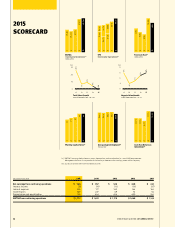

Black & Decker 2015 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2015 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

03

The Evolution Of Stanley Black & Decker

Stanley Black & Decker has undergone a notable transformation over the

last years — evolving from a small cap building products company to a

large cap diversified industrial. This transformation encompassed three

distinct phases:

• A period of restructuring in the late s through the early s when

we were primarily a tools and doors company, generated low growth and

a low-teens operating margin rate, and when we began our move towards

acquisitions to position the Company for growth

• The Security platform build between and , a period when we

initiated our now successful and pervasive operating system, SFS, and

built the Security platform with over acquisitions, creating a more

balanced portfolio with a higher operating margin rate

• The post-Black & Decker merger era of through the present day,

when we became the global leader in tools & storage, the number two

player in both commercial electronic security and engineered fastening

solutions and achieved annual average organic growth closer to %

with a mid-teens operating margin rate

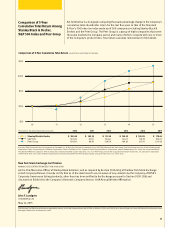

Over this -year period, we have grown our revenues from $ billion+ to over

$ billion, market capitalization from $. billion to $. billion, and

employees from , to more than , while generating total shareholder

returns exceeding %, far surpassing the S&P (+%) and many elite

industrial companies. Measured against our peers, we’ve produced top quartile

sales growth over the last five years, with EBITDA growth well above average

during that time, while over the last years our free cash flow conversion

ranks near the top. The Stanley Black & Decker of today is a fundamentally

dierent and stronger organization than the Company of the past.

We believe the success of our transformation is a result of our ability to

incorporate many of the best attributes of high performing industrial

companies, including:

While we stack up well in many of these areas, we have set the bar high and

believe opportunities remain to continue to improve in several respects,

including increasing operating margins, expanding the reach of our SFS

operating system beyond its traditional roots to generate growth and

margin expansion, and continuing to enhance the portfolio. We are actively

addressing each of these opportunities through further reducing our SG&A

via Functional Transformation, generating meaningful operating leverage

and improving Security’s margins, refreshing our core operating system

with the launch of SFS ., and actively managing our portfolio through

strategic M&A.

• A world-class operating system

and high performance culture

• Strong organic and

acquisitive growth

• A focus on consistently

improving margins

• Strong free cash flow conversion

• A balanced approach

to capital allocation

• Active portfolio management

• A track record of delivering

on expectations

15 YEARS OF PURPOSEFUL

TRANSFORMATION —

2000 TO 2015

Revenues

$2B+ to $11B

Market Cap

$2.7B to $16.4B

Employees

15.5K to 50K+

Total Shareholder Return

>400%

EXECUTING ON OUR

STRATEGIC FRAMEWORK

Continue Organic Growth Momentum

• Utilize SFS 2.0 as a Catalyst

• Mix into Higher Growth,

Higher Margin Businesses

• Increase Relative Weighting of

Emerging Markets — Goal of >20%

Be Selective and

Operate in Markets Where:

• Brand Is Meaningful

• Value Proposition Is Definable and

Sustainable Through Innovation

• Global Cost Leadership

Is Achievable

Pursue Focused Acquisitive Growth

• Consolidate Tool Industry and

Strengthen the Core

• Expand Industrial Platform —

(Engineered Fastening /

Infrastructure)