Delta Airlines 2013 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

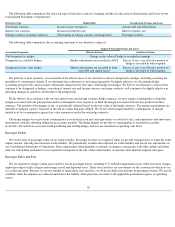

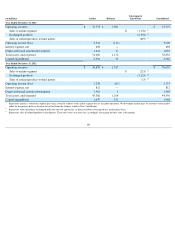

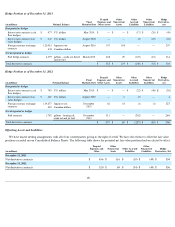

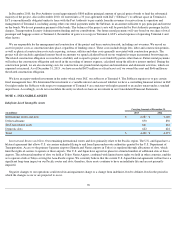

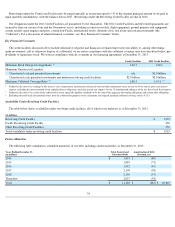

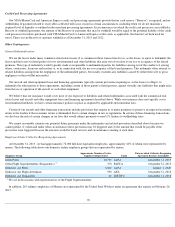

Hedge Position as of

December 31, 2013

Hedge Position as of

December 31, 2012

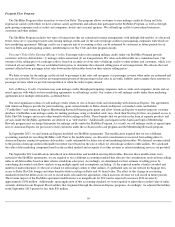

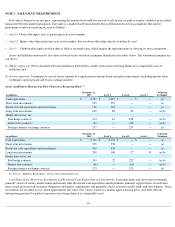

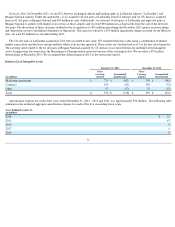

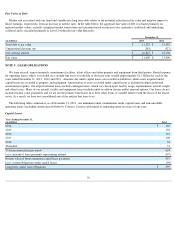

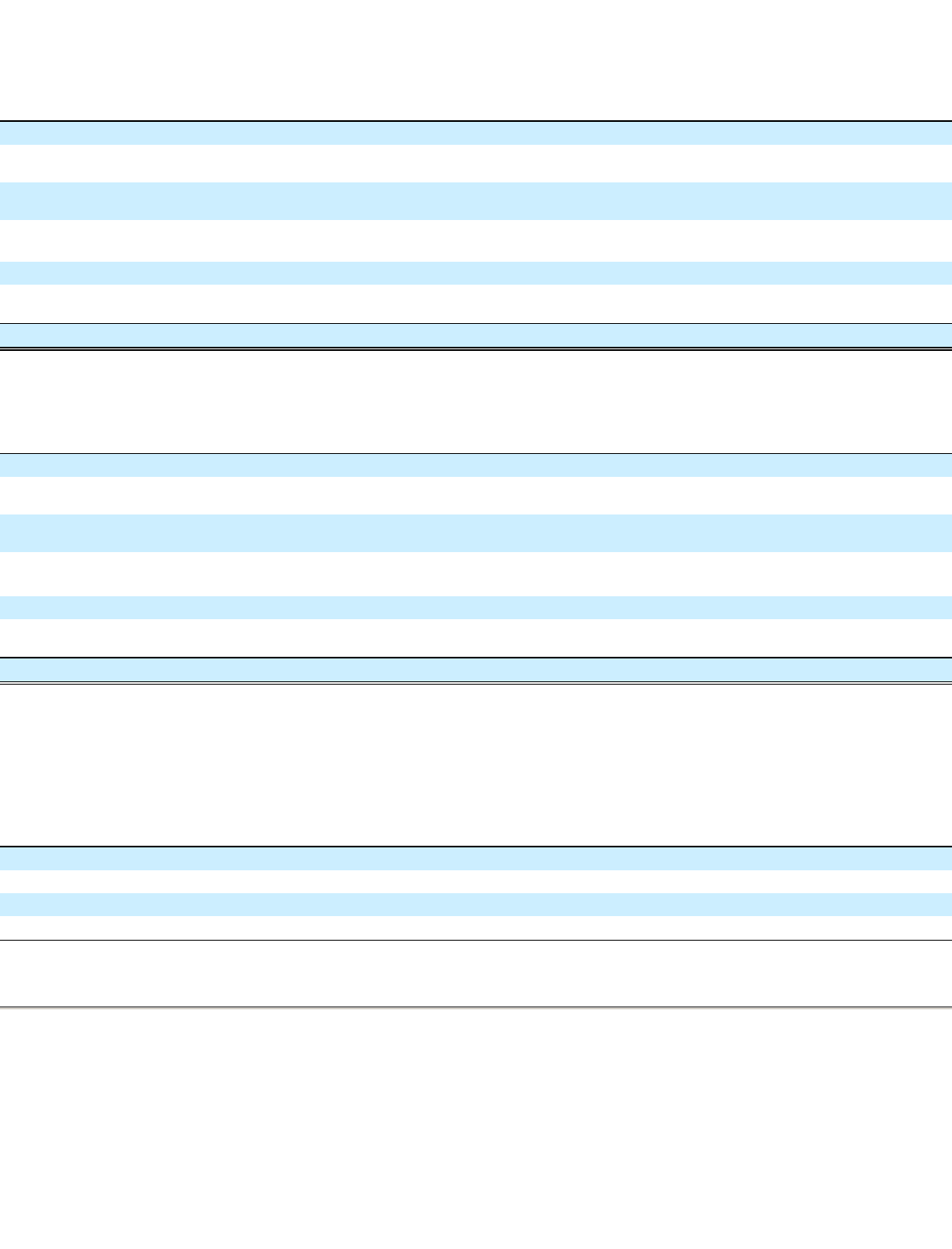

Offsetting Assets and Liabilities

We have master netting arrangements with all of our counterparties giving us the right of setoff. We have elected not to offset the fair value

positions recorded on our Consolidated Balance Sheets. The following table shows the potential net fair value positions had we elected to offset.

68

(in millions) Notional Balance Final

Maturity Date

Prepaid

Expenses and

Other Assets

Other

Noncurrent

Assets

Other

Accrued

Liabilities

Other

Noncurrent

Liabilities

Hedge

Derivatives,

net

Designated as hedges

Interest rate contracts (cash

flow hedges)

$

477

U.S. dollars May 2019

$

—

$

—

$

(

17

)

$

(26

)

$

(43

)

Interest rate contracts (fair

value hedges)

$

445

U.S. dollars August 2022

—

—

(

2

)

(22

)

(24

)

Foreign currency exchange

contracts

120,915

Japanese yen August 2016

157

100

—

—

257

438

Canadian dollars

Not designated as hedges

Fuel hedge contracts

4,077

gallons - crude oil, diesel

and jet fuel March 2015

428

29

(127

)

(16

)

314

Total derivative contracts

$

585

$

129

$

(146

)

$

(64

)

$

504

(in millions) Notional Balance Final

Maturity Date

Prepaid

Expenses and

Other Assets

Other

Noncurrent

Assets

Other

Accrued

Liabilities

Other

Noncurrent

Liabilities

Hedge

Derivatives,

net

Designated as hedges

Interest rate contracts (cash

flow hedges)

$

740

U.S. dollars May 2019

$

—

$

—

$

(

22

)

$

(48

)

$

(70

)

Interest rate contracts (fair

value hedges)

$

469

U.S. dollars August 2022

—

6

(2

)

—

4

Foreign currency exchange

contracts

119,277

Japanese yen December

2015

62

63

(1

)

(1

)

123

430

Canadian dollars

Not designated as hedges

Fuel contracts

1,792

gallons - heating oil,

crude oil and jet fuel December

2013

511

—

(

262

)

—

249

Total derivative contracts

$

573

$

69

$

(287

)

$

(49

)

$

306

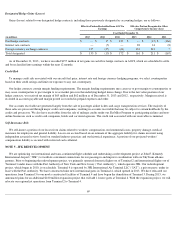

(in millions)

Prepaid

Expenses and

Other

Other

Noncurrent

Assets Other Accrued

Liabilities

Other

Noncurrent

Liabilities Hedge

Derivatives, Net

December 31, 2013

Net derivative contracts

$

456

$

116

$

(19

)

$

(49

)

$

504

December 31, 2012

Net derivative contracts

$

320

$

69

$

(34

)

$

(49

)

$

306