Dell 2010 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

DELL INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

administrative appeals procedures. The IRS has recently remanded the audit for tax years 2004 through 2006 back to examination for

further review. Dell believes that it has provided adequate reserves related to all matters contained in tax periods open to examination.

However, should Dell experience an unfavorable outcome in the IRS matter, such an outcome could have a material impact on its results

of operations, financial position, and cash flows. Although the timing of income tax audit resolutions and negotiations with taxing

authorities is highly uncertain, Dell does not anticipate a significant change to the total amount of unrecognized income tax benefits

within the next 12 months.

Dell takes certain non-income tax positions in the jurisdictions in which it operates and has received certain non-income tax assessments

from various jurisdictions. These jurisdictions include Brazil, where Dell has been in litigation with a state government over the proper

application of transactional taxes to warranties and software related to the sale of computers, as well as over the appropriate use of state

statutory incentives to reduce the transactional taxes. Dell has also negotiated certain tax incentives with the state that can be used to

offset potential tax liabilities should the courts rule against it. The incentives are based upon the number of jobs Dell maintains within the

state. Recently, Dell settled two cases related to warranties and software under a taxpayer amnesty program utilizing the incentive credits

instead of cash to minimize the impact to its consolidated financial statements. The third outstanding case, which is on appeal and for

which Dell has pledged its manufacturing facility in Hortolandia, Brazil to the government, remains pending. Dell does not expect the

outcome of this case to have a material impact to its consolidated financial statements.

Dell believes its positions in these non-income tax litigation matters are supportable, that a liability is not probable, and that it will

ultimately prevail. In the normal course of business, Dell's positions and conclusions related to its non-income taxes could be challenged

and assessments may be made. To the extent new information is obtained and Dell's views on its positions, probable outcomes of

assessments, or litigation change, changes in estimates to Dell's accrued liabilities would be recorded in the period in which such

determination is made.

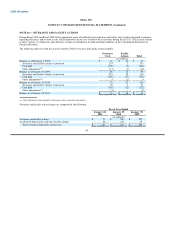

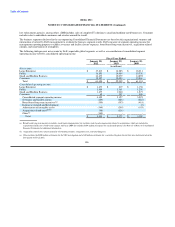

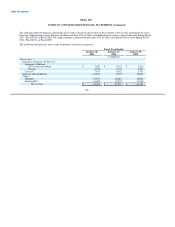

NOTE 13 — EARNINGS PER SHARE

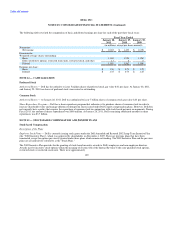

Basic earnings per share is based on the weighted-average effect of all common shares issued and outstanding and is calculated by

dividing net income by the weighted-average shares outstanding during the period. Diluted earnings per share is calculated by dividing

net income by the weighted-average number of common shares used in the basic earnings per share calculation plus the number of

common shares that would be issued assuming exercise or conversion of all potentially dilutive common shares outstanding. Dell

excludes equity instruments from the calculation of diluted earnings per share if the effect of including such instruments is anti-dilutive.

Accordingly, certain stock-based incentive awards have been excluded from the calculation of diluted earnings per share totaling

179 million, 220 million, and 252 million shares for Fiscal 2011, Fiscal 2010, and Fiscal 2009, respectively.

99