ComEd 2010 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2010 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

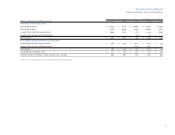

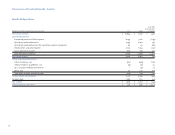

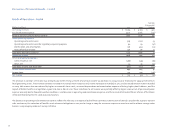

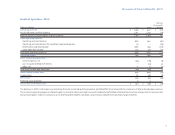

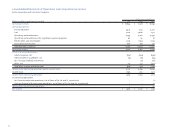

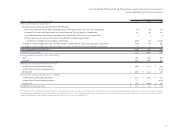

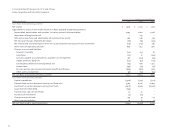

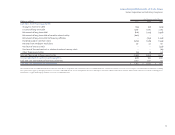

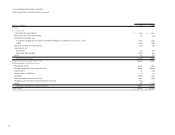

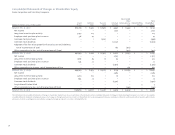

Discussion of Financial Results - PECO

Results of Operations – PECO

Favorable

(Unfavorable)

(Dollars in millions) 2010 2009 Variance

Operating revenues $ 5,519 $ 5,311 $ 208

Purchased power and fuel expense 2,762 2,746 (16)

Revenue net of purchased power and fuel expense 2,757 2,565 192

Other operating expenses

Operating and maintenance 680 640 (40)

Operating and maintenance for regulatory required programs 53 – (53)

Depreciation and amortization 1,060 952 (108)

Taxes other than income 303 276 (27)

Total other operating expenses 2,096 1,868 (228)

Operating income 661 697 (36)

Other income and deductions

Interest expense, net (193) (187) (6)

Loss in equity method investments – (24) 24

Other, net 8 13 (5)

Total other income and deductions (185) (198) 13

Income before income taxes 476 499 (23)

Income taxes 152 146 (6)

Net income 324 353 (29)

Preferred stock dividends 4 4 –

Net income on common stock $ 320 $ 349 $ (29)

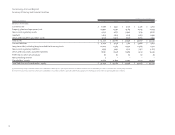

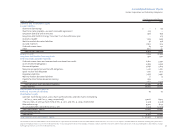

The decrease in PECO’s net income was primarily driven by increased operating expense partially offset by increased electric revenues net of purchased power expense.

The increase in operating expense reflected higher incremental storm costs and increased scheduled amortization of competitive transition charges. Electric revenues net

of purchased power expense increased as a result of favorable weather conditions and increased competitive transition charge recoveries.

31