Delta Airlines 2013 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

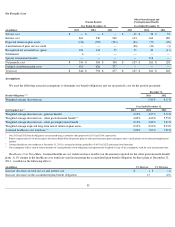

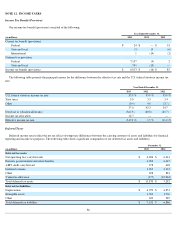

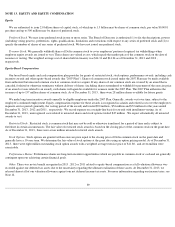

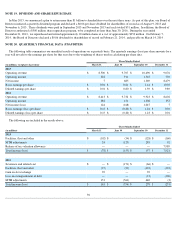

NOTE 16 . RESTRUCTURING AND OTHER ITEMS

The following table shows amounts recorded in restructuring and other items on our Consolidated Statements of Operations:

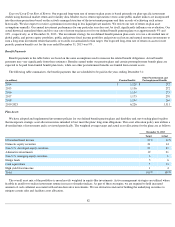

Facilities, Fleet and Other . We recorded restructuring charges of $402 million and $293 million during 2013 and 2012 primarily related to

our fleet restructuring initiative. Under the fleet restructuring initiative, we are focused on removing older, less efficient aircraft from our fleet

and replacing them with B-737-900ER, B-717-200 and CRJ-900 aircraft that we have committed to acquire. The 2013 and 2012 restructuring

charges are related to older, retiring aircraft, including remaining lease payments for grounded aircraft, the acceleration of aircraft depreciation

and lease return costs and related equipment disposals. As an extension of our fleet restructuring initiative and our desire to reduce the number of

regional jets in our network, we shut down the operations of Comair, a wholly-owned regional airline subsidiary, as of September 29, 2012. The

restructuring charges in 2012 also include amounts associated with the closure of Comair.

During 2011, we recorded charges related to consolidation of facilities and certain aircraft that were removed from our operations.

An important component of the fleet restructuring initiative is to reduce 50-seat CRJ aircraft, which are our least fuel efficient aircraft and

have the lowest customer satisfaction ratings. We are targeting a fleet size of 100 to 125 aircraft within the next two years. Our current fleet

includes aircraft we lease and aircraft that are operated for us by regional carriers that own or lease aircraft through third parties. As part of the

reduction, we will retire a significant portion of the fleet that is leased by us. We expect to continue to recognize material restructuring charges

as we retire the leased aircraft for the remaining obligations under the leases. Although many factors could change over the next two years, we

currently estimate that future charges will be between $200 million to $300 million , in addition to the $107 million

recorded in 2013. The timing

and amount of these charges will depend on a number of factors, including our final negotiations with lessors, the timing of removing aircraft

from service and the ultimate disposition of aircraft included in the fleet restructuring program. Also, to accelerate the restructuring of the fleet,

we may park a portion of the fleet on a temporary basis until contracts for aircraft flying under contract carrier agreements expire. The

temporarily parked aircraft will be returned to service as aircraft flying under these expiring agreements exit the fleet. We will continue to incur

operating lease expense for these temporarily parked aircraft. As a result of restructuring the fleet, we expect to benefit from improved

operational and fuel efficiency, customer service and reduced future maintenance cost that we will experience over the life of the new aircraft.

Severance and Related Costs . During 2012, we recognized a severance charge of $237 million , which included $116 million of special

termination benefits (see Note 11 ). We offered voluntary severance programs in which more than 2,000 employees elected to participate. These

participants became eligible for retiree healthcare benefits. Also, we accrued $66 million in severance and related costs in 2012 to provide

severance benefits to Comair's 1,700 employees, as we ceased operations at the carrier.

During 2011, we recorded charges associated primarily with voluntary workforce reduction programs to align staffing with expected future

capacity.

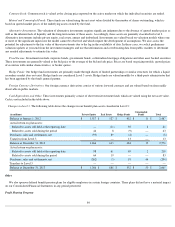

Gain on Slot Exchange.

During December 2011, we closed transactions with US Airways where we received takeoff and landing rights (each

a "slot pair") at LaGuardia in exchange for slot pairs at Reagan National. In approving these transactions, the Department of Transportation

restricted our use of the exchanged slots. We recorded a $78 million deferred gain in December 2011. We recognized this deferred gain in 2012

as the restrictions lapsed.

91

Year Ended December 31,

(in millions) 2013 2012 2011

Facilities, fleet and other

$

402

$

293

$

135

Severance and related costs —

237

100

Routes and slots (See Note 6) —

(

78

)

7

Total restructuring and other items

$

402

$

452

$

242