Dell 2010 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

the terms and conditions of the stock awards granted to employees. The dividend yield of zero is based on the fact that Dell has never

paid cash dividends and has no present intention to pay cash dividends.

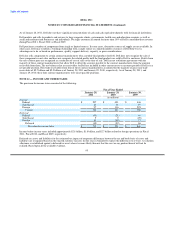

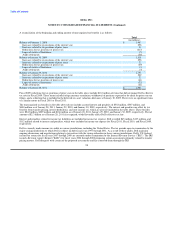

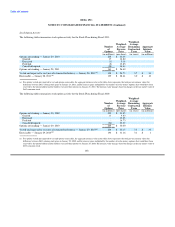

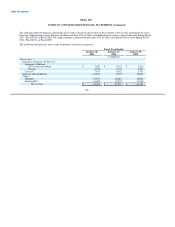

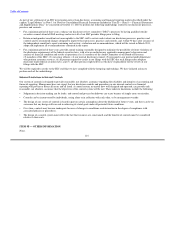

The weighted-average fair value of stock options was determined based on the Black-Scholes option pricing model weighted for all

grants utilizing the assumptions in the following table:

Fiscal Year Ended

January 28, January 29, January 30,

2011 2010 2009

Expected term (in years) 4.5 4.5 3.6

Risk-free interest rate (U.S. Government Treasury Note) 2.2% 1.8% 2.3%

Volatility 37% 44% 37%

Dividends -% -% -%

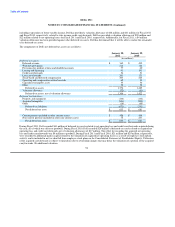

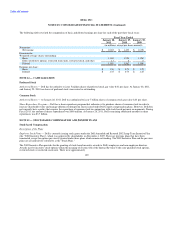

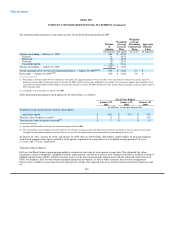

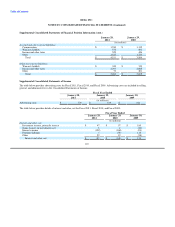

Restricted Stock Awards

Non-vested restricted stock awards and activities were as follows:

Fiscal 2011 Fiscal 2010 Fiscal 2009

Weighted- Weighted- Weighted-

Number Average Number Average Number Average

of Grant Date of Grant Date of Grant Date

Shares Fair Value Shares Fair Value Shares Fair Value

(in millions) (per share) (in millions) (per share) (in millions) (per share)

Non-vested restricted stock:

Beginning balance 40 $ 16.84 36 $ 22.45 36 $ 24.90

Granted 26 14.53 22 11.39 18 19.11

Vested(a) (17) 19.10 (13) 22.78 (10) 24.64

Forfeited (7) 15.21 (5) 18.23 (8) 23.15

Non-vested restricted stock ending balance 42 $ 14.71 40 $ 16.84 36 $ 22.45

(a) Upon vesting, restricted stock units are generally sold to cover the required withholding taxes. However, select participants may choose the net shares settlement

method to cover withholding tax requirements. Total shares withheld were approximately 354,000, 157,000, and 48,000 for Fiscal 2011, Fiscal 2010, and Fiscal

2009, respectively. Total payments for the employee's tax obligations to the taxing authorities were $5 million, $2 million, and $1 million in Fiscal 2011, Fiscal

2010, and Fiscal 2009, respectively, and are reflected as a financing activity within the Consolidated Statements of Cash Flows.

For the Fiscal 2011, Fiscal 2010, and Fiscal 2009, total estimated vest date fair value of restricted stock awards was $250 million,

$134 million, and $197 million.

At January 28, 2011, January 29, 2010, and January 30, 2009, there was $341 million, $393 million, and $507 million, respectively, of

unrecognized stock-based compensation expense, net of estimated forfeitures, related to non-vested restricted stock awards. These awards

are expected to be recognized over a weighted-average period of approximately 1.9, 1.8, and 2.0 years, respectively.

104