Berkshire Hathaway 2011 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion (Continued)

Commodity Price Risk

Our diverse group of operating businesses use commodities in various ways in manufacturing and providing services. As

such, we are subject to price risks related to various commodities. In most instances, we attempt to manage these risks through

pricing of our products and services to customers. To the extent that we are unable to sustain price increases in response to

commodity price increases, our operating results will likely be adversely affected. We utilize derivative contracts to a limited

degree in managing commodity price risks, most notably through MidAmerican. MidAmerican’s exposures to commodities

include variations in the price of fuel to generate electricity, wholesale electricity that is purchased and sold and natural gas

supply for customers. Commodity prices are subject to wide price swings as supply and demand are impacted by, among many

other unpredictable items, weather, market liquidity, generating facility availability, customer usage, storage and transmission

and transportation constraints. To mitigate a portion of the risk, MidAmerican uses derivative instruments, including forwards,

futures, options, swaps and other agreements, to effectively secure future supply or sell future production generally at fixed

prices. The settled cost of these contracts is generally recovered from customers in regulated rates. Accordingly, net unrealized

gains and losses associated with interim price movements on such contracts are recorded as regulatory assets or liabilities.

Financial results would be negatively impacted if the costs of wholesale electricity, fuel or natural gas are higher than what is

permitted to be recovered in rates. MidAmerican also uses futures, options and swap agreements to economically hedge gas and

electric commodity prices for physical delivery to non-regulated customers. MidAmerican does not engage in a material amount

of proprietary trading activities.

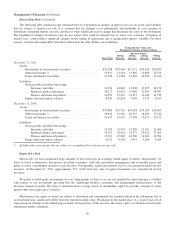

The table that follows summarizes our commodity price risk on energy derivative contracts of MidAmerican as of

December 31, 2011 and 2010 and shows the effects of a hypothetical 10% increase and a 10% decrease in forward market prices

by the expected volumes for these contracts as of each date. The selected hypothetical change does not reflect what could be

considered the best or worst case scenarios. Dollars are in millions.

Fair Value

Net Assets

(Liabilities) Hypothetical Price Change

Estimated Fair Value after

Hypothetical Change in

Price

December 31, 2011 .................................... $(445) 10% increase $(348)

10% decrease (542)

December 31, 2010 .................................... $(613) 10% increase $(546)

10% decrease (680)

FORWARD-LOOKING STATEMENTS

Investors are cautioned that certain statements contained in this document as well as some statements in periodic press

releases and some oral statements of Berkshire officials during presentations about Berkshire or its subsidiaries are “forward-

looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995 (the “Act”). Forward-looking

statements include statements which are predictive in nature, which depend upon or refer to future events or conditions, which

include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates” or similar expressions. In addition,

any statements concerning future financial performance (including future revenues, earnings or growth rates), ongoing business

strategies or prospects and possible future Berkshire actions, which may be provided by management, are also forward-looking

statements as defined by the Act. Forward-looking statements are based on current expectations and projections about future

events and are subject to risks, uncertainties and assumptions about Berkshire and its subsidiaries, economic and market factors

and the industries in which we do business, among other things. These statements are not guaranties of future performance and

we have no specific intention to update these statements.

Actual events and results may differ materially from those expressed or forecasted in forward-looking statements due to a

number of factors. The principal important risk factors that could cause our actual performance and future events and actions to

differ materially from such forward-looking statements include, but are not limited to, changes in market prices of our

investments in fixed maturity and equity securities, losses realized from derivative contracts, the occurrence of one or more

catastrophic events, such as an earthquake, hurricane or act of terrorism that causes losses insured by our insurance subsidiaries,

changes in laws or regulations affecting our insurance, railroad, utilities and energy and finance subsidiaries, changes in federal

income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in

which we do business.

92