Berkshire Hathaway 2012 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2012 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

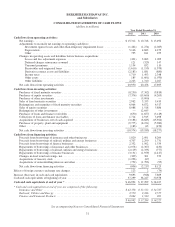

Notes to Consolidated Financial Statements (Continued)

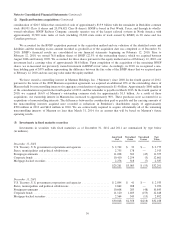

(4) Investments in equity securities (Continued)

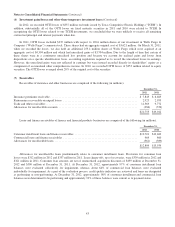

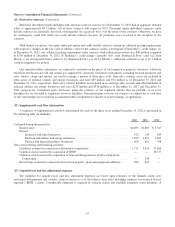

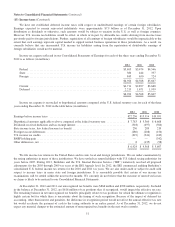

Investments in equity securities are reflected in our Consolidated Balance Sheets as follows (in millions).

December 31,

2012 2011

Insurance and other ...................................................................... $86,467 $76,063

Railroad, utilities and energy * ............................................................. 675 488

Finance and financial products * ............................................................ 520 440

$87,662 $76,991

* Included in other assets.

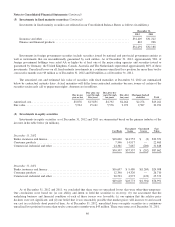

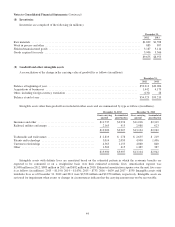

(5) Other investments

Other investments include fixed maturity and equity securities of The Goldman Sachs Group, Inc. (“GS”), General Electric

Company (“GE”), Wm. Wrigley Jr. Company (“Wrigley”), The Dow Chemical Company (“Dow”) and Bank of America

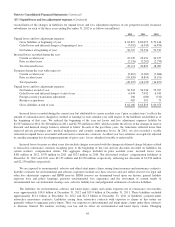

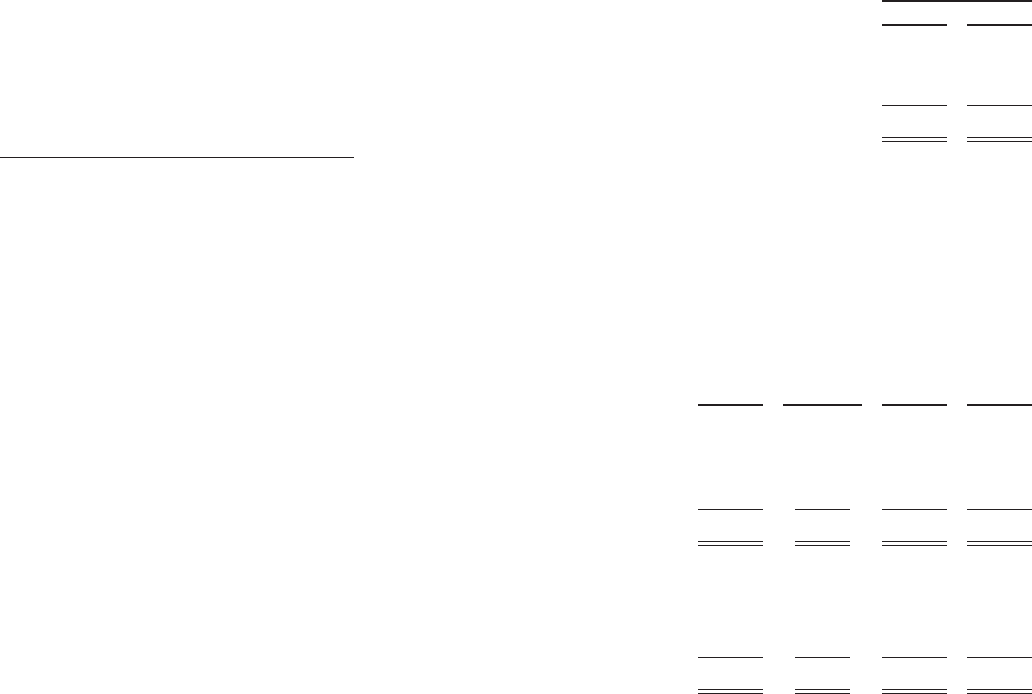

Corporation (“BAC”). A summary of other investments follows (in millions).

Cost

Net

Unrealized

Gains

Fair

Value

Carrying

Value

December 31, 2012

Other fixed maturity and equity securities:

Insurance and other ................................................ $13,109 $3,823 $16,932 $16,057

Finance and financial products ....................................... 3,148 1,804 4,952 4,952

$16,257 $5,627 $21,884 $21,009

December 31, 2011

Other fixed maturity and equity securities:

Insurance and other ................................................ $13,051 $1,055 $14,106 $13,111

Finance and financial products ....................................... 3,198 623 3,821 3,810

$16,249 $1,678 $17,927 $16,921

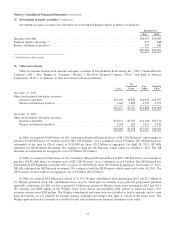

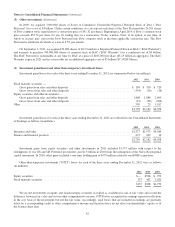

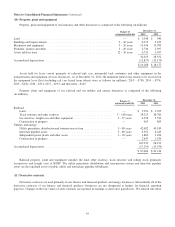

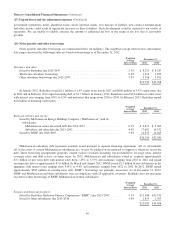

In 2008, we acquired 50,000 shares of 10% Cumulative Perpetual Preferred Stock of GS (“GS Preferred”) and warrants to

purchase 43,478,260 shares of common stock of GS (“GS Warrants”) for a combined cost of $5 billion. The GS Preferred was

redeemable at any time by GS at a price of $110,000 per share ($5.5 billion in aggregate). On April 18, 2011, GS fully

redeemed our GS Preferred investment. We continue to hold the GS Warrants, which expire on October 1, 2013. The GS

Warrants are exercisable for an aggregate cost of $5 billion ($115/share).

In 2008, we acquired 30,000 shares of 10% Cumulative Perpetual Preferred Stock of GE (“GE Preferred”) and warrants to

purchase 134,831,460 shares of common stock of GE (“GE Warrants”) for a combined cost of $3 billion. The GE Preferred was

redeemable by GE beginning in October 2011 at a price of $110,000 per share ($3.3 billion in aggregate). On October 17, 2011,

GE fully redeemed our GE Preferred investment. We continue to hold the GE Warrants, which expire on October 16, 2013. The

GE Warrants are exercisable for an aggregate cost of $3 billion ($22.25/share).

In 2008, we acquired $4.4 billion par amount of 11.45% Wrigley subordinated notes maturing in 2018 and $2.1 billion of

5% Wrigley preferred stock. The subordinated notes may be called prior to maturity at par plus the prepayment premium

applicable at that time. In 2009, we also acquired $1.0 billion par amount of Wrigley senior notes maturing in 2013 and 2014.

We currently own $800 million of the Wrigley senior notes and an unconsolidated joint venture in which we hold a 50%

economic interest owns $200 million. The Wrigley subordinated and senior notes are classified as held-to-maturity and we carry

these investments at cost, adjusted for foreign currency exchange rate changes that apply to certain of the senior notes. The

Wrigley preferred stock is classified as available-for-sale and recorded in our financial statements at fair value.

41