Dominion Power 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16 Dominion 2008

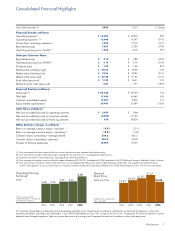

Free Cash Flow Covers Operations, Maintenance—and Dividend.

Revenue generated by our businesses gives us the cash needed to cover

the costs of operating and maintaining them efficiently and safely. And it

covers your dividend payments, as well as some of our spending for growth—

an estimated $2.4 billion in 2009 and $2.0 billion in 2010, of which about

90 percent is planned for our regulated entities.

Like many businesses expanding for the long term, we plan to raise the

balance of needed growth capital by accessing the debt and equity markets.

In all instances, we will access the markets in a manner that we believe will

maintain our credit profile and strong liquidity position. Fortunately, our

financial strength and reputation give us continued access to capital markets

and help ensure that we maintain adequate liquidity.

Accessing Debt Markets, Maintaining Credit Ratings. Our access

to traditional funding sources was beginning to function more normally by

late 2008 and early 2009. In late 2008, for example, in two separate offer-

ings we issued $1.3 billion of new long-term debt through our electric utility

subsidiary and holding company. More than 120 institutional investors

participated in each offering. While the interest rates on this debt are higher

than they have been in recent years, we were pleased to demonstrate our

access to markets that were largely closed to many companies. In addition,

short-term markets for our commercial paper program began to act more

rationally by year-end, although rates were higher than in the recent past. At

no point did we ever lose access to the commercial paper markets.

Because of our continued ability to access the long-term capital markets,

we ended 2008 with $2.9 billion in readily available liquidity, excluding com-

mitments by Lehman Brothers.

Fortunately, our financial strength and

reputation give us continued

access to capital markets and help ensure

that we maintain adequate liquidity.