Dell 1997 Annual Report Download - page 40

Download and view the complete annual report

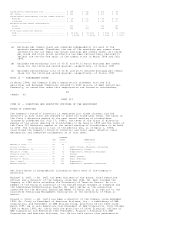

Please find page 40 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. reduction of 25% to reflect the probability of forfeiture due to

termination of employment prior to vesting and the probability of a

shortened option term due to termination of employment prior to the option

expiration date. The ultimate values of the options will depend on the

future market prices of the common stock, which cannot be forecast with

reasonable accuracy. The actual value, if any, that an optionee will

recognize upon exercise of an option will depend on the difference between

the market value of the common stock on the date the option is exercised

and the applicable exercise price.

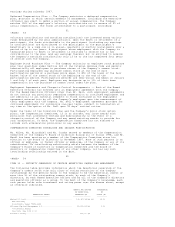

(c) These options were granted as a part of the ESOIP, which is described

below. These options were fully vested when granted but were not

exercisable until the first anniversary of the date of grant. These options

were received in lieu of fiscal 1997 annual bonuses in the following

amounts: Mr. Topfer, $1,031,622 (100%); Mr. Meredith, $545,232 (100%); and

Mr. Kelly, $151,682 (40%). Those amounts are shown in the Bonus column of

the "Summary Compensation Table" above.

50

<PAGE> 52

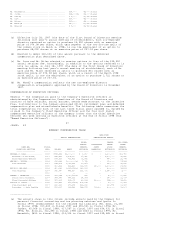

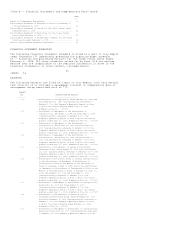

The following table sets forth, for each Named Executive Officer, information

concerning the exercise of stock options during fiscal 1998 and the value of

unexercised stock options at the end of fiscal 1998.

AGGREGATED OPTION EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION VALUES

NUMBER OF SHARES VALUE OF UNEXERCISED

UNDERLYING UNEXERCISED IN-THE-MONEY OPTIONS

SHARES OPTIONS AT FISCAL YEAR-END AT FISCAL YEAR-END(B)

ACQUIRED VALUE --------------------------- ---------------------------

NAME ON EXERCISE REALIZED(A) EXERCISABLE UNEXERCISABLE EXERCISABLE UNEXERCISABLE

---- ----------- ----------- ----------- ------------- ----------- -------------

Mr. Dell............. 0 $ 0 832,000 6,048,000 $36,214,480 $200,467,820

Mr. Topfer........... 1,241,000 37,519,304 0 3,698,388 0 163,012,986

Mr. Rollins.......... 408,000 13,921,321 128,000 2,544,000 5,786,558 102,532,852

Mr. Meredith......... 620,000 19,910,401 472,670 1,134,990 22,126,660 49,392,046

Mr. Kelly............ 28,000 734,414 250,376 543,916 11,309,826 22,043,709

---------------

(a) Calculated using the difference between (1) the actual sales price of the

underlying shares (if the underlying shares were sold immediately upon

exercise) or the closing sales price of the common stock on the date of

exercise (if the underlying shares were not sold immediately upon exercise)

and (2) the exercise price.

(b) Amounts were calculated by multiplying the number of unexercised options by

the closing sales price of the common stock on the last trading day of

fiscal 1998 ($49.72) and subtracting the exercise price.

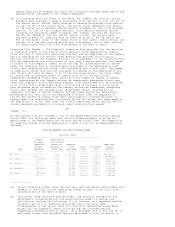

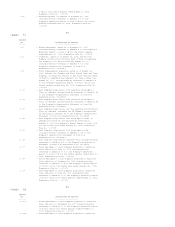

Under the ESOIP, which is a program implemented under the Incentive Plan,

certain members of the Company's management (including the executive officers)

may elect, on an annual basis, to receive stock options in lieu of all or a

portion of the annual bonus that they would otherwise receive. The exercise

price of the options is 80% of the fair market value of the Company's common

stock on the date of issuance. The number of shares subject to the options is

dependent on the amount of bonus a participant designates for the program and is

calculated by dividing the designated bonus amount by 20% of the fair market

value of the common stock on the date of issuance. For the first two years of

the program (fiscal 1996 and fiscal 1997), the options were fully vested at the

time of issuance but were not exercisable for a period of one year. Effective

for fiscal 1998, the options are subject to a one-year vesting period and do not

vest and become exercisable until the first anniversary of the date of grant.

All decisions regarding participation in the program and the amount of bonus to

designate must be made several months in advance of the anticipated bonus

payment date. With respect to fiscal 1998, 240 persons (including four of the

Named Executive Officers) elected to participate in the program with respect to

their bonuses for such year.

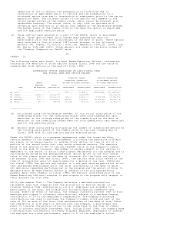

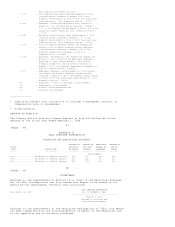

401(k) Retirement Plan -- The Company maintains a defined contribution

retirement plan that complies with the provisions of Section 401(k) of the

Internal Revenue Code. Substantially all U.S. employees are eligible to

participate in the plan, and eligibility for participation commences upon

hiring. Under the terms of the plan, the Company currently matches 100% of each

employee participant's voluntary contributions, subject to a maximum Company

contribution of 3% of the employee's compensation. The Company's matching

contributions are used to purchase the Company's common stock and vest at the

rate of 20% on each of the first five anniversaries of the date of hire. After

the completion of five years of service with the Company, a participant may

elect to transfer the portion of his or her funds held in the form of common

stock to another available investment fund. During fiscal 1998, the Company made

a discretionary contribution for every eligible employee, regardless of whether

the employee was a plan participant, equal to 2% of the employee's actual