Creative 2007 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2007 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

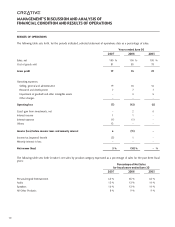

SELECTED CONSOLIDATED FINANCIAL DATA

The following table contains selected data from Creative’s Consolidated Statements of Operations for the five years ended

June 30, 2007. The data for the three years ended June 30, 2007 is derived from and should be read in conjunction with

the consolidated financial statements and related notes thereto included elsewhere in this annual report. The data for the

two years ended June 30, 2004 and 2003 is derived from the audited financial statements which are not included in this

annual report.

CONSOLIDATED STATEMENTS OF OPERATIONS DATA

(US$’000, EXCEPT PER SHARE DATA):

For the years ended June 30

2007 2006 2005 2004 2003

Sales, net $ 914,906 $ 1,127,531 $ 1,224,411 $ 814,853 $ 701,769

Cost of goods sold 737,203 963,217 949,151 533,513 452,952

Gross profit 177,703 164,314 275,260 281,340 248,817

Operating expenses:

Selling, general and administrative 175,180 195,197 196,258 167,588 162,839

Research and development 63,646 77,186 82,325 69,504 58,775

Impairment of goodwill and other – 31,478 65,225 – –

intangible assets – 31,478 65,225 – –

Operating (loss) income (145,420) (68,548) 44,248 27,203 28,073

Gain (loss) from investments, net 18,904 74,405 72,602 (6,049) (45,414)

Interest income 6,241 3,571 4,592 2,623 3,612

Interest expense (9,411) (3,674) (1,001) (1,495) (648)

Others 3,572 (4,260) 5,685 3,736 2,191

(Loss) income before income

taxes and minority interest (126,114) 1,494 126,126 26,018 (12,186)

Provision for income taxes (4) 7,150 (969) 8,539 (2,720) (5,698)

Minority interest in loss (income) 805 63 (418) 79 (1,843)

Net income (loss) $ (118,159) $ 588 $ 134,247 $ 23,377 $ (19,727)

Basic (loss) earnings per share $ (1.42) $ 0.01 $ 1.66 $ 0.30 $ (0.27)

Weighted average ordinary shares

outstanding (’000) 83,093 82,661 80,654 79,202 73,182

Diluted (loss) earnings per share $ (1.42) $ 0.01 $ 1.61 $ 0.29 $ (0.27)

Weighted average ordinary shares

and equivalents outstanding (’000) 83,093 85,333 83,630 80,851 73,182

For the years ended June 30

2007 2006 2005 2004 2003

Sales, net $ 914,906 $ 1,127,531 $ 1,224,411 $ 814,853 $ 701,769

Cost of goods sold 737,203 963,217 949,151 533,513 452,952

Gross profit 177,703 164,314 275,260 281,340 248,817

Operating expenses:

Selling, general and administrative 175,180 195,197 196,258 167,588 162,839

Research and development 63,646 77,186 82,325 69,504 58,775

Impairment of goodwill and other

intangible assets – 31,478 65,225 – –

Other charges (1) – 5,873 – – –

Operating (loss) income (61,123) (145,420) (68,548) 44,248 27,203

(Loss) gain from investments, net (1,880) 18,904 74,405 72,602 (6,049)

Interest income 9,916 6,241 3,571 4,592 2,623

Interest expense (10,245) (9,411) (3,674) (1,001) (1,495)

Others (2) 114,622 3,572 (4,260) 5,685 3,736

Income (loss) before income

taxes and minority interest 51,290 (126,114) 1,494 126,126 26,018

Income tax (expense) benefit (3) (23,918) 7,150 (969) 8,539 (2,720)

Minority interest in loss (income) 817 805 63 (418) 79

Net income (loss) $ 28,189 $ (118,159) $ 588 $ 134,247 $ 23,377

Basic earnings (loss) per share $ 0.34 $ (1.42) $ 0.01 $ 1.66 $ 0.30

Weighted average ordinary shares

outstanding (‘000) 83,452 83,093 82,661 80,654 79,202

Diluted earnings (loss) per share $ 0.34 $ (1.42) $ 0.01 $ 1.61 $ 0.29

Weighted average ordinary shares

and equivalents outstanding (‘000) 83,913 83,093 85,333 83,630 80,851

Dividends declared per share $ 0.25 $ 0.25 $ 0.50 $ 0.25 $ 0.25