Creative 2007 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2007 Creative annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Net investment (loss) gain

Net loss of $1.9 million in fiscal year 2007 was mainly due to $2.0 million write-downs of investments. Net investment gain of

$18.9 million in fiscal year 2006 included a $20.9 million net gain from sales of investments offset by $2.0 million in write-downs

of investments.

As part of its long-term business strategy, from time to time, Creative makes strategic equity investments in companies that can

provide Creative with technologies or products that management believes will give Creative a competitive advantage in the markets

in which Creative competes.

Net interest

Net interest for fiscal years 2007 and 2006 was an expense of $0.3 million and $3.2 million respectively. The lower net interest

expense for fiscal year 2007 was due to higher interest income from the higher average cash balance in fiscal year 2007 compared

to fiscal year 2006 which helped to offset the bulk of the interest expense in fiscal year 2007.

Others

Other income was $114.6 million in fiscal year 2007 compared to $3.6 million in fiscal year 2006. Other income of $114.6 million

in fiscal year 2007 included a $100.0 million paid-up license by Apple Inc. for use of the Creative ZEN Patent in its products and a

$12.1 million exchange gain. Other income of $3.6 million in fiscal year 2006 comprised mainly of $1.4 million in dividends received

from investments and $2.0 million in sundry income, the bulk of which pertained to a write-back of unclaimed invoices.

Income tax (expense) benefit

Income tax expense of $23.9 million in fiscal year 2007 was mainly due to $18.0 million withholding tax paid on the license fees

received from Apple and the changes in the mix of taxable income arising from various geographical regions. Income taxes of

foreign subsidiaries are based on the corporate income tax rates of the country in which the subsidiary is located. Net operating

profits from some subsidiaries are not offsetable with net operating losses sustained by subsidiaries from a different tax jurisdiction.

In Singapore, Creative was granted a Pioneer Certificate under the International Headquarters Award that will expire in March 2010.

Profits arising from qualifying activities under the Pioneer Certificate will be exempted from income tax, subject to certain conditions.

The Singapore corporate income tax rate of 18% is applicable to profits excluded from the Pioneer Certificate.

In fiscal year 2006, tax write-back includes a $10.0 million reversal of income taxes. The reversal was related to corporate taxes

provided for in full for profits arising from qualifying activities from the commencement date of the Pioneer Certificate until the

second quarter of fiscal year 2004, based on the standard tax rates of 24.5% for fiscal year 2001, 22% for fiscal years 2002 and

2003, and 20% for fiscal year 2004.

YEAR ENDED JUNE 30, 2006 COMPARED TO YEAR ENDED JUNE 30, 2005

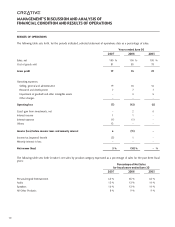

Net sales

Net sales for the year ended June 30, 2006 decreased by 8% compared to the year ended June 30, 2005. Sales of PDE products,

which include digital audio players and digital cameras, decreased by 5% compared to fiscal year 2005 and represented 65% of

sales in fiscal year 2006 compared to 63% of sales in fiscal year 2005. During the first six months of fiscal year 2006, sales of PDE

products increased by 34% compared to the same period in the prior fiscal year, but sales of such products slowed significantly

in the second half of the fiscal year. The slowdown in sales of PDE products in the second half of fiscal year 2006 was mainly

due to a drop in flash memory prices during that period, which created uncertainty and price instability in the retail market for

flash-based digital audio players and contributed to a slowdown in worldwide sales of digital audio players, and Creative’s decision

to streamline its lineup of digital audio players to focus on strategic and more profitable products. Sales of audio products, which

consist of Sound Blaster audio cards and chipsets, decreased by 12% compared to fiscal year 2005 and represented 13% of sales

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS