Black & Decker 2015 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2015 Black & Decker annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

09

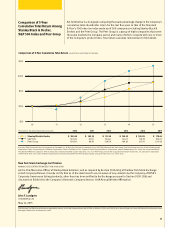

Set forth below is a line graph comparing the yearly percentage change in the Company’s

cumulative total shareholder return for the last five years to that of the Standard

& Poor’s Index (an index made up of companies including Stanley Black &

Decker) and the Peer Group. The Peer Group is a group of eight companies that serve

the same markets the Company serves and many of which compete with one or more

of the Company’s product lines. Total return assumes reinvestment of dividends.

Comparison of -Year

Cumulative Total Return Among

Stanley Black & Decker,

S&P Index and Peer Group

New York Stock Exchange Certification

ANNUAL CEO CERTIFICATION SECTION A.A

As the Chief Executive Ocer of Stanley Black & Decker, and as required by Section A.(a) of the New York Stock Exchange

Listed Company Manual, I hereby certify that as of the date hereof I am not aware of any violation by the Company of NYSE’s

Corporate Governance listing standards, other than has been notified to the Exchange pursuant to Section A.(b) and

disclosed on ExhibitH to the Company’s Domestic Company Section A Annual Written Armation.

John F. Lundgren

CHAIRMAN & CEO

May ,

The Company has filed the certifications required by Section of the Sarbanes-Oxley Act of as Exhibits (i)(a) and (i)(b) to its Annual Report on Form -K filed with the Securities and

Exchange Commission on February , .

THE POINTS IN THE ABOVE TABLE ARE AS FOLLOWS:

Stanley Black & Decker $ . $ . $ . $ . $ . $ .

S&P . . . . . .

Peer Group . . . . . .

Assumes $ invested at the closing price on December , , in the Company’s common stock, S&P Index and the Peer Group. The Peer Group consists of the following eight

companies: Eaton Corporationplc, Danaher Corporation, Illinois Tool Works, Inc., Ingersoll-Rand Company, Masco Corporation, Newell Rubbermaid, Inc., Snap-On Incorporated and

The Sherwin-Williams Company. Prior to, the Company included Cooper Industries, Inc. in its Peer Group. Due to the acquisition of Cooper Industries, Inc. by Eaton Corporation

in November , the results of Eaton Corporation have been included in the Peer Group in place of Cooper Industries, Inc. for all years.

$250

$150

$100

$50

$200

10 11 12 13 14 15

Comparison of 5-Year Cumulative Total Return (VALUE OF $100 INVESTMENT AT YEAR END)