Creative 2007 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2007 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

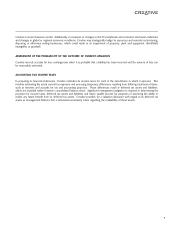

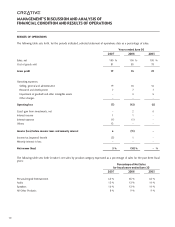

CONSOLIDATED BALANCE SHEET DATA (US$’000):

As of June 30

2007 2006 2005 2004 2003

Cash and cash equivalents $ 250,480 $ 213,995 $ 187,246 $ 211,077 $ 232,053

Working capital 351,260 405,907 506,527 297,502 209,389

Total assets 723,033 830,613 1,077,474 940,848 646,843

Long-term debt, net of

current maturities 129,131 206,593 209,455 35,614 39,027

Shareholders’ equity 408,570 393,153 581,132 691,497 428,837

Notes:

(1) Other charges of $5.9 million in the results of operations in fiscal year 2006 comprised a $4.9 million restructuring charge

relating to 3Dlabs Inc., Ltd (“3Dlabs”) and $1.0 million in employee separation costs under a worldwide workforce reduction

exercise.

(2) Other income of $114.6 million in fiscal year 2007 included a $100.0 million paid-up license by Apple Inc. for use of the

Creative ZEN Patent in its products.

(3) As described in Note 10 of “Notes to Consolidated Financial Statements,” Creative was granted a Pioneer Certificate under

the International Headquarters Award that will expire in March 2010. Under the Pioneer Certificate, profits arising from

qualifying activities will be exempted from income tax in Singapore, subject to certain conditions. As a result of obtaining

this Pioneer Certificate, income taxes in fiscal year 2006 and 2004 includes a $10.0 million and $12.3 million reversal of

income taxes. The reversal was related to corporate taxes provided for in full for profits arising from qualifying activities from

the commencement date of the Pioneer Certificate until the second quarter of fiscal year 2004, based on the standard tax

rates of 24.5% for fiscal year 2001 and 22% for fiscal years 2002 and 2003 and 20% for fiscal year 2004. These standard

corporate income tax rates continue to be applicable to profits arising from activities excluded from the Pioneer Certificate. See

Management’s Discussion and Analysis of Financial Condition and Results of Operations (“MD&A”) for further discussion.