E-Z-GO 1999 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 1999 E-Z-GO annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1999 Textron Annual Report 31999 Textron Annual Report 3

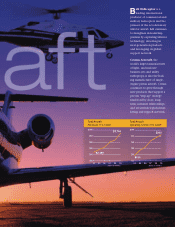

89 90 91 92 93 94 95 96 97 98 99

$0.70

Textron has reported

ten consecutive years

of earnings growth,

including double-digit

gains in each of the

last seven years.

Consistent EPS

Growth

$4.05

esults.

We exceeded the market’s expecta-

tions in each of these measures as

we redeployed $2.9 billion in capi-

tal from the 1999 divestiture of

Avco Financial Services – the largest

disposition in Textron’s history.

This redeployment, evident in our

significant acquisition activity,

caused a temporary reduction

in our margins and return on

invested capital (ROIC) to 10.4%

and 12.6%, respectively. As we

realize the increasing returns

from our recent investments,

we should continue to make

significant progress in these

important measures.

Our ten-year record of 23% average

annual returns to shareowners

underscores the fundamental

strength of Textron. However,

our strong financial performance

and strategic momentum were

not rewarded in the stock market

in 1999. This disappointment

only fueled our determination

to execute our well-defined

strategies to build the great

company we aspire to be.

Our approach for delivering value

is straightforward: adhere to

established financial goals,

execute clear growth strategies,

and demand operating excellence

from each member of the Textron

team. We are confident that

Textron’s market valuation will

ultimately reflect our sustained,

outstanding results.

Earnings per share from continuing operations