Crucial 2014 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2014 Crucial annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

ITEM 1A. RISK FACTORS

In addition to the factors discussed elsewhere in this Form 10-K, the following are important factors which could cause

actual results or events to differ materially from those contained in any forward-looking statements made by or on behalf of us.

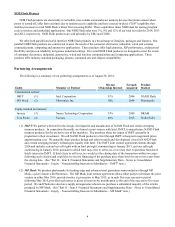

We have experienced dramatic declines in average selling prices for our semiconductor memory products which have

adversely affected our business.

If average selling prices for our memory products decrease faster than we can decrease per gigabit costs, our business,

results of operations or financial condition could be materially adversely affected. We have experienced significant decreases

in our average selling prices per gigabit in recent years as noted in the table below and may continue to experience such

decreases in the future. In some prior periods, average selling prices for our memory products have been below our

manufacturing costs and we may experience such circumstances in the future.

DRAM Trade NAND

Flash*

(percentage change in average selling prices)

2014 from 2013 6% (23)%

2013 from 2012 (11)% (18)%

2012 from 2011 (45)% (55)%

2011 from 2010 (39)% (12)%

* Trade NAND Flash excludes sales to Intel from IMFT.

We may be unable to maintain or improve gross margins.

Our gross margins are dependent upon continuing decreases in per gigabit manufacturing costs achieved through

improvements in our manufacturing processes, including reducing the die size of our existing products. In future periods, we

may be unable to reduce our per gigabit manufacturing costs at sufficient levels to maintain or improve gross margins. Factors

that may limit our ability to reduce costs include, but are not limited to, strategic product diversification decisions affecting

product mix, the increasing complexity of manufacturing processes, difficulty in transitioning to smaller line-width process

technologies, technological barriers and changes in process technologies or products that may require relatively larger die sizes.

Per gigabit manufacturing costs may also be affected by the relatively smaller production quantities and shorter product

lifecycles of certain specialty memory products.

The semiconductor memory industry is highly competitive.

We face intense competition in the semiconductor memory market from a number of companies, including Samsung

Electronics Co., Ltd.; SanDisk Corporation; SK Hynix Inc. and Toshiba Corporation. Some of our competitors are large

corporations or conglomerates that may have greater resources to withstand downturns in the semiconductor markets in which

we compete, invest in technology and capitalize on growth opportunities. Consolidation of industry competitors could put us at

a competitive disadvantage. In addition, some governments, such as China, may be considering providing, or have provided,

significant financial assistance to some of our competitors or to new entrants. Our competitors seek to increase silicon capacity,

improve yields, reduce die size and minimize mask levels in their product designs. Transitions to smaller line-width process

technologies and product and process improvements have resulted in significant increases in the worldwide supply of

semiconductor memory. Increases in worldwide supply of semiconductor memory also result from semiconductor memory fab

capacity expansions, either by way of new facilities, increased capacity utilization or reallocation of other semiconductor

production to semiconductor memory production. Our competitors may increase capital expenditures resulting in future

increases in worldwide supply. Increases in worldwide supply of semiconductor memory, if not accompanied by commensurate

increases in demand, would lead to further declines in average selling prices for our products and would materially adversely

affect our business, results of operations or financial condition.