Dell 1997 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 1997 Dell annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.higher-end enterprise and higher-platform notebook systems.

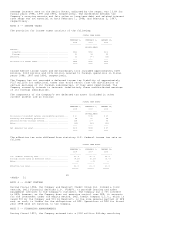

The unit volume increase in fiscal 1997 was also a result of increased demand

for the Company's products across all product lines. In particular, demand for

enterprise products resulted in unit growth of 160% in fiscal 1997, compared to

a 37% decrease in units in fiscal 1996. Additionally in fiscal 1997, the Company

continued to introduce products utilizing latest technology, including products

incorporating Intel's Pentium and Pentium Pro processors with speeds at the

200MHz level.

13

<PAGE> 15

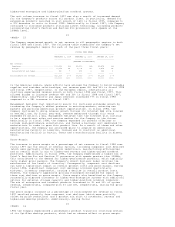

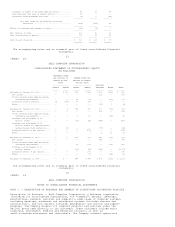

The Company experienced growth in net revenue in all geographic regions in both

fiscal 1998 and fiscal 1997. The following table summarizes the Company's net

revenue by geographic region for each of the past three fiscal years:

FISCAL YEAR ENDED

----------------------------------------------------------

FEBRUARY 1, 1998 FEBRUARY 2, 1997 JANUARY 28, 1996

---------------- ----------------- -----------------

(DOLLARS IN MILLIONS)

Net revenue:

Americas............................... $ 8,531 69% $5,279 68% $3,474 66%

Europe................................. 2,956 24 2,004 26 1,478 28

Asia-Pacific and Japan................. 840 7 476 6 344 6

------- ---- ------ ---- ------ ----

Consolidated net revenue................. $12,327 100% $7,759 100% $5,296 100%

======= ==== ====== ==== ====== ====

In the Americas region, where efforts have allowed the Company to build valuable

supplier and customer relationships, net revenue grew 62% and 52% in fiscal 1998

and fiscal 1997, respectively. In the European region, substantially all

countries experienced revenue growth in both fiscal 1998 and fiscal 1997. This

allowed Europe to increase revenue 48% and 36% in fiscal 1998 and fiscal 1997,

respectively. Asia-Pacific and Japan revenues increased 77% in fiscal 1998

compared to a 38% increase in fiscal 1997.

Management believes that opportunity exists for continued worldwide growth by

increasing the Company's market presence in existing markets, entering new

markets and pursuing additional product opportunities. In fiscal 1998, the

Company continued to drive revenue growth through its Internet Web site located

at www.dell.com. By fiscal year-end, revenue generated through this venue

exceeded $4 million a day. Management believes that the Internet will continue

to be a significant sales and service medium for the Company in the future.

Additionally in fiscal 1998, the Company expanded its product offerings to

include high-performance workstations, and formed a business unit dedicated to

workstations in order to grow this product line. As a result of these and other

opportunities, the Company has announced plans to acquire an additional

manufacturing facility in Limerick, Ireland and to construct an additional

manufacturing facility in Austin, Texas and a manufacturing facility in Xiamen,

China.

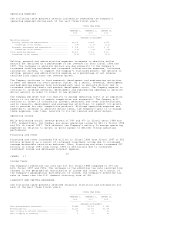

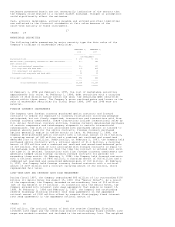

Gross Margin

The increase in gross margin as a percentage of net revenue in fiscal 1998 over

fiscal 1997 was the result of several factors, including component cost declines

(which were partially offset by price reductions), manufacturing efficiencies

and an overall shift in mix to higher-end servers and higher-priced notebook

platforms. Additionally in fiscal 1998, the Company experienced a higher mix of

Intel's Pentium Pro and Pentium II processors with speeds greater than 200MHz.

This contributed to the demand for higher-performance products, which typically

carry higher gross margins. The Company's direct business model involves the

maintenance of low levels of inventory. Consequently, component cost declines

can have a significant impact on overall product costs and gross margin. During

fiscal 1998, significant component cost declines occurred (particularly

mid-year, in memory components), causing a decline in overall product costs.

However, the Company's aggressive pricing strategies mitigated the impact of

these cost declines on gross margin. Gross margin also benefited as the Company

successfully migrated customers to higher-end enterprise systems with additional

options for external storage capacity and higher-platform notebook computers.

The mix of enterprise and notebook products increased to 9% and 20% of system

revenue, respectively, compared with 4% and 18%, respectively, during the prior

fiscal year.

The gross margin increase as a percentage of consolidated net revenue in fiscal

1997 resulted primarily from component cost declines (which were partially

offset by price reductions) and a product mix shift to notebooks, servers and

higher-end desktop products. Additionally, during fiscal

14

<PAGE> 16

1996 the Company experienced a problematic product transition involving certain

of its OptiPlex desktop products, which had an adverse effect on gross margin.