market, and by a significant reduction in long-term interest rates and changes in OAS levels. Our total

comprehensive income (loss) was $(1.2) billion and $282 million for 2011 and 2010, respectively, consisting of:

2Freddie Mac