Berkshire Hathaway 2011 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2011 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

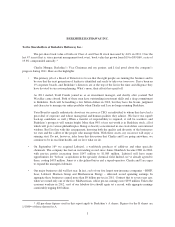

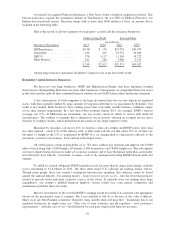

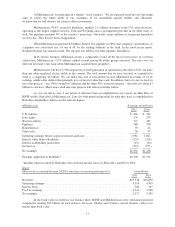

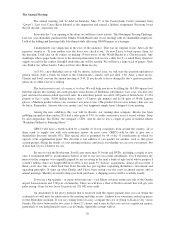

Manufacturing, Service and Retailing Operations

Our activities in this part of Berkshire cover the waterfront. Let’s look, though, at a summary balance

sheet and earnings statement for the entire group.

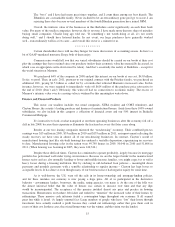

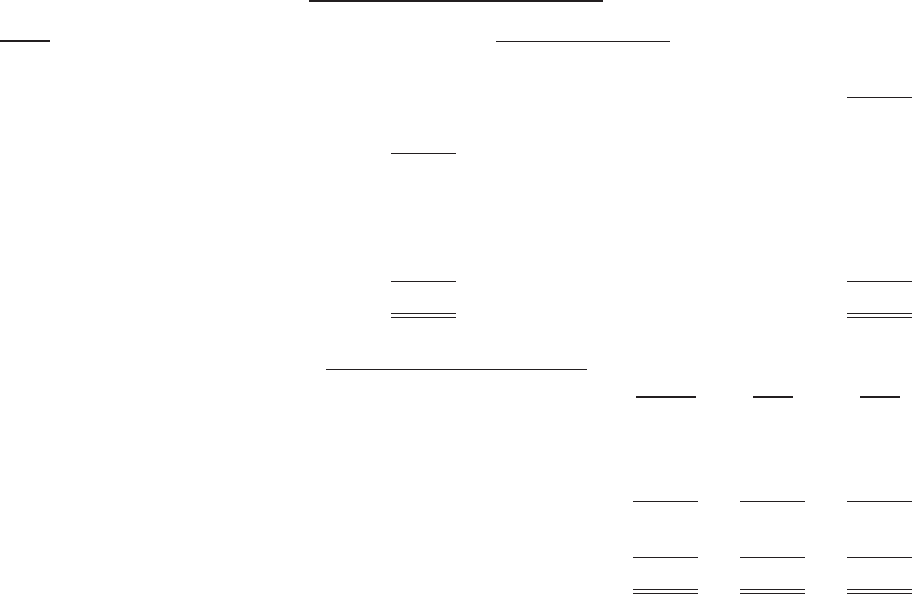

Balance Sheet 12/31/11 (in millions)

Assets Liabilities and Equity

Cash and equivalents ................... $ 4,241 Notes payable .................... $ 1,611

Accounts and notes receivable ........... 6,584 Other current liabilities ............. 15,124

Inventory ............................ 8,975 Total current liabilities ............. 16,735

Other current assets .................... 631

Total current assets .................... 20,431

Deferred taxes .................... 4,661

Goodwill and other intangibles ........... 24,755 Term debt and other liabilities ....... 6,214

Fixed assets .......................... 17,866 Non-controlling interests ............ 2,410

Other assets .......................... 3,661 Berkshire equity .................. 36,693

$66,713 $66,713

Earnings Statement (in millions)

2011** 2010 2009

Revenues ................................................... $72,406 $66,610 $61,665

Operating expenses (including depreciation of $1,431 in 2011,

$1,362 in 2010 and $1,422 in 2009) ............................ 67,239 62,225 59,509

Interest expense .............................................. 130 111 98

Pre-tax earnings .............................................. 5,037* 4,274* 2,058*

Income taxes and non-controlling interests ........................ 1,998 1,812 945

Net earnings ................................................ $ 3,039 $ 2,462 $ 1,113

*Does not include purchase-accounting adjustments.

**Includes earnings of Lubrizol from September 16.

This group of companies sells products ranging from lollipops to jet airplanes. Some of the businesses

enjoy terrific economics, measured by earnings on unleveraged net tangible assets that run from 25% after-tax to

more than 100%. Others produce good returns in the area of 12-20%. A few, however, have very poor returns, a

result of some serious mistakes I made in my job of capital allocation. These errors came about because I misjudged

either the competitive strength of the business being purchased or the future economics of the industry in which it

operated. I try to look out ten or twenty years when making an acquisition, but sometimes my eyesight has been

poor. Charlie’s has been better; he voted no more than “present” on several of my errant purchases.

Berkshire’s newer shareholders may be puzzled over our decision to hold on to my mistakes. After all,

their earnings can never be consequential to Berkshire’s valuation, and problem companies require more

managerial time than winners. Any management consultant or Wall Street advisor would look at our laggards and

say “dump them.”

That won’t happen. For 29 years, we have regularly laid out Berkshire’s economic principles in these

reports (pages 93-98) and Number 11 describes our general reluctance to sell poor performers (which, in most

cases, lag because of industry factors rather than managerial shortcomings). Our approach is far from Darwinian,

and many of you may disapprove of it. I can understand your position. However, we have made – and continue to

make – a commitment to the sellers of businesses we buy that we will retain those businesses through thick and

thin. So far, the dollar cost of that commitment has not been substantial and may well be offset by the goodwill it

builds among prospective sellers looking for the right permanent home for their treasured business and loyal

associates. These owners know that what they get with us can’t be delivered by others and that our commitments

will be good for many decades to come.

12