Delta Airlines 2013 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2013 Delta Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

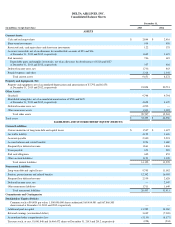

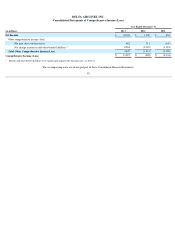

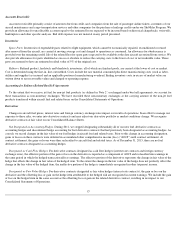

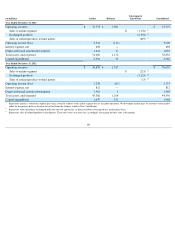

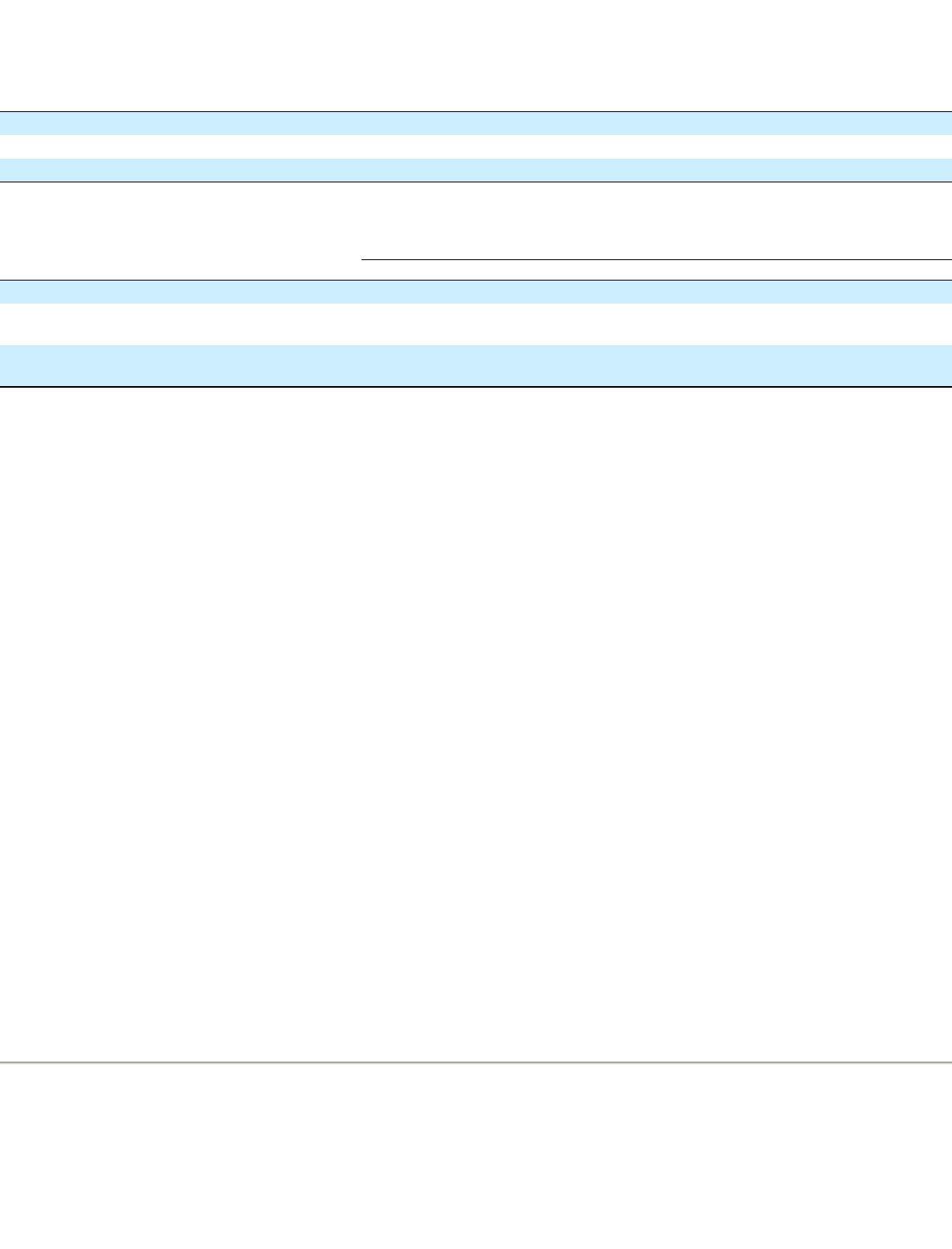

The following table summarizes the risk each type of derivative contract is hedging and the classification of related gains and losses on our

Consolidated Statements of Operations:

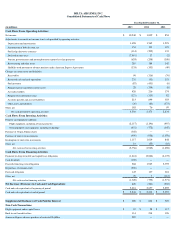

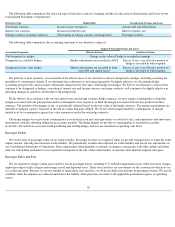

The following table summarizes the accounting treatment of our derivative contracts:

We perform, at least quarterly, an assessment of the effectiveness of our derivative contracts designated as hedges, including assessing the

possibility of counterparty default. If we determine that a derivative is no longer expected to be highly effective, we discontinue hedge

accounting prospectively and recognize subsequent changes in the fair value of the hedge in earnings. We believe our derivative contracts that

continue to be designated as hedges, consisting of interest rate and foreign currency exchange contracts, will continue to be highly effective in

offsetting changes in cash flow attributable to the hedged risk.

Hedge Margin. In accordance with our fuel, interest rate and foreign currency hedge contracts, we may require counterparties to fund the

margin associated with our gain position and/or counterparties may require us to fund the margin associated with our loss position on these

contracts. The amount of the margin, if any, is periodically adjusted based on the fair value of the hedge contracts. The margin requirements are

intended to mitigate a party's exposure to the risk of contracting party default. We do not offset margin funded to counterparties or margin

funded to us by counterparties against fair value amounts recorded for our hedge contracts.

The hedge margin we receive from counterparties is recorded in cash and cash equivalents or restricted cash, cash equivalents and short-term

investments, with the offsetting obligation in accounts payable. The hedge margin we provide to counterparties is recorded in accounts

receivable. All cash flows associated with purchasing and settling hedge contracts are classified as operating cash flows.

Passenger Tickets

We record sales of passenger tickets in air traffic liability. Passenger revenue is recognized when we provide transportation or when the ticket

expires unused, reducing the related air traffic liability. We periodically evaluate the estimated air traffic liability and record any adjustments in

our Consolidated Statements of Operations. These adjustments relate primarily to refunds, exchanges, transactions with other airlines and other

items for which final settlement occurs in periods subsequent to the sale of the related tickets at amounts other than the original sales price.

Passenger Taxes and Fees

We are required to charge certain taxes and fees on our passenger tickets, including U.S. federal transportation taxes, federal security charges,

airport passenger facility charges and foreign arrival and departure taxes. These taxes and fees are assessments on the customer for which we act

as a collection agent. Because we are not entitled to retain these taxes and fees, we do not include such amounts in passenger revenue. We record

a liability when the amounts are collected and reduce the liability when payments are made to the applicable government agency or operating

carrier.

58

Derivative Type Hedged Risk Classification of Gains and Losses

Fuel hedge contracts Increases in jet fuel prices Aircraft fuel and related taxes

Interest rate contracts Increases in interest rates Interest expense, net

Foreign currency exchange contracts Fluctuations in foreign currency exchange rates Passenger revenue

Impact of Unrealized Gains and Losses

Accounting Designation Effective Portion Ineffective Portion

Not designated as hedges Change in fair value of hedge is recorded in earnings

Designated as cash flow hedges Market adjustments are recorded in AOCI Excess, if any, over effective portion of

hedge is recorded in other expense

Designated as fair value hedges Market adjustments are recorded in long-

term debt and capital leases Excess, if any, over effective portion of

hedge is recorded in other expense