Crucial 2014 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2014 Crucial annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

NOR Flash Memory

NOR Flash products are electrically re-writeable, non-volatile semiconductor memory devices that retain content when

power is turned off, offer fast read times due to random access capability and have execute-in-place ("XiP") capability that

enables processors to read NOR Flash without first accessing RAM. These capabilities make NOR ideal for storing program

code in wireless and embedded applications. Our NOR Flash sales were 3%, 9% and 12% of our total net sales for 2014, 2013

and 2012, respectively. NOR Flash products are sold primarily by EBU and CNBU.

We offer both parallel and serial interface NOR Flash products in a broad range of densities, packages and features. Our

parallel NOR Flash products are constructed to meet the needs of the consumer electronics, industrial, wired and wireless

communications, computing and automotive applications. These products offer high densities, XiP performance, architectural

flexibility and proven reliability in rigorous industrial settings. Our serial NOR Flash products are designed to meet the needs

of consumer electronics, industrial, automotive, wired and wireless communications and computing applications. These

products offer industry-standard packaging, pinouts, command sets and chipset compatibility.

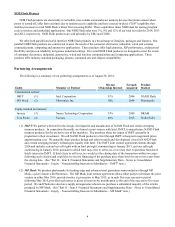

Partnering Arrangements

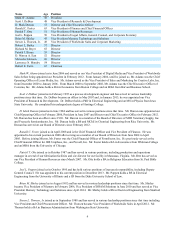

The following is a summary of our partnering arrangements as of August 28, 2014:

Entity Member or Partner Micron

Ownership Interest Formed/

Acquired Product

Market

Consolidated entities:

IMFT (1) Intel Corporation 51% 2006 NAND Flash

MP Mask (2) Photronics, Inc. 50% 2006 Photomasks

Equity method investments:

Inotera (3) Nanya Technology Corporation 33% 2009 DRAM

Tera Probe (4) Various 40% 2013 Wafer Probe

(1) IMFT: We partner with Intel for the design, development and manufacture of NAND Flash and certain emerging

memory products. In connection therewith, we formed a joint venture with Intel, IMFT, to manufacture NAND Flash

memory products for the exclusive use of the members. The members share the output of IMFT generally in

proportion to their investment. We sell NAND Flash products to Intel through IMFT at long-term negotiated prices

approximating cost. We generally share product design and other research and development costs for NAND Flash

and certain emerging memory technologies equally with Intel. The IMFT joint venture agreement extends through

2024 and includes certain buy-sell rights with an Intel put right, commencing in January 2015, and our call right

commencing in January 2018, pursuant to which Intel may elect to sell to us, or we may elect to purchase from Intel,

Intel's interest in IMFT. If Intel elects to sell to us, we would set the closing date of the transaction within two years

following such election and could elect to receive financing of the purchase price from Intel for one to two years from

the closing date. (See "Part II – Item 8. Financial Statements and Supplementary Data – Notes to Consolidated

Financial Statements – Equity – Noncontrolling Interests in Subsidiaries – IMFT" note.)

(2) MP Mask: We produce photomasks for leading-edge and advanced next generation semiconductors through MP

Mask, a joint venture with Photronics. The MP Mask joint venture agreement allows either party to terminate the joint

venture in either May 2016, provided notice is given prior to May 2015, or in each five-year successive period

following May 2016, provided such notice is given at least twelve months prior to the end of the successive five-year

period. We and Photronics also have supply arrangements wherein we purchase a substantial majority of the reticles

produced by MP Mask. (See "Part II – Item 8. Financial Statements and Supplementary Data – Notes to Consolidated

Financial Statements – Equity – Noncontrolling Interests in Subsidiaries – MP Mask" note.)