Delta Airlines 2013 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We record impairment losses on flight equipment and other long-lived assets used in operations when events and circumstances indicate the

assets may be impaired and the estimated future cash flows generated by those assets are less than their carrying amounts. Factors which could

cause impairment include, but are not limited to, (1) a decision to permanently remove flight equipment or other long-lived assets from

operations, (2) significant changes in the estimated useful life, (3) significant changes in projected cash flows, (4) permanent and significant

declines in fleet fair values and (5) changes to the regulatory environment. For long-lived assets held for sale, we discontinue depreciation and

record impairment losses when the carrying amount of these assets is greater than the fair value less the cost to sell.

To determine whether impairments exist for aircraft used in operations, we group assets at the fleet-type level (the lowest level for which

there are identifiable cash flows) and then estimate future cash flows based on projections of capacity, passenger mile yield, fuel costs, labor

costs and other relevant factors. If an impairment occurs, the impairment loss recognized is the amount by which the aircraft's carrying amount

exceeds its estimated fair value. We estimate aircraft fair values using published sources, appraisals and bids received from third parties, as

available.

Goodwill and Other Intangible Assets

We apply a fair value-based impairment test to the carrying value of goodwill and indefinite-lived intangible assets on an annual basis (as of

October 1) and, if certain events or circumstances indicate that an impairment loss may have been incurred, on an interim basis. In 2012, the

FASB issued "Testing Indefinite-Lived Intangible Assets for Impairment." The standard gives companies the option to perform a qualitative

assessment to determine whether it is more likely than not that an indefinite-lived intangible asset is impaired rather than calculating the fair

value of the indefinite-lived intangible asset. It is effective prospectively for annual and interim impairment tests performed for fiscal years

beginning after September 15, 2012, with early adoption permitted. We adopted this standard and have applied the provisions to our annual

indefinite-lived intangible asset impairment tests in both the December 2013 and 2012 quarters. The adoption of this standard did not have a

material impact on our Consolidated Financial Statements. In September 2011, the FASB issued "Testing Goodwill for Impairment." The

standard revises the way in which entities test goodwill for impairment. We adopted this standard and applied its provisions to our annual

goodwill impairment tests in each of the December 2013, 2012 and 2011 quarters.

We value goodwill and identified intangible assets primarily using market capitalization and income approach valuation techniques. These

measurements include the following significant unobservable inputs: (1) our projected revenues, expenses and cash flows, (2) an estimated

weighted average cost of capital, (3) assumed discount rates depending on the asset and (4) a tax rate. These assumptions are consistent with

those hypothetical market participants would use. Since we are required to make estimates and assumptions when evaluating goodwill and

indefinite-lived intangible assets for impairment, the actual amounts may differ materially from these estimates.

Changes in certain events and circumstances could result in impairment. Factors which could cause impairment include, but are not limited

to, (1) negative trends in our market capitalization, (2) an increase in fuel prices, (3) declining passenger mile yields, (4) lower passenger

demand as a result of a weakened U.S. and global economy, (5) interruption to our operations due to a prolonged employee strike, terrorist

attack, or other reasons and (6) changes to the regulatory environment.

Goodwill. Our goodwill balance, which is related to the airline segment, was $9.8 billion at December 31, 2013 . In evaluating goodwill for

impairment, we estimate the fair value of our reporting unit by considering market capitalization and other factors if it is more likely than not

that the fair value of our reporting unit is less than its carrying value. If the reporting unit's fair value exceeds its carrying value, no further

testing is required. If, however, the reporting unit's carrying value exceeds its fair value, we then determine the amount of the impairment charge,

if any. We recognize an impairment charge if the carrying value of the reporting unit's goodwill exceeds its estimated fair value.

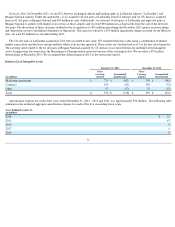

Identifiable Intangible Assets. Our identifiable intangible assets, which are related to the airline segment, had a net carrying amount of $4.7

billion at December 31, 2013 . Indefinite-lived assets are not amortized and consist of routes, slots, the Delta tradename and assets related to

SkyTeam. Definite-lived intangible assets consist primarily of marketing agreements and are amortized on a straight-line basis or under the

undiscounted cash flows method over the estimated economic life of the respective agreements. Costs incurred to renew or extend the term of an

intangible asset are expensed as incurred.

61