Berkshire Hathaway 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Management's Discussion (Continued)

Insurance — Underwriting (Continued)

General Re (Continued)

Underwriting results for 2001 include approximately $1.54 billion of net losses from the September 11th

terrorist attack. While the potential impact of catastrophes and other large individual property losses is normally

factored into reinsurance prices, past pricing did not consider the unprecedented magnitude of possible losses

arising from the terrorist acts. The severity of the losses arising from the September 11th attack underscored that

risks of this kind were not contemplated in premium rates. Lines of business that previously were expected to have

little correlation were adversely affected in the same event to an unforeseen degree. Claims arising from other

catastrophes and large individual property losses ($20 million or greater) in 2001, 2000 and 1999 periods were $87

million, $53 million and $202 million, respectively. In addition, during 2001 General Re recorded $46 million of

estimated losses associated with Enron-related liability coverages.

Results in 2001 also included $800 million of net underwriting losses arising from increases to loss reserve

estimates for loss events occurring in 2000 and prior years. The reserve increases occurred in almost all casualty

lines of business, including commercial umbrella, professional liability, medical malpractice, general liability, and

workers compensation. Long-tail liabilities such as these, particularly reinsurance lines, are inherently difficult to

estimate, and while management now believes that reserves are now approximately correct, there are no guarantees.

In 2000, underwriting results for the traditional reinsurance operations also included underwriting losses from

increases to prior years’ reserves of about $92 million, arising primarily in the medical malpractice, commercial

umbrella and casualty treaty reinsurance lines. In 1999, North American property/casualty results included a small

gain from the reduction of prior years’ loss reserve estimates.

Underwriting results for 2000 also included a net underwriting loss of $239 million from a large excess

reinsurance contract in-force during 1999 and 2000. The effect of this agreement on the 1999 net underwriting

results was not significant due to a retrocession to the Berkshire Hathaway Reinsurance Group. Although, this

contract produced a sizable underwriting loss, it is expected to provide more than commensurate investment benefits

in future years due to the large amount of float generated.

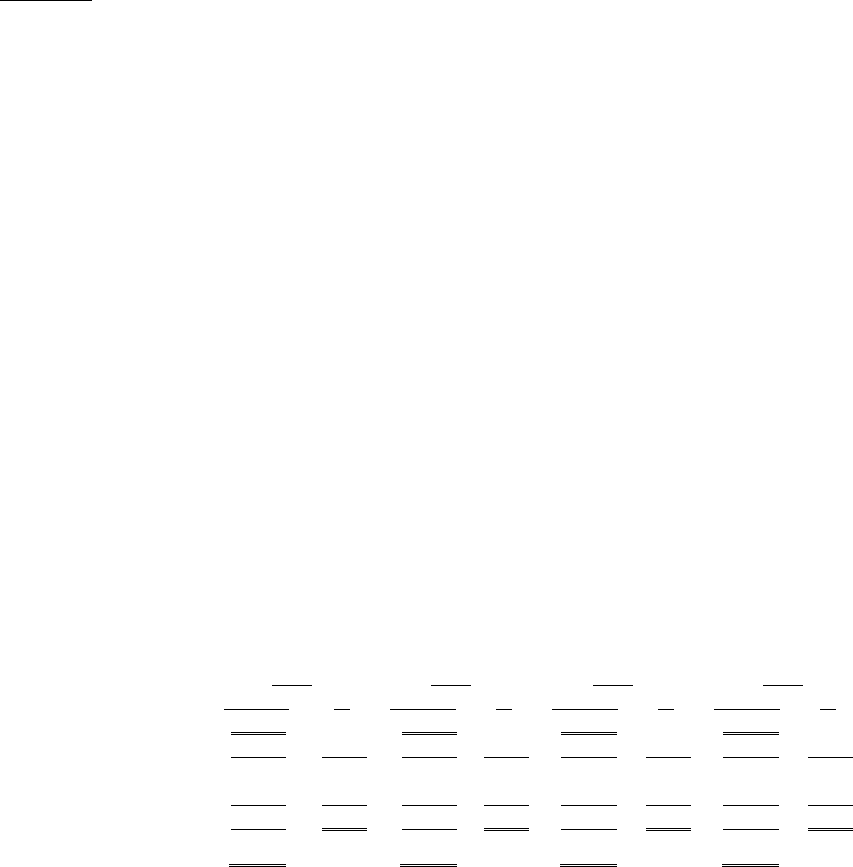

General Re’ s international property/casualty underwriting results for the past three years are summarized

below.

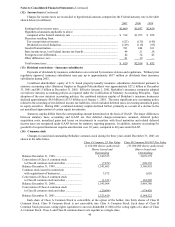

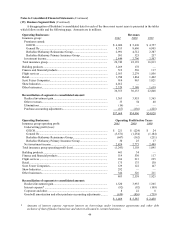

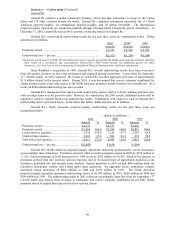

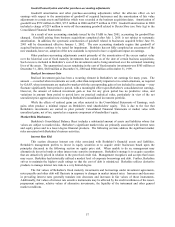

— (dollars in millions) —

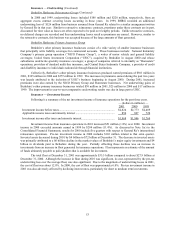

2001 2000(1) 2000(2) 1999

Amount %Amount %Amount %Amount %

Premiums written ....................... $2,553 $3,036 $2,505 $2,506

Premiums earned ........................ $2,397 100.0 $3,046 100.0 $2,478 100.0 $2,343 100.0

Losses and loss expenses............ 2,413 100.7 2,577 84.6 2,091 84.4 2,041 87.1

Underwriting expenses............... 730 30.4 987 32.4 803 32.4 775 33.1

Total losses and expenses........... 3,143 131.1 3,564 117.0 2,894 116.8 2,816 120.2

Underwriting loss — pre-tax...... $ (746) $ (518) $ (416) $ (473)

(1) Column includes 15 months of data due to elimination of one-quarter lag reporting in 2000.

(2) Column includes 12 months reported on a one-quarter lag and is shown for comparability with 1999.

The international property/casualty operations write quota-share and excess reinsurance on risks around the

world. In recent years, the largest international markets have been in Germany and Western Europe. As previously

noted, the international property/casualty operations discontinued reporting their results on a one-quarter lag during

the fourth quarter of 2000. Results for the 2000 period contain fifteen months, or one additional quarter of

information (fourth quarter of 1999 plus four quarters of 2000). The preceding table shows underwriting results for

both the twelve month and fifteen month periods. The comparative analysis that follows excludes the additional

quarter.

Earned premiums in 2001 decreased from 2000 amounts by 3.3%, whereas 2000 earned premiums

exceeded 1999 levels by 5.8%. Adjusting for the effects of overall declining foreign exchange rates, earned

premiums in local currencies increased 3.9% during 2001, 16.7% during 2000 and 12.0% during 1999. Growth in

2001 premiums was primarily due to increased premiums in Lloyd’ s Syndicate 435 and in the U.K. casualty treaty

business, partially offset by decreased premiums in Latin America and at Cologne Re. The decrease at Cologne Re

relates primarily to the non-renewal of unprofitable treaty business. Earned premium growth in 2000 was

principally attributable to premiums to reinstate coverage as a result of the 1999 European winter storm losses as

well as increases in Lloyd’ s Syndicate 435.