Dell 1997 Annual Report Download - page 38

Download and view the complete annual report

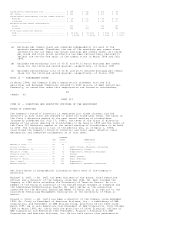

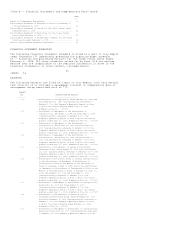

Please find page 38 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. 1996; and Mr. Kelly, $3,350 in fiscal 1998 and $5,693 in fiscal 1997) and

relocation expenses paid by the Company and reimbursement for the related

tax liability (Mr. Topfer, $2,741 in fiscal 1998 and $82,484 in fiscal

1996; and Mr. Rollins, $128,816 in fiscal 1998 and $34,456 in fiscal 1997).

For Mr. Rollins, the amount shown for fiscal 1997 also includes the amount

of bonus paid on commencement of employment ($90,000). For Mr. Meredith,

the amount shown for fiscal 1996 also includes imputed interest on

below-market loans that have since been repaid ($2,049). For Mr. Kelly, the

amounts shown also include expat allowances ($335,406 in fiscal 1998,

$365,709 in fiscal 1997 and $245,948 in fiscal 1996) and reimbursement for

miscellaneous goods and services ($66,782 in fiscal 1998, $51,214 in fiscal

1997 and $42,327 in fiscal 1996).

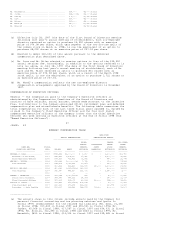

(b) For Mr. Topfer, the amount shown represents the value of 160,000 shares of

the Company's common stock awarded on July 24, 1995 (calculated using the

closing sales price of the common stock on the date of grant, which was

$4.00). The shares are subject to vesting and transfer restrictions that

will lapse with respect to all of the shares on the fourth anniversary of

the date of grant. In addition, the shares are subject to forfeiture (and

any gain realized on the sale of the shares is subject to repayment to the

Company) if Mr. Topfer competes with the Company within two years after his

employment with the Company is terminated.

For Mr. Meredith, the amount shown represents the value of 80,000 shares of

the Company's common stock awarded on July 24, 1995 (calculated using the

closing sales price of the common stock on the date of grant, which was

$4.00). The shares are subject to vesting and transfer restrictions that

will lapse with respect to one-seventh of the shares on each of the first

seven anniversaries of the date of grant. In addition, the shares are

subject to forfeiture (and any gain realized on the sale of the shares is

subject to repayment to the Company) if Mr. Meredith competes with the

Company within two years after his employment with the Company is

terminated.

For Mr. Kelly, the amount shown represents the value of 160,000 shares of

the Company's common stock awarded on February 7, 1995 (calculated using

the closing sales price of the common stock on the date of grant, which was

$2.57) and the value of 80,000 shares of the Company's common stock awarded

on July 24, 1995 (calculated using the closing sales price of the common

stock on the date of grant, which was $4.00). With respect to each award,

the shares are subject to vesting and transfer restrictions that will lapse

with respect to one-seventh of the shares on each of the first seven

anniversaries of the date of grant. In addition, the shares are subject to

forfeiture (and any gain realized on the sale of the shares is subject to

repayment to the Company) if Mr. Kelly competes with the Company within two

years after his employment with the Company is terminated.

48

<PAGE> 50

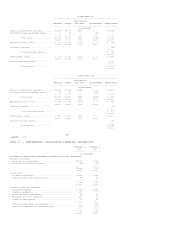

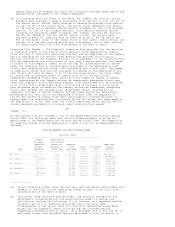

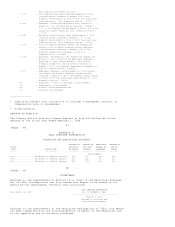

The total number and value of the shares of restricted stock held by the

Named Executive Officers as of the end of fiscal 1998 are as follows, with

the values based on the closing sales price of the Company's common stock on

the last trading day of fiscal 1998 ($49.72):

NUMBER

OF SHARES VALUE

--------- ----------

Mr. Dell.................................................... 0 $ 0

Mr. Topfer.................................................. 160,000 7,955,040

Mr. Rollins................................................. 0 0

Mr. Meredith................................................ 57,120 2,839,949

Mr. Kelly................................................... 194,160 9,653,441

When and if the Board of Directors declares and pays dividends on the

Company's common stock, such dividends will be paid on the outstanding

shares of restricted stock described in this note at the same rate as they

are paid to all stockholders.

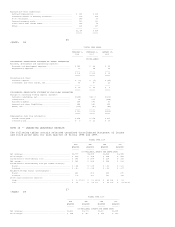

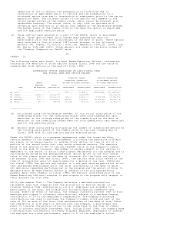

(c) Does not include options granted under the Executive Stock Ownership

Incentive Program described below (the "ESOIP"), pursuant to which a Named

Executive Officer may elect to receive discounted stock options in lieu of

all or a portion of annual bonus. See note (e) below for information

regarding ESOIP elections made for fiscal 1998 annual bonuses. For

information regarding the stock option grants made during fiscal 1998

(including information with respect to options granted pursuant to ESOIP

elections made for fiscal 1997 annual bonuses), see the table titled "Option

Grants in Last Fiscal Year" under "Item 11 -- Executive

Compensation -- Compensation of Executive Officers -- Incentive Plan Awards"

below.

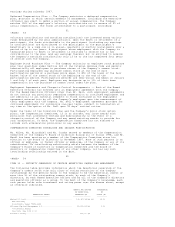

(d) Includes the value of the Company's contributions to the Company-sponsored

401(k) retirement savings plan that is available to all Company employees,

the amount of the Company's contributions to the deferred compensation plan

that is available to certain members of the Company's management and the