Creative 2007 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2007 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

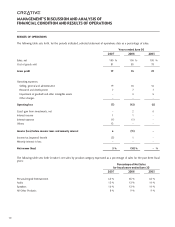

YEAR ENDED JUNE 30, 2007 COMPARED TO YEAR ENDED JUNE 30, 2006

Net sales

Net sales for the year ended June 30, 2007 decreased by 19% compared to the year ended June 30, 2006 mainly due to lower

sales of personal digital entertainment (“PDE”) and audio products. Sales of PDE products, which include digital audio players and

digital cameras, decreased by 21% compared to fiscal year 2006 and represented 63% of sales in fiscal year 2007 compared to

65% of sales in fiscal year 2006. The decrease in sales of PDE products was primarily attributable to lower average selling prices

of digital audio players resulting from product mix and management’s decision to streamline the company’s lineup of digital audio

players to focus on strategic and more profitable products. Sales of audio products, which consist of Sound Blaster audio cards

and chipsets, decreased by 22% compared to fiscal year 2006 and represented 13% of sales in fiscal years 2007 and 2006. The

decrease in audio product sales was mainly due to a decrease in sales of low-end audio sound cards. Sales of speakers decreased

by 6% in fiscal year 2007 compared to fiscal year 2006 and represented 16% of sales in fiscal year 2007 compared to 13% in

fiscal year 2006. Sales from all other products, which include graphics products, communication products, accessories and other

miscellaneous items, decreased by 20% compared to fiscal year 2006 and represented 8% of sales in fiscal year 2007 and 9% in

fiscal year 2006. The decrease was primarily attributable to decreases in sales of graphics and other miscellaneous products.

Gross profit

Gross profit in fiscal year 2007 was 19% of sales compared to 15% in fiscal year 2006. Gross profit at 19% in fiscal year 2007

was consistent with the mix of products sold during the fiscal year with a higher percentage of sales coming from digital audio

players which generally have lower gross profit margins due to competitive pricing on the digital audio players. The lower gross

profit margin in fiscal year 2006 was primarily attributable to a substantial write-down of flash memory inventory amounting to

$19.0 million in the third quarter of fiscal year 2006 due to a drop in flash memory prices. The drop in flash memory prices

caused market uncertainty that resulted in lower sales and selling prices of digital audio players, negatively impacting the gross

profit margin of fiscal year 2006.

Operating expenses

In line with the decrease in sales and management’s efforts to reduce operating costs, selling, general and administrative (“SG&A”)

expenses in fiscal year 2007 decreased by 10% compared to fiscal year 2006. As a percentage of sales, SG&A expenses were

19% of sales compared to 18% of sales in fiscal year 2006.

Research and development (“R&D”) expenses decreased by 18% compared to fiscal year 2006. The decrease was in line with the

management’s costs cutting efforts and a reduced R&D spending by Creative’s wholly-owned subsidiary, 3Dlabs, due to a change

in its business strategy to focus on the portable handheld device market instead of the professional workstation graphics business.

As a percentage of sales, R&D expenses were 7% of sales in fiscal years 2007 and 2006.

In fiscal year 2006, there was a change in the business strategy of 3Dlabs to refocus on the portable handheld device market instead

of the professional workstation graphics business. As a result, the fair value of 3Dlabs could no longer support the carrying value

of the goodwill and other intangible assets associated with the acquisition of 3Dlabs in May 2002. Accordingly, Creative recorded

a $31.5 million impairment of goodwill and other intangible assets in fiscal year 2006. See Note 3 of “Notes to Consolidated

Financial Statements.”

Other charges of $5.9 million for fiscal year 2006 comprised mainly restructuring charges incurred by 3Dlabs due to the change in

business strategy. The restructuring charges comprised mainly employee severance costs and fixed assets impairment write-downs.

See Note 12 of “Notes to Consolidated Financial Statements.”