ComEd 2010 Annual Report Download - page 29

Download and view the complete annual report

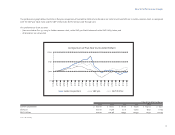

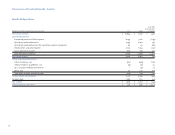

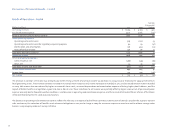

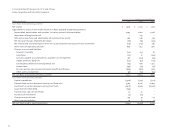

Please find page 29 of the 2010 ComEd annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Exelon’s net income was $2,563 million for the 12 months ended Dec. 31, 2010, as compared to $2,707 million for the 12 months ended Dec. 31, 2009, and diluted earnings

per average common share were $3.87 for the 12 months ended Dec. 31, 2010, as compared to $4.09 for the 12 months ended Dec. 31, 2009. All amounts presented below

are before the impact of income taxes, except as noted.

Exelon and its subsidiaries evaluate their operating performance using the measure of revenue net of purchased power and fuel expense. Exelon and its subsidiaries

believe that revenue net of purchased power and fuel expense is a useful measurement because it provides information that can be used to evaluate its operational

performance. Revenue net of purchased power and fuel expense is not a presentation defined under GAAP and may not be comparable to other companies’ presentations

or deemed more useful than the GAAP information provided elsewhere in this report.

Revenue net of purchased power and fuel expense increased by $172 million primarily due to increased revenues of $201 million at Generation largely related to favorable

capacity revenues, including under the Reliability Pricing Model, in the Midwest and Mid-Atlantic regions. Exelon’s results also were affected by the impact of favorable

weather conditions of $168 million in the ComEd and PECO service territories and a decrease in costs of $84 million associated with the Illinois Settlement Legislation,

primarily at Generation. Further, revenues at the utility companies increased by $92 million to recover the costs of regulatory required programs, which are offset in

operating expenses, and ComEd recognized recovery of $59 million from customers associated with its uncollectible accounts rider mechanism. Offsetting these favorable

impacts were unfavorable market and portfolio conditions of $174 million, increased nuclear fuel costs of $115 million, a reduction of $95 million in mark-to-market gains

from Generation’s hedging activities in 2010 compared to 2009 and a $57 million impairment of SO2 emissions allowances related to the U.S. Environmental Protection

Agency’s proposed Transport Rule.

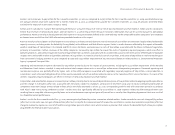

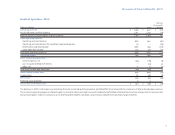

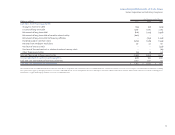

Operating and maintenance expense decreased by $75 million primarily due to the impact of 2009 activities, including the $223 million impairment of the Handley

and Mountain Creek stations recorded in 2009 and reduced stock compensation costs in 2010 of $40 million across the operating companies. Decreased operating and

maintenance expense was partially offset by higher costs at the utility companies associated with regulatory required programs of $84 million, a 2009 reduction in

Generation’s asset retirement obligation of $51 million and incremental costs of $42 million related to storms in the ComEd and PECO service territories. The costs of the

utilities’ regulatory required programs are offset in revenue net of purchased power and fuel expense.

Depreciation and amortization expense increased by $241 million primarily due to increased depreciation expense of $144 million related to ongoing capital expenditures

and the change in estimated useful lives associated with the plants subject to shutdowns announced in December 2009 and increased scheduled amortization of

competitive transition charges at PECO of $98 million, which were fully amortized as of Dec. 31, 2010, corresponding with the end of the transition period in accordance

with PECO’s 1998 restructuring settlement. Exelon’s results were also significantly affected by $120 million in 2009 expenses related to debt extinguishment costs

resulting from a 2009 debt refinancing, and by lower net nuclear decommissioning trust gains of $102 million in 2010 for Non-Regulatory Agreement Units as a result of

less favorable market performance.

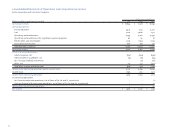

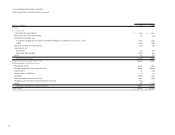

Exelon’s results for the 12 months ended Dec. 31, 2010, were negatively affected by certain income tax-related matters. Exelon recorded a non-cash charge of $65 million

(after tax) in 2010 and a non-cash gain of $66 million (after tax) in 2009 for the remeasurement of income tax uncertainties. Exelon also recorded a $65 million (after tax)

charge to income tax expense as a result of health care legislation passed in March 2010, which includes a provision that reduces the deductibility of retiree prescription

drug benefits for federal income tax purposes.

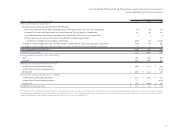

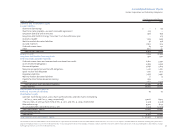

Discussion of Financial Results - Exelon

27