Dell 1997 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(to be paid in July 1997), the Board of Directors decided to review the

Company's non-employee director compensation arrangement and, pending completion

of that review, unanimously elected to forego the adjustment in their annual

option awards for the July 1997 stock split. Consequently, each non-employee

director who was serving immediately after the stockholders' meeting in 1997

received an annual option award covering 24,000 shares (rather than 48,000,

which would have been the award had the split adjustment been made).

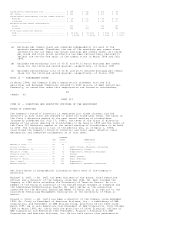

In November 1997, after completing a thorough review and analysis of

non-employee director compensation plans at various companies deemed comparable

for this purpose, the Board of Directors unanimously determined that it was in

the best interests of the Company and its stockholders to modify the terms of

the compensation paid to non-employee directors, including the size of the

automatic option awards, and adopted new non-employee director compensation

arrangements. Under the new arrangements, the number of shares of common stock

subject to each annual option award for a Service Year will be equal to the

"Annual Award Base Number" for that Service Year divided by the fair market

value of the common stock on the date of grant. The number of shares subject to

an initial option award for a new non-employee director will be equal to the

"Initial Award Base Number" divided by the fair market value of the common stock

on the date of grant, and the first annual option award for a new non-employee

director will be prorated on the same basis as the director's annual retainer

fee, as described above. The Annual Award Base Number will be $650,000 (subject

to an annual escalation factor of 10%), and the Initial Award Base Number at any

given time will be 300% of the then-applicable Annual Award Base Number. The

annual option awards for each Service Year are to be granted as of the first day

of that Service Year, and an initial option award is to be granted to a new

non-employee director as of the date of the first Board of Directors meeting

attended. Under the new arrangements, the method of computing the number of

shares subject to the initial and annual option awards will not be adjusted to

take into account future stock splits (including the two-for-one split of the

common stock paid in March 1998); however, once an option has been issued, the

number of shares subject to the option and the exercise price of the option will

be adjusted to take into account any subsequent stock splits.

As a result of these new non-employee director compensation arrangements, each

of the Company's current non-employee directors will receive, effective as of

the date of the upcoming annual meeting of stockholders (which is scheduled for

July 17, 1998), an annual option award covering a number of shares equal to

$650,000 divided by the fair market value of the common stock on the date of

grant. It is not possible to compute the size of the award at the present time;

however, if the number were computed on the basis of the fair market value of

the common stock as of March 31, 1998, the size of the award would be

approximately 9,600 shares, which is substantially smaller than it would have

been (96,000 shares) had the non-employee director compensation arrangements not

been changed.

In the case of both initial awards and annual awards, the exercise price of the

option is equal to the "fair market value" of the common stock on the date of

grant, which is defined as the average of the high and low reported sales price

of the common stock on that date. The option vests and becomes exercisable with

respect to 20% of the shares on each of the first five anniversaries of the date

of grant, so long as the director remains a member of the Board of Directors

through those dates. The option terminates when the director ceases to be a

member of the Board of Directors (if the Board of Directors demands or requests

the director's resignation), 90 days after the director ceases to be a member of

the Board of Directors (if the director resigns for any other reason) or one

year after the director ceases to be a member of the Board of Directors because

of death or permanent disability. In any event, the option terminates on the

tenth anniversary of the date of grant.

46

<PAGE> 48

Because Mr. Mandl was appointed to the Board of Directors at the time that the

new compensation arrangement was approved, his compensation is based on the new

arrangement. Consequently, effective November 21, 1997, the date of the first

Board of Directors meeting that Mr. Mandl attended, Mr. Mandl received an option

covering 61,356 shares of common stock, 46,017 were attributable to his initial

award and 15,339 were attributable to the annual award for the Service Year that

commenced in 1997. Had the Board of Directors not changed the non-employee

director compensation arrangement, Mr. Mandl would have received an option

covering 240,000 shares.

Other Benefits -- The Company reimburses non-employee directors for their

reasonable expenses associated with attending Board of Directors meetings and

provides the directors with liability insurance coverage with respect to their

activities as directors of the Company.

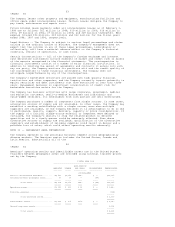

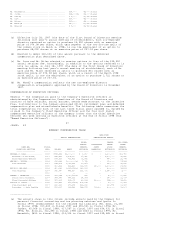

Compensation During Fiscal 1998 -- The following table describes the fiscal 1998

fees and stock option grants for each of the Company's non-employee directors.

CASH

NAME PAYMENTS OPTIONS GRANTED(A)

---- -------- ------------------

Mr. Carty............................................ $35,000(b) 48,000 shares