Citrix 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Citrix annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Citrix Systems, Inc. Annual Report

Year Ended December 31,

(In thousands) 2006 2005 2004 2003 2002

(Restated) (Restated) (Restated) (Restated)

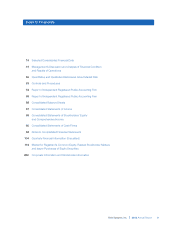

Consolidated Balance Sheet Data(a):

Total assets $ 2,024,473 $ 1,698,982 $ 1,306,416 $ 1,369,768 $ 1,186,993

Current portion of long-term debt —— — 351,423 —

Stockholders’ equity 1,464,289 1,214,528 936,833 717,191 622,573

Long term debt —31,000 — — —

(a) For more information regarding the investigation of our historical stock option granting practices and the associated restatements, see

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” and Note 2 to our consolidated financial

statements included elsewhere in this Annual Report.

(b) Cost of revenues includes amortization of product related intangible assets of $19.2 million, $16.8 million, $6.1 million, $11.0 million and

$10.8 million in 2006, 2005, 2004, 2003 and 2002, respectively.

(c) Our diluted weighted–average shares outstanding primarily fluctuates based on the level of stock repurchases made under our stock

repurchase program and shares issued in connection with our acquisitions. See Notes 4 and 8 to our consolidated financial statements

included in this Annual Report.

The following adjusts our consolidated income statements

for the years ended December 31, 2005, 2004, 2003 and

2002 for the restatements as described in “Management’s

Discussion and Analysis of Financial Condition and Results

of Operations” and in Note 2 to our consolidated financial

statements included elsewhere in this Annual Report.

Year Ended December 31,

2005 2004

(In thousands, except per share data) (As reported) (Adjustments) (As restated) (As reported) (Adjustments) (As restated)

Consolidated Statements of Income Data:

Net revenues $ 908,722 $ — $ 908,722 $ 741,157 $ — $ 741,157

Cost of revenues(a) 57,964 135 58,099 26,423 233 26,656

Gross margin 850,758 (135) 850,623 714,734 (233) 714,501

Operating expenses:

Research and development 108,687 64 108,751 86,357 297 86,654

Sales, marketing and support 393,420 733 394,153 337,566 211 337,777

General and administrative 125,538 (113) 125,425 106,516 (717) 105,799

Amortization of other intangible assets 11,622 — 11,622 6,204 — 6,204

In-process research and development 7,000 — 7,000 19,100 — 19,100

Total operating expenses 646,267 684 646,951 555,743 (209) 555,534

Income from operations 204,491 (819) 203,672 158,991 (24) 158,967

Interest income 23,614 — 23,614 14,274 — 14,274

Interest expense (2,229) (197) (2,426) (4,367) (170) (4,537)

Write-off of deferred debt issuance costs — — — (7,219) — (7,219)

Other income (expense), net (368) (138) (506) 2,754 97 2,851

Income before income taxes 225,508 (1,154) 224,354 164,433 (97) 164,336

Income taxes 59,168 (423) 58,745 32,887 162 33,049

Net income $ 166,340 $ (731) $ 165,609 $ 131,546 $ (259) $ 131,287

Diluted earnings per share(b) $ 0.93 $ — $ 0.93 $ 0.75 $ — $ 0.75

Diluted weighted-average shares outstanding(b) 178,036 (265) 177,771 174,734 (360) 174,374