Dollar General 2012 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

8. Derivative financial instruments (Continued)

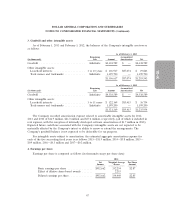

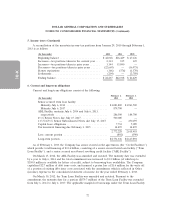

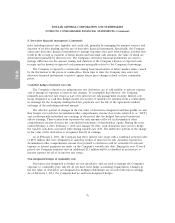

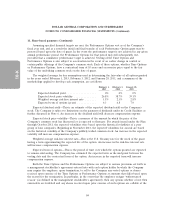

The table below presents the fair value of the Company’s derivative financial instruments as well as

their classification on the consolidated balance sheets as of February 1, 2013 and February 3, 2012:

February 1, February 3,

(in thousands) 2013 2012

Derivatives Designated as Hedging Instruments

Interest rate swaps classified in current liabilities as

Accrued expenses and other ................................... $ — $10,820

Interest rate swaps classified in noncurrent liabilities as Other liabilities ..... $4,822 $ —

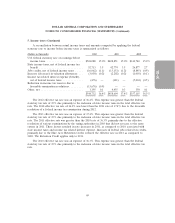

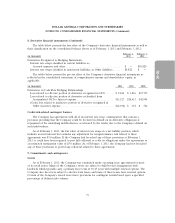

The tables below present the pre-tax effect of the Company’s derivative financial instruments as

reflected in the consolidated statements of comprehensive income and shareholders’ equity, as

applicable:

(in thousands) 2012 2011 2010

Derivatives in Cash Flow Hedging Relationships

Loss related to effective portion of derivative recognized in OCI ..... $ 9,626 $ 3,836 $19,717

Loss related to effective portion of derivative reclassified from

Accumulated OCI to Interest expense ....................... $13,327 $28,633 $42,994

(Gain) loss related to ineffective portion of derivative recognized in

Other (income) expense ................................. $(2,392) $ 312 $ 526

Credit-risk-related contingent features

The Company has agreements with all of its interest rate swap counterparties that contain a

provision providing that the Company could be declared in default on its derivative obligations if

repayment of the underlying indebtedness is accelerated by the lender due to the Company’s default on

such indebtedness.

As of February 1, 2013, the fair value of interest rate swaps in a net liability position, which

includes accrued interest but excludes any adjustment for nonperformance risk related to these

agreements, was $5.0 million. If the Company had breached any of these provisions at February 1,

2013, it could have been required to post full collateral or settle its obligations under the agreements at

an estimated termination value of $5.0 million. As of February 1, 2013, the Company had not breached

any of these provisions or posted any collateral related to these agreements.

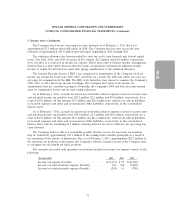

9. Commitments and contingencies

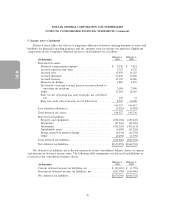

Leases

As of February 1, 2013, the Company was committed under operating lease agreements for most

of its retail stores. Many of the Company’s stores are subject to build-to-suit arrangements with

landlords which typically carry a primary lease term of 10-15 years with multiple renewal options. The

Company also has stores subject to shorter-term leases and many of these leases have renewal options.

Certain of the Company’s leased stores have provisions for contingent rentals based upon a specified

percentage of defined sales volume.

77