Dominion Power 2008 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2008 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.2008 Dominion 17

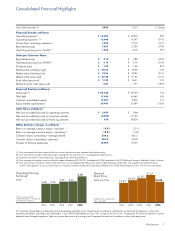

Of course, our access to the capital markets depends strongly on our

credit ratings. You can be assured that the company will work to maintain its

solid ratings. Standard & Poor’s, Fitch and Moody’s rated Dominion Resources

senior unsecured debt A-, BBB+ and Baa2, respectively. Each maintains a

“stable” outlook on its rating. The agencies rate Virginia Electric and Power

Company senior unsecured debt A-, A- and Baa1 respectively, all with

stable outlooks. We manage our cash coverage ratios and balance sheet to

targets that we believe will maintain these ratings over time.

Popular Stock Purchase Plans: Reliable Market for New Equity.

In 2008 we issued $240 million of equity through our employee savings

plans and direct stock purchase plan—including our dividend reinvestment

plan—among other programs. These popular plans have historically gener-

ated about $250 million per year, thanks to continued interest by our existing

shareholders in purchasing additional Dominion shares. This is an important

advantage. The amounts raised through these plans are expected to offset the

need for us to “time” the equity markets and issue large blocks of stock.

We still foresee the need to issue additional equity, more than half of

which will be handled through the reliable annual contribution of our employ-

ee savings plans and direct stock purchase plan, for a total of $500 million in

2009 and $400 million in 2010.

To help with the remaining needs, we have entered into at-the-market

sales agency agreements with major financial institutions that will allow

the company to offer common stock from time to time during the course of

those agreements. In light of Dominion’s total market capitalization—about

$21 billion at year-end—our planned equity issuances in 2009 and 2010

represent a relatively small amount of our equity base.

Proceeds Expected From Asset Sales. Hard cash from asset sales

plays a continuing role in Dominion’s management of your capital. It also

helps to neutralize the need to access capital markets and issue new shares.

You can be assured that the company will work

to maintain its solid [credit] ratings.