Dollar General 2012 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2012 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

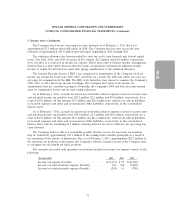

6. Current and long-term obligations (Continued)

remains unchanged. The Company capitalized $5.2 million of debt issue costs associated with the

amendment.

On October 9, 2012, the Credit Facilities were further amended to add additional capacity for the

Company to repurchase, redeem or otherwise acquire shares of its capital stock, not to exceed

$250.0 million. The Company incurred a fee of $1.7 million associated with these amendments which is

included in Other (income) expense in the consolidated statement of income for the year ended

February 1, 2013. The Company was reimbursed for these fees as further discussed in Note 12.

Borrowings under the Credit Facilities bear interest at a rate equal to an applicable margin plus, at

the Company’s option, either (a) LIBOR or (b) a base rate (which is usually equal to the prime rate).

The applicable margin for borrowings as of February 1, 2013 and February 3, 2012 was (i) under the

Term Loan, 2.75% for LIBOR borrowings and 1.75% for base-rate borrowings and (ii) under the ABL

Facility, 1.50% for LIBOR borrowings and 0.50% for base-rate borrowings. At February 3, 2012, prior

to the amendment discussed above, the ABL Facility also had a ‘‘last out’’ tranche of $101.0 million for

which the applicable margin was 2.25% for LIBOR borrowings and 1.25% for base rate borrowings.

The applicable margins for borrowings under the ABL Facility are subject to adjustment each quarter

based on average daily excess availability under the ABL Facility. The Company also must pay

customary letter of credit fees. The interest rate for borrowings under the Term Loan Facility was 3.0%

and 3.1% (without giving effect to the interest rate swaps discussed in Note 8), as of February 1, 2013

and February 3, 2012, respectively.

The senior secured credit agreement for the Term Loan Facility requires the Company to prepay

outstanding term loans, subject to certain exceptions, with percentages of excess cash flow, proceeds of

non-ordinary course asset sales or dispositions of property, and proceeds of incurrences of certain debt.

In addition, the senior secured credit agreement for the ABL Facility requires the Company to prepay

the ABL Facility, subject to certain exceptions, with proceeds of non-ordinary course asset sales or

dispositions of property and any borrowings in excess of the then current borrowing base. The Term

Loan Facility can be prepaid in whole or in part at any time. No prepayments have been required

under the prepayment provisions listed above through February 1, 2013.

All obligations under the Credit Facilities are unconditionally guaranteed by substantially all of the

Company’s existing and future domestic subsidiaries (excluding certain immaterial subsidiaries and

certain subsidiaries designated by the Company under the Credit Facilities as ‘‘unrestricted

subsidiaries’’).

All obligations and guarantees of those obligations under the Term Loan Facility are secured by,

subject to certain exceptions, a second-priority security interest in all existing and after-acquired

inventory and accounts receivable; a first priority security interest in substantially all of the Company’s

and the guarantors’ tangible and intangible assets (other than the inventory and accounts receivable

collateral); and a first-priority pledge of the capital stock held by the Company. All obligations under

the ABL Facility are secured by all existing and after-acquired inventory and accounts receivable,

subject to certain exceptions.

The Credit Facilities contain certain covenants, including, among other things, covenants that limit

the Company’s ability to incur additional indebtedness, sell assets, incur additional liens, pay dividends,

make investments or acquisitions, or repay certain indebtedness.

73