Berkshire Hathaway 2012 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ŠTodd Combs and Ted Weschler, our new investment managers, have proved to be smart, models of

integrity, helpful to Berkshire in many ways beyond portfolio management, and a perfect cultural fit. We

hit the jackpot with these two. In 2012 each outperformed the S&P 500 by double-digit margins. They left me in

the dust as well.

Consequently, we have increased the funds managed by each to almost $5 billion (some of this emanating

from the pension funds of our subsidiaries). Todd and Ted are young and will be around to manage

Berkshire’s massive portfolio long after Charlie and I have left the scene. You can rest easy when they

take over.

ŠBerkshire’s yearend employment totaled a record 288,462 (see page 106 for details), up 17,604 from last

year. Our headquarters crew, however, remained unchanged at 24. No sense going crazy.

Š

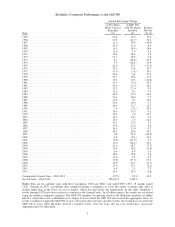

Berkshire’s “Big Four” investments – American Express, Coca-Cola, IBM and Wells Fargo – all had good

years. Our ownership interest in each of these companies increased during the year. We purchased

additional shares of Wells Fargo (our ownership now is 8.7% versus 7.6% at yearend 2011) and IBM (6.0%

versus 5.5%). Meanwhile, stock repurchases at Coca-Cola and American Express raised our percentage

ownership. Our equity in Coca-Cola grew from 8.8% to 8.9% and our interest at American Express from

13.0% to 13.7%.

Berkshire’s ownership interest in all four companies is likely to increase in the future. Mae West had it

right: “Too much of a good thing can be wonderful.”

The four companies possess marvelous businesses and are run by managers who are both talented and

shareholder-oriented. At Berkshire we much prefer owning a non-controlling but substantial portion of a

wonderful business to owning 100% of a so-so business. Our flexibility in capital allocation gives us a

significant advantage over companies that limit themselves only to acquisitions they can operate.

Going by our yearend share count, our portion of the “Big Four’s” 2012 earnings amounted to $3.9 billion.

In the earnings we report to you, however, we include only the dividends we receive – about $1.1 billion.

But make no mistake: The $2.8 billion of earnings we do not report is every bit as valuable to us as what

we record.

The earnings that the four companies retain are often used for repurchases – which enhance our share of

future earnings – and also for funding business opportunities that are usually advantageous. Over time we

expect substantially greater earnings from these four investees. If we are correct, dividends to Berkshire

will increase and, even more important, so will our unrealized capital gains (which, for the four, totaled

$26.7 billion at yearend).

Š

There was a lot of hand-wringing last year among CEOs who cried “uncertainty” when faced with capital-

allocation decisions (despite many of their businesses having enjoyed record levels of both earnings and

cash). At Berkshire, we didn’t share their fears, instead spending a record $9.8 billion on plant and

equipment in 2012, about 88% of it in the United States. That’s 19% more than we spent in 2011, our

previous high. Charlie and I love investing large sums in worthwhile projects, whatever the pundits are

saying. We instead heed the words from Gary Allan’s new country song, “Every Storm Runs Out of Rain.”

We will keep our foot to the floor and will almost certainly set still another record for capital expenditures

in 2013. Opportunities abound in America.

************

A thought for my fellow CEOs: Of course, the immediate future is uncertain; America has faced the

unknown since 1776. It’s just that sometimes people focus on the myriad of uncertainties that always exist

while at other times they ignore them (usually because the recent past has been uneventful).

5