Dell 2010 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2010 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

we have aligned with a select number of third party financial services companies. We are exploring the possibility of expanding DFS'

operations into select international markets.

The results of DFS are included in the business segment where the customer receivable was originated. DFS has contributed to the

growth in profitability for all of our business segments in recent periods.

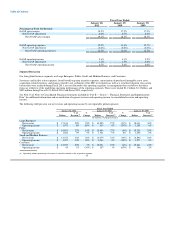

At January 28, 2011 and January 29, 2010, our net financing receivables balances were $4.4 billion and $3.0 billion, respectively. The

increase was primarily the result of the consolidation of two previously nonconsolidated qualifying special purpose entities ("SPEs") and

a purchase of revolving customer receivables from CIT Group Inc. ("CIT") as discussed below. To manage the expected growth in

financing receivables, we will continue to balance the use of our own working capital and other sources of liquidity, including

securitization programs. Beginning in the first quarter of Fiscal 2011, CIT, formerly a joint venture partner of Dell Financial Services

L.L.C. ("DFS"), our wholly-owned subsidiary, is no longer funding DFS financing receivables.

During Fiscal 2011, we continued to transfer certain customer financing receivables to SPEs in securitization transactions. The purpose of

the SPEs is to facilitate the funding of customer receivables through financing arrangements with multi-seller conduits that issue asset-

backed debt securities in the capital markets. We transferred $1.9 billion, $0.8 billion, and $1.4 billion to these SPEs during Fiscal 2011,

Fiscal 2010, and Fiscal 2009, respectively. Our risk of loss related to these securitized receivables is limited to the amount of our over-

collateralization in the transferred pool of receivables. We have a securitization program to fund revolving loans through a consolidated

SPE, which we account for as a secured borrowing. Additionally, as of January 29, 2010, the two SPEs that funded fixed-term leases and

loans were not consolidated. As of the beginning of the first quarter of Fiscal 2011, we adopted the new accounting guidance that requires

us to apply variable interest entity accounting to these special purpose entities and therefore consolidated the two remaining

nonconsolidated SPEs. The impact of the adoption resulted in a $1 million decrease to beginning retained earnings for Fiscal 2011 and

did not impact our results of operations or our cash flows. Starting in the first quarter of Fiscal 2011, we account for these fixed-term

securitization programs as secured borrowings. At January 28, 2011 and January 29, 2010, the structured financing debt related to all of

our secured borrowing securitization programs was $1.0 billion and $164 million, respectively, and the carrying amount of the

corresponding financing receivables was $1.3 billion and $0.3 billion, respectively.

During Fiscal 2011, we purchased a portfolio of revolving receivables from CIT that consisted of revolving Dell customer account

balances. These receivables, which are considered credit impaired loans, were purchased for $430 million and had a principal and accrued

interest balance of $570 million at the date of purchase. All of the receivables have been serviced by DFS since their inception. In

connection with the acquisition, we ended our servicing relationship with CIT for these assets. See the "Restricted Cash" discussion for

additional information on the termination of our agreement with CIT. We believe the overall economics generated by these assets will be

accretive to our results and will provide an acceptable return on capital.

We maintain an allowance to cover expected financing receivable credit losses and evaluate credit loss expectations based on our total

portfolio. For Fiscal 2011, Fiscal 2010, and Fiscal 2009, the principal charge-off rate for our total portfolio, excluding the effect of the

receivables purchased from CIT during Fiscal 2011, was 6.6%, 8.0%, and 7.0%, respectively. If the receivables purchased from CIT had

been included in our portfolio for all of Fiscal 2011, the rate would have been 7.5%. Principal charge-offs for the purchased receivables

do not impact our allowance for losses as they were contemplated in the purchase price and are reflected in the yield recognized as

interest income. The allowance for losses is determined based on various factors, including historical and anticipated experience, past due

receivables, receivable type, and customer risk profile. At January 28, 2011 and January 29, 2010, the allowance for financing receivable

losses was $241 million and $237 million, respectively. In general, we are seeing improving loss rates associated with our financing

receivables as the economy has stabilized. We have an extensive process to manage our exposure to customer risk, including active

management of credit lines and our collection activities. The credit quality mix of our financing receivables has improved in recent years

due to our underwriting actions and as the mix of high quality commercial accounts in our portfolio has increased. Based on our

assessment of the customer financing receivables, we believe that we are adequately reserved.

The Credit Card Accountability, Responsibility, and Disclosure Act of 2009 was signed into U.S. law on May 22, 2009, and has affected

the consumer financing provided by DFS. Commercial credit is unaffected by the changes in law. All provisions of the law are now in

effect. This Act imposed new restrictions on credit card companies in the

42