Freddie Mac 2011 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2011 Freddie Mac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

which appeals were pending). Of the total amount of repurchase requests outstanding at December 31, 2011,

approximately $1.2 billion were issued due to mortgage insurance rescission or mortgage insurance claim denial.

Our credit loss exposure is also partially mitigated by mortgage insurance, which is a form of credit enhancement.

Primary mortgage insurance is required to be purchased, typically at the borrower’s expense, for certain mortgages with

higher LTV ratios. As of December 31, 2011, we had mortgage insurance coverage on loans that represent approximately

13% of the UPB of our single-family credit guarantee portfolio. We received payments under primary and other mortgage

insurance of $2.5 billion and $1.8 billion in 2011 and 2010, respectively, which helped to mitigate our credit losses. See

“NOTE 4: MORTGAGE LOANS AND LOAN LOSS RESERVES — Table 4.5 — Recourse and Other Forms of Credit

Protection” for more detail. The financial condition of many of our mortgage insurers continued to deteriorate in 2011.

We expect to receive substantially less than full payment of our claims from Triad Guaranty Insurance Corp., Republic

Mortgage Insurance Company, and PMI Mortgage Insurance Co., which are three of our mortgage insurance

counterparties. We believe that certain other of our mortgage insurance counterparties may lack sufficient ability to meet

all their expected lifetime claims paying obligations to us as those claims emerge. Our loan loss reserves reflect our

estimates of expected insurance recoveries related to probable incurred losses. As of December 31, 2011, only six

insurance companies remained as eligible insurers for Freddie Mac loans, which means that, in the future, our mortgage

insurance exposure will be concentrated among a smaller number of counterparties.

See “MD&A — RISK MANAGEMENT — Credit Risk — Institutional Credit Risk” for further information on our

agreements with our seller/servicers and our exposure to mortgage insurers.

Maintaining Sound Credit Quality of New Loan Purchases and Guarantees

We continue to focus on maintaining credit policies, including our underwriting standards, that allow us to purchase

and guarantee loans made to qualified borrowers that we believe will provide management and guarantee fee income, over

the long-term, that exceeds our expected credit-related and administrative expenses on such loans.

The credit quality of the single-family loans we acquired in 2011 (excluding relief refinance mortgages, which

represented approximately 26% of our single-family purchase volume during 2011) is significantly better than that of

loans we acquired from 2005 through 2008, as measured by early delinquency rate trends, original LTV ratios, FICO

scores, and the proportion of loans underwritten with fully documented income. As of December 31, 2011 and

December 31, 2010, approximately 51% and 39%, respectively, of our single-family credit guarantee portfolio consisted of

mortgage loans originated after 2008 (including relief refinance mortgages), which have experienced lower serious

delinquency trends in the early years of their terms than loans originated in 2005 through 2008.

The improvement in credit quality of loans we have purchased during the last three years (excluding relief refinance

mortgages) is primarily the result of the combination of: (a) changes in our credit policies, including changes in our

underwriting standards; (b) fewer purchases of loans with higher risk characteristics; and (c) changes in mortgage

insurers’ and lenders’ underwriting practices.

Our underwriting procedures for relief refinance mortgages are limited in many cases, and such procedures generally

do not include all of the changes in underwriting standards we have implemented in the last several years. As a result,

relief refinance mortgages generally reflect many of the credit risk attributes of the original loans. However, borrower

participation in our relief refinance mortgage initiative may help reduce our exposure to credit risk in cases where

borrower payments under their mortgages are reduced, thereby strengthening the borrower’s potential to make their

mortgage payments.

Approximately 92% of our single-family purchase volume in 2011 consisted of fixed-rate amortizing mortgages.

Approximately 78% and 80% of our single-family purchase volumes in 2011 and 2010, respectively, were refinance

mortgages, including approximately 33% and 35%, respectively, of these loans that were relief refinance mortgages, based

on UPB.

There is an increase in borrower default risk as LTV ratios increase, particularly for loans with LTV ratios above

80%. Over time, relief refinance mortgages with LTV ratios above 80% (HARP loans) may not perform as well as relief

refinance mortgages with LTV ratios of 80% and below because of the continued high LTV ratios of these loans. In

addition, relief refinance mortgages may not be covered by mortgage insurance for the full excess of their UPB over 80%.

Approximately 12% of our single-family purchase volume in both 2011 and 2010 was relief refinance mortgages with

LTV ratios above 80%. Relief refinance mortgages of all LTV ratios comprised approximately 11% and 7% of the UPB in

our total single-family credit guarantee portfolio at December 31, 2011 and 2010, respectively.

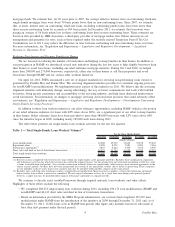

The table below presents the composition, loan characteristics, and serious delinquency rates of loans in our single-

family credit guarantee portfolio, by year of origination at December 31, 2011.

6Freddie Mac