Dell 2010 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

counterparty in accordance with our policies. We monitor and manage these activities depending on current and expected market

developments.

See "Part I — Item 1A — Risk Factors" for further discussion of risks associated with our use of counterparties. The impact on our

Consolidated Financial Statements of any credit adjustments related to these counterparties has been immaterial.

Liquidity

Cash generated from operations is our primary source of operating liquidity and we believe that internally generated cash flows are

sufficient to support day-to-day business operations. Our working capital management team actively monitors the efficiency of our

balance sheet under various macroeconomic and competitive scenarios. These scenarios quantify risks to the financial statements and

provide a basis for actions necessary to ensure adequate liquidity, both domestically and internationally, to support our acquisition and

investment strategy, share repurchase activity and other corporate needs. We utilize external capital sources, such as long-term notes and

structured financing arrangements, and short-term borrowings, consisting primarily of commercial paper, to supplement our internally

generated sources of liquidity as necessary. We have a currently effective shelf registration statement filed with the SEC for the issuance

of debt securities. The current shelf registration will terminate during the first quarter of Fiscal 2012 and we intend to replace the shelf

registration prior to its termination to allow us to continue to issue debt securities. We anticipate we will enter the debt capital markets in

the near term; however, it will depend on the favorability of market conditions. We intend to maintain appropriate debt levels based upon

cash flow expectations, the overall cost of capital, cash requirements for operations, and discretionary spending, including for

acquisitions and share repurchases. Due to the overall strength of our financial position, we believe that we will have adequate access to

capital markets. Any future disruptions, uncertainty or volatility in those markets may result in higher funding costs for us and adversely

affect our ability to obtain funds.

Our cash balances are held in numerous locations throughout the world, most of which are outside of the U.S. While our U.S. cash

balances do fluctuate, we typically operate with 10-20% of our cash balances held domestically. Demand on our domestic cash has

increased as a result of our strategic initiatives. We fund these initiatives through a balance of internally generated cash, external sources

of capital, which includes our $2 billion commercial paper program, and, when advantageous, access to foreign cash in a tax efficient

manner. Where local regulations limit an efficient intercompany transfer of amounts held outside of the U.S., we will continue to utilize

these funds for local liquidity needs. Under current law, balances available to be repatriated to the U.S. would be subject to U.S. federal

income taxes, less applicable foreign tax credits. We have provided for the U.S. federal tax liability on these amounts for financial

statement purposes, except for foreign earnings that are considered permanently reinvested outside of the U.S. We utilize a variety of tax

planning and financing strategies with the objective of having our worldwide cash available in the locations where it is needed. Our

non-U.S. domiciled cash and investments are generally denominated in the U.S. Dollar.

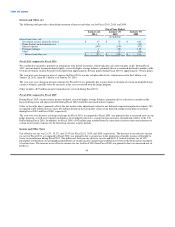

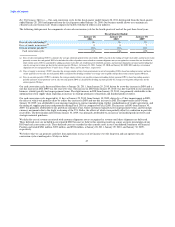

The following table contains a summary of our Consolidated Statements of Cash Flows for the past three fiscal years:

Fiscal Year Ended

January 28, January 29, January 30,

2011 2010 2009

(in millions)

Net change in cash from:

Operating activities $ 3,969 $ 3,906 $ 1,894

Investing activities (1,165) (3,809) 177

Financing activities 477 2,012 (1,406)

Effect of exchange rate changes on cash and cash equivalents (3) 174 (77)

Change in cash and cash equivalents $ 3,278 $ 2,283 $ 588

45