Dominion Power 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Dominion Power annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

14 Dominion 2008

segments—a growing natural gas and oil exploration and production

business (E&P)— we reduced our exposure to earnings volatility and swings

in commodity prices.

By refocusing more toward utility-based infrastructure businesses while

maintaining upside potential in quality market-based businesses—more than

half of our operating earnings comes from our regulated electric power

and natural gas companies—we have built a “regulated plus” model with the

following financial goals: Earnings growth in challenging economic condi-

tions; an increasing dividend; and strong and stable credit ratings.

Because of our current business mix—and financial and operating

strength—we have maintained adequate liquidity and continued access to

capital markets during the current economic crisis. Even when money is tight,

we are obligated to keep our infrastructure modernization and expansion

plans on track. We will not lie dormant until an economic recovery bell sud-

denly goes off and, only then, begin. Siting, designing, permitting and

constructing a generation facility takes time and large amounts of capital.

Preparing now for future growth is a responsibility that customers rely

on us to carry through.

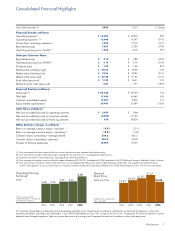

Meeting Operating Earnings, Dividend Targets. Our shareholders

entrust us with the responsibility to base earnings and dividend targets on

realistic assumptions and expectations.

In 2008 our operating earnings were $3.16 per share. That was slightly

above the upper end of our guidance range and up 23 percent from 2007

operating earnings of $2.56 per share. Our 2008 earnings under Generally

Accepted Accounting Principles (GAAP) also were $3.16 per share, down

Targeted

Dividend Increase*

Recent increase puts

targeted 2010 payout ratio

of ~55% in reach.

Dollars per Share

*All dividend declarations subject

to Board of Directors approval

2005 2007 2008 2009* 2010*2006

1.34 1.38 1.46 1.58

1.75

~ 55%

Payout

Ratio