Berkshire Hathaway 2001 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2001 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.16

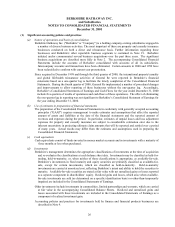

There is a spread of about two percentage points between what Berkadia pays on its borrowing and what it

receives from FINOVA, with this spread flowing 90% to Berkshire and 10% to Leucadia. As I write this, each loan

has been paid down to $3.9 billion.

As part of the bankruptcy plan, which was approved on August 10, 2001, Berkshire also agreed to offer

70% of face value for up to $500 million principal amount of the $3.25 billion of new 7½% bonds that were issued

by FINOVA. (Of these, we had already received $426.8 million in principal amount because of our 13% ownership

of the original debt.) Our offer, which was to run until September 26, 2001, could be withdrawn under a variety of

conditions, one of which became operative if the New York Stock Exchange closed during the offering period.

When that indeed occurred in the week of September 11th, we promptly terminated the offer.

Many of FINOVAs loans involve aircraft assets whose values were significantly diminished by the events

of September 11th. Other receivables held by the company also were imperiled by the economic consequences of

the attack that day. FINOVAs prospects, therefore, are not as good as when we made our proposal to the

bankruptcy court. Nevertheless we feel that overall the transaction will prove satisfactory for Berkshire. Leucadia

has day-to-day operating responsibility for FINOVA, and we have long been impressed with the business acumen

and managerial talent of its key executives.

* * * * * * * * * * * *

Its déjà vu time again: In early 1965, when the investment partnership I ran took control of Berkshire, that

company had its main banking relationships with First National Bank of Boston and a large New York City bank.

Previously, I had done no business with either.

Fast forward to 1969, when I wanted Berkshire to buy the Illinois National Bank and Trust of Rockford.

We needed $10 million, and I contacted both banks. There was no response from New York. However, two

representatives of the Boston bank immediately came to Omaha. They told me they would supply the money for

our purchase and that we would work out the details later.

For the next three decades, we borrowed almost nothing from banks. (Debt is a four-letter word around

Berkshire.) Then, in February, when we were structuring the FINOVA transaction, I again called Boston, where

First National had morphed into FleetBoston. Chad Gifford, the companys president, responded just as Bill Brown

and Ira Stepanian had back in 1969 youve got the money and well work out the details later.

And thats just what happened. FleetBoston syndicated a loan for $6 billion (as it turned out, we didnt

need $400 million of it), and it was quickly oversubscribed by 17 banks throughout the world. Sooooo . . . if you

ever need $6 billion, just give Chad a call assuming, that is, your credit is AAA.

* * * * * * * * * * * *

One more point about our investments: The media often report that Buffett is buying this or that security,

having picked up the fact from reports that Berkshire files. These accounts are sometimes correct, but at other

times the transactions Berkshire reports are actually being made by Lou Simpson, who runs a $2 billion portfolio for

GEICO that is quite independent of me. Normally, Lou does not tell me what he is buying or selling, and I learn of

his activities only when I look at a GEICO portfolio summary that I receive a few days after the end of each month.

Lous thinking, of course, is quite similar to mine, but we usually end up in different securities. Thats largely

because hes working with less money and can therefore invest in smaller companies than I. Oh, yes, theres also

another minor difference between us: In recent years, Lous performance has been far better than mine.