Black & Decker 2015 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2015 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STANLEY BLACK & DECKER ANNUAL REPORT02

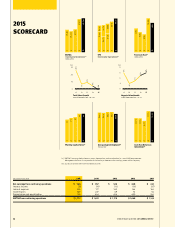

2015 Business Highlights

• Generated organic growth of %. Tools & Storage organic growth was

%, with above-market growth in all regions — North America (+%),

Europe (+%) and Emerging Markets (+%) — as share gains were powered

by innovative new product introductions, expanded retail partnerships,

e-commerce initiatives, commercial investments in developed markets,

and the success of our mid-price point products in emerging markets.

Engineered Fastening achieved % organic growth, led by its automotive

business and within Security, Europe posted % organic growth — its

best performance in years — while our North America mechanical locks

business grew % organically

• Improved the Company’s operating margin rate by basis points over

to .%, overcoming significant foreign currency headwinds.

Our focus on surgical price actions and cost control combined with

commodity deflation allowed us to realize strong operating leverage

in a challenging environment

• Posted a second consecutive year of record operating margin rates in

Tools & Storage and Engineered Fastening. The Tools & Storage operating

margin rate expanded basis points to .% and Engineered Fastening’s

rate ended in the high teens, up basis points

• Continued the successful release of mid-price point products across the

emerging markets. This initiative, now in its second year, helped deliver

organic growth in the emerging markets, most notably in Latin America

(+ %), in the face of dicult conditions in many of the markets we

serve. During the year we launched new power tool models and

significantly expanded the volume of our STANLEY branded oerings

within these markets

• Improved the Security business. The operating process enhancements

and leadership changes we made in our Security Europe business

generated improved operating results: % organic growth for the year

with five consecutive quarters of flat or positive organic growth, year-

over-year operating margin rate improvement each quarter with the rate

approaching % in the fourth quarter, strong orders, a healthy backlog,

and attrition well within our targeted range of %–%. Within North

America, our eorts to improve field eciency and upgrade operational

talent are taking hold, and we ended the year with an improving margin

trend in our commercial electronic security business along with strong

orders and a growing backlog. We also reinvigorated our mechanical

lock business, which grew mid-single digit organically and improved its

operating margin rate by over basis points

2015 SUMMARY

OF RESULTS

• Total revenues were $11.2 billion,

with organic growth of 6%

• Operating margin rate increased

to 14.2%, a 90 basis point increase

in the face of approximately

$220 million of foreign currency

headwinds

• Earnings per share increased

10% to a record $5.92

• Free cash flow totaled $871 million,

enabling our 48th consecutive

annual dividend increase

• Working capital turns were 9.2X,

continuing our industry-leading

performance