Black & Decker 2015 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2015 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

01

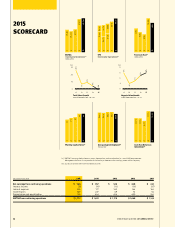

Highlights from the year included:

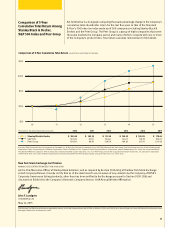

• Outperforming our peer group and the overall S&P , with SWK’s

share price up % for the year versus % for our peers and a drop of

% for the S&P , reflecting a consistent pattern of delivering on or

exceeding financial expectations throughout the year

• Achieving our highest ever earnings per share and operating margin

rate, along with record operating margin rates in Tools & Storage and

Engineered Fastening

• Accelerating organic growth to % year-over-year

Organic growth was once again a key driver of our results, with share gains

across much of our portfolio. Our Tools & Storage and Engineered Fastening

franchises led the way, with several Security businesses, most notably

Europe, also contributing positive organic growth.

Our continued focus on cost control and proactive approach to managing

price and mix resulted in margin expansion across our portfolio, despite the

negative impact of approximately $ million of foreign currency operating

margin headwinds.

From a capital allocation perspective, we increased our annual dividend

for the th consecutive year, executed our $ billion share repurchase

program, and achieved a % cash flow return on investment — an

important measure of our asset eciency and margins.

Looking ahead, we are confident that our opportunities for growth and

value creation remain substantial. Leveraging our unique and proven SFS

operating system, we are well positioned to build on our highly scalable,

industry-leading Tools & Storage and Engineered Fastening platforms,

while at the same time continuing the positive trajectory in Security.

In , we made substantial progress against our

long-term strategic and financial objectives, generating

increasing value for shareholders, while continuing to

position Stanley Black & Decker for a future of sustained

high performance. The results achieved are a testament

to the entire Stanley Black & Decker team’s agility and

passion to perform, as well as the enduring strength of

our world-class franchises.

LETTER TO SHAREHOLDERS

VISIT THE 2015

YEAR IN REVIEW WEBSITE

Visit yearinreview.

stanleyblackanddecker.

com to view stories

and pictures that bring

exciting aspects of the

Stanley Black & Decker

story to life, to explore

our financials, to review

our sustainable practices,

and to read about our

businesses, our brands

and our plans for growth.