Dell 1997 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.purchase shares under the existing stock option agreements typically vests

pro-rata at each option anniversary date over a five-year period. Stock options

must be exercised within ten years from date of grant. Stock options are

generally issued at fair market value. Under the Incentive Plan, each

nonemployee director of the Company automatically receives nonqualified stock

options annually.

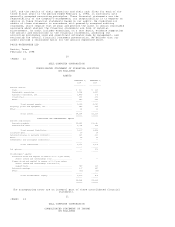

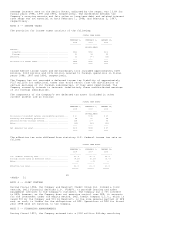

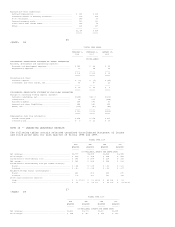

The following table summarizes stock option activity:

FISCAL YEAR ENDED

---------------------------------------------------------

FEBRUARY 1, 1998 FEBRUARY 2, 1997 JANUARY 28, 1996

----------------- ----------------- -----------------

WEIGHTED WEIGHTED WEIGHTED

NUMBER AVERAGE NUMBER AVERAGE NUMBER AVERAGE

OF EXERCISE OF EXERCISE OF EXERCISE

SHARES PRICE SHARES PRICE SHARES PRICE

------ -------- ------ -------- ------ --------

(SHARE DATA IN MILLIONS)

Outstanding at beginning of year... 113 $ 3.89 94 $2.10 90 $1.13

Granted............................ 22 $27.21 43 $6.58 32 $3.91

Canceled........................... (5) $ 6.19 (7) $2.34 (8) $1.02

Exercised.......................... (20) $ 3.02 (17) $1.50 (20) $1.05

--- --- ---

Outstanding at end of year......... 110 $ 8.99 113 $3.89 94 $2.10

=== === ===

Exercisable at year-end............ 25 $11.90 19 $1.81 19 $1.30

31

<PAGE> 33

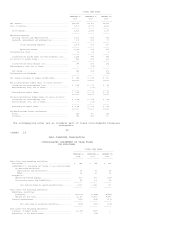

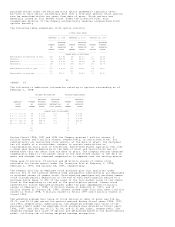

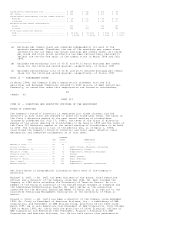

The following is additional information relating to options outstanding as of

February 1, 1998:

OPTIONS OUTSTANDING OPTIONS EXERCISABLE

-------------------------------- -------------------

WEIGHTED WEIGHTED WEIGHTED

EXERCISE NUMBER AVERAGE AVERAGE NUMBER AVERAGE

PRICE OF EXERCISE CONTRACTUAL OF EXERCISE

RANGE SHARES PRICE LIFE (YEARS) SHARES PRICE

--------------- ------ -------- ------------ ------- ---------

(SHARE DATA IN MILLIONS)

$ 0.01 - $ 1.99 28 $ 1.16 5.8 12 $ 1.38

$ 2.00 - $ 4.99 27 $ 3.61 7.5 7 $ 3.47

$ 5.00 - $ 9.99 27 $ 6.16 8.3 4 $ 6.18

$10.00 - $19.99 14 $14.08 8.9 2 $11.24

$20.00 - $50.50 14 $36.00 9.4 -- $ --

--- --

110 25

=== ==

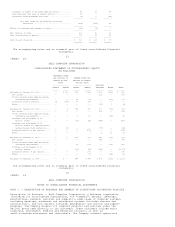

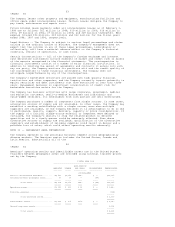

During fiscal 1998, 1997 and 1996 the Company granted 1 million shares, 3

million shares and 6 million shares, respectively, of restricted stock. For

substantially all restricted stock grants, at the date of grant, the recipient

has all rights of a stockholder, subject to certain restrictions on

transferability and a risk of forfeiture. Restricted shares typically vest over

a seven-year period beginning on the date of grant and restrictions may not

extend more than ten years from the date of grant. The Company records unearned

compensation equal to the market value of the restricted shares on the date of

grant and charges the unearned compensation to expense over the vesting period.

There were 10 million, 29 million and 68 million shares of common stock

available for future grants under the Incentive Plan at February 1, 1998,

February 2, 1997, and January 28, 1996, respectively.

The Company also has an employee stock purchase plan that qualifies under

Section 423 of the Internal Revenue Code and permits substantially all employees

to purchase shares of common stock. Participating employees may purchase common

stock through payroll deductions at the end of each participation period at a

purchase price equal to 85% of the lower of the fair market value of the common

stock at the beginning or the end of the participation period. Common stock

reserved for future employee purchases under the plan aggregated 13 million

shares at February 1, 1998, 15 million shares at February 2, 1997, and 19

million shares at January 28, 1996. Shares issued under this plan were 2 million

shares in fiscal 1998, 3 million shares in fiscal 1997 and 3 million shares in

fiscal 1996.

The weighted average fair value of stock options at date of grant was $16.26,

$3.73, and $2.22 per option for options granted during fiscal years 1998, 1997,

and 1996, respectively. Additionally, the weighted average fair value of the

purchase rights under the employee stock purchase plan granted in fiscal years

1998, 1997, and 1996 was $6.11, $2.04, and $1.01 per right, respectively. The

weighted average fair value of options was determined based on the Black-Scholes

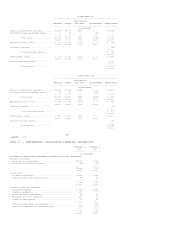

model, utilizing the following weighted average assumptions: