D-Link 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 D-Link annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

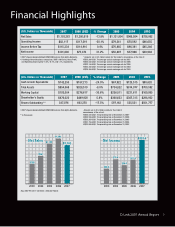

The operational strength becomes clearer when we look at the

breakdown of annual revenue by region, where the Emerging and

Asia Pacific markets generated 48% of total revenue, followed by

Europe with 29%, then North America at 23%. Emerging and Asia

Pacific markets also displayed strong sales growth with 23%,

followed by a 15% increase in Europe, while North America declined

11% from FY2006.

Worldwide, we experienced increased revenue growth with WLAN

leading the product categories at 39%, followed by switch at 26%,

broadband at 20%, and digital home devices at 11% of global annual

revenue. All had great performance, with growth rates of 14%, 14%,

9 % and 5%, respectively. Switch and wireless product revenue also

increased compared to the previous year, a reflection of D-Link’s

success in the SMB and 11n product categories.

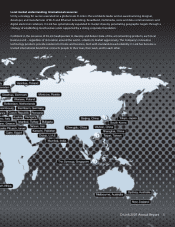

Localized Global Presence

Our continued market penetration worldwide was due, in large part,

to our strengthening of localized business units on every major

continent. This is in direct correlation to our increased revenue and

profit, especially in Emerging and Asia Pacific markets where 22

operating business units were added in FY2007, bringing our total

global presence to 127 offices worldwide.

The strong growth momentum established in FY2006 continued into

FY2007, fueled by local long-term infrastructure and economic

expansion.

Emerging and Asia Pacific Markets

Switch products, especially those with Green Ethernet technology,

accounted for a majority of sales in Russia for FY2007, while

broadband products and IP surveillance cameras were the main

cause of Latin America’s growth. We successfully penetrated Japan’s

market in FY2007 with initial success attributed to the demand for

core-to-edge managed gigabit switches, while Southeast Asia

focused on wireless switch solutions. One of the reasons for our

success was our ability to partner with the region’s governments,

universities, hospitals and other growing businesses and

organizations, as well as further cultivation of new and existing

channel partnerships.

Europe

The same partnership strategy was evident in all European regions.

Growth in areas such as Western and Nordic Europe was stimulated

by our Wi-Fi networking and IP storage product sales, while Eastern

Europe saw sales steadily increase from a variety of broadband

projects. We have realized the financial benefits of our efforts during

the past two years from consolidating sales, marketing, and product

strategies across all countries in the region, and unifying our brand

presence despite the challenges of intensified competition in a

mature European market.

North America

North America market revenue declined to 23% of total sales for the

Company. However, we remain confident in our strategy to deal with

increased price competition, high retail overheads and other

challenges that face the saturated consumer market. We have

increased the focus on our 802.11n solutions with aggressive pricing

and product segmentation strategies to meet the growing demands

for this important market segment. In-Stat reports that the North

American home network storage market will continue to present the

greatest opportunities worldwide in terms of volume. Media serving

features that offer a simple-to-use interface is what the market wants,

which D-Link provides. For the SMB and enterprise side, we are even

more optimistic. Our business products are becoming increasingly

attractive to organizations through our affordability, functionality

and cost-effectiveness versus that of our largest competitors,

especially in a downward-trending market.

The Future Remains Bright

For FY2008’s industry outlook, the demand from Telcos/ISPs for

networking infrastructure remains healthy. As for the enterprise

sector, corporate spending seems to have softened while consumer

expenditures remains stagnant, especially in developed countries.

Although we see 11n Wi-Fi technology will gradually replace 11g, the

future of WiMAX remains to be seen. Overall, the networking

industry is projected to grow at a stable pace for FY2008.

Although D-Link saw a decline in sales among both North American

and European markets, the Company believes that this is a result of

the enduring economic challenges of these regions rather than a

decline in global presence. Overall, profits have steadily increased,

which can be accounted for by the large success in sales from both

Emerging and Asia Pacific markets. D-Link continues to foresee a

profitable outcome for the Company, with the North American and

European regions enhancing the SMB channel coverage.

The key drivers to D-Link’s growth will be the launch of new models

on SMB products, such as managed Green Ethernet and Metro

Ethernet switches; consumer products, such as 11n-enabled IP

cameras and NAS storage, and D-Link 2.0 (D-Life) products, including

IP telephony and camera devices.

Our continued growth and track record for success give us a solid

foundation on which to build for the future. More importantly, it is

you – our devoted employees, our loyal customers, our dedicated

partners and our trusting shareholders – who we thank the most.

We are proud to have you on our winning team.

D-Link 2007 Annual Report 3

Sincerely,

John Lee

Chairman

D-Link Group